- Dogecoin price could extend its gains after hitting $0.077 for the first time in nearly three months.

- DOGE token’s on-chain metrics support thesis for price rally in the meme coin as more token holders edge closer to profitability.

- The meme coin notes higher on-chain activity and creation of new wallets, driving demand among traders.

Dogecoin, one of the largest meme coins in the crypto ecosystem, is on track to possibly extend its gains further this week. The meme coin crossed the barrier at $0.077, making a comeback to this level for the first time since August 2023.

According to on-chain metrics for DOGE, there is scope for further gains and the outlook on the asset continues to remain bullish.

Also read: Dogecoin Price Forecast: Why this week is important for DOGE holders

These on-chain metrics support a bullish thesis for DOGE price

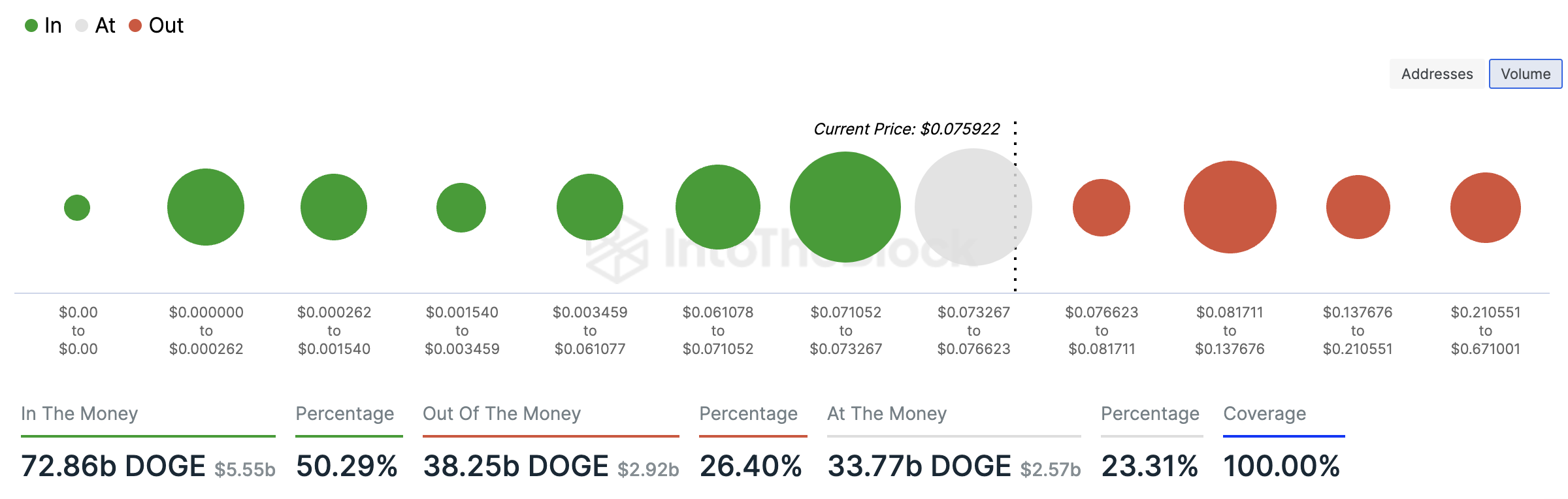

Global In/Out of the Money around price

An on-chain indicator from data intelligence platform, IntoTheBlock, In/Out of the Money around price (IOMAP) reveals the percentage of DOGE wallet addresses that are currently sitting on unrealized profits or losses. At the current DOGE price of $0.0759:

- 50.29% wallets are “In the Money,” meaning they are sitting on unrealized profits (their average cost of acquisition is lower than the current DOGE price.)

- 26.40% wallets are “Out of the Money,” meaning they are sitting on unrealized losses

Typically, as the percentage of wallets “In the Money” climbs, we are nearing a local top in DOGE price. As seen in the chart below, there is a support wall at $0.0710 to $0.0732 with its 221.06K addresses holding 29.21 billion DOGE. Support outstrips resistance at $0.0766 to $0.0817 with its 154.16K addresses holding 4.79 billion DOGE, therefore the asset has the potential for an upward breakout. It is important to note that traders need to be cautious as the asset approaches what is likely a local top.

If Dogecoin price slices through the $0.0817 level, the next key hurdle is at $0.0137.

Global In/Out of the Money DOGE

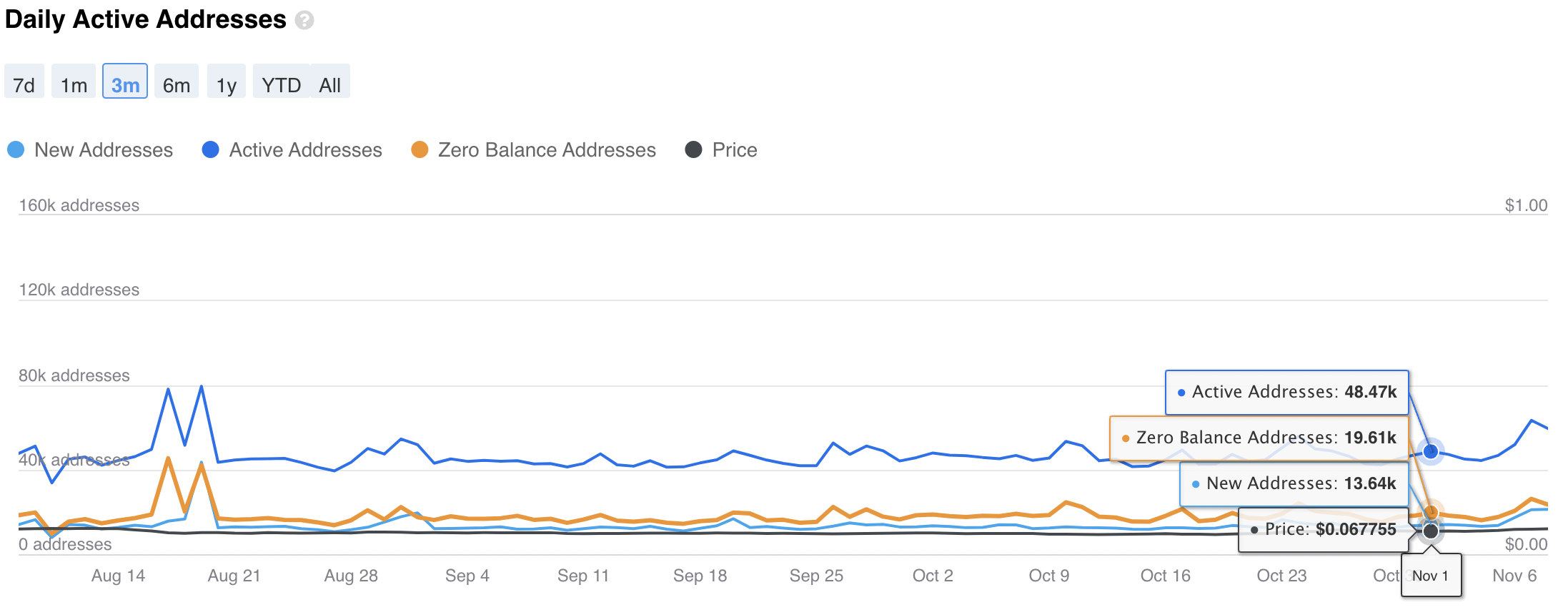

Daily Active Addresses, New addresses: Both metrics climbed in November

Between November 1 and 8, Daily Active Addresses and New Addresses climbed 22.36% and 55.00% respectively, as seen in the chart below. Rises in these metrics supports a bullish thesis, as it indicates rising demand for DOGE among market participants.

Daily active addresses and new addresses in DOGE

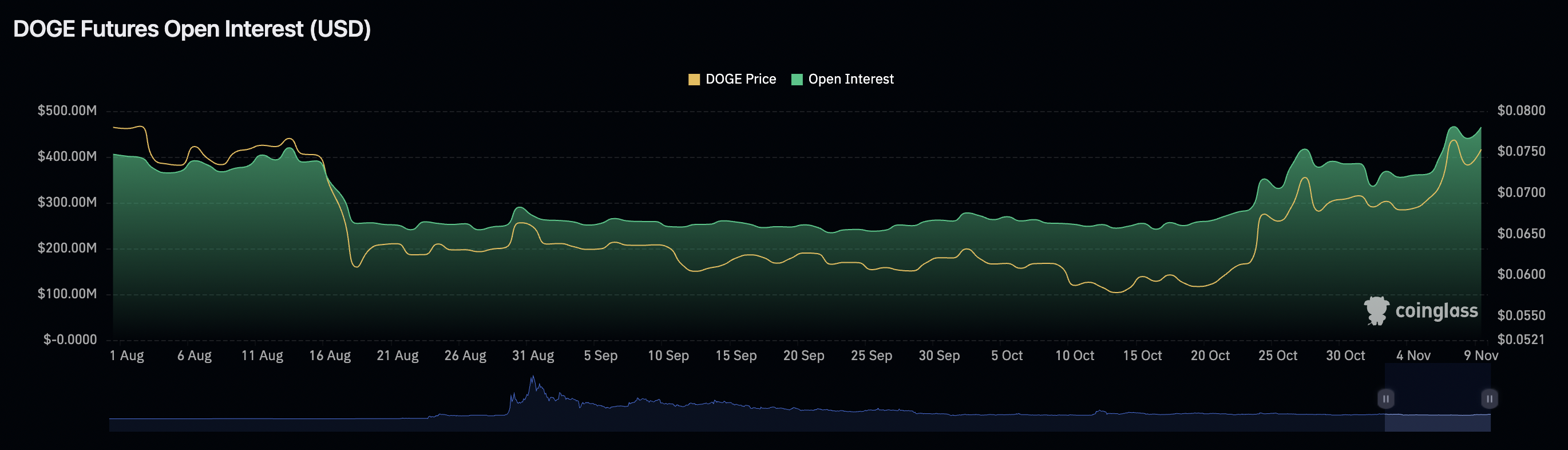

DOGE Futures Open Interest

pen Interest in DOGE climbed to levels previously seen in August 2023, alongside the increase in price, based on data from Coinglass. Rising Open Interest implies there is an increase in capital inflows to the asset, supporting a bullish outlook.

DOGE Futures Open Interest and price

The $0.1000 target becomes relevant for DOGE as the meme coin recently crossed the $0.0770 level. In addition, it marks the next key resistance for Dogecoin price in its uptrend.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Chainlink holds near three-year high fueled by EU tokenized securities partnership

Chainlink (LINK) price trades slightly down around $25.50 on Tuesday following a 33% rally that was spurred by its partnership with Frankfurt-based fintech 21X for Europe’s first tokenized securities trading and settlement system.

Trending altcoins: Hedera, VeChain and Algorand extend rally by posting double-digit gains

Three trending altcoins – Hedera (HBAR), VeChain (VET), and Algorand (ALGO) – post double-digit gains on Tuesday after surging last week, benefiting from the recent consolidation of Bitcoin prices.

Ondo Finance Price Forecast: ONDO reaches a new all-time high of $1.79

Ondo Finance surges more than 11% on Tuesday and reaches a new all-time high of $1.79. ONDO’s daily trading volume reached a new yearly high of $994 million, suggesting a surge in traders’ interest and liquidity.

XRP en route to new all-time high; key metrics to watch out for

Ripple whales have accumulated over $1.8 billion worth of XRP tokens amid a 200% rise in weekly active addresses. WisdomTree filed an S-1 registration with the SEC for an XRP ETF. XRP investors across several cohorts realized over $2.7 billion in profits in past three days following heavy Ripple token unlock.

Bitcoin: A healthy correction

Bitcoin (BTC) experienced a 7% correction earlier in the week, dropping to $90,791 on Tuesday before recovering to $97,000 by Friday. On-chain data suggests a modest rebound in institutional demand, with holders buying the dip. A recent report indicates BTC remains undervalued, projecting a potential rally toward $146K.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.