Dogecoin price eludes rationale as it continues to consolidate

- Dogecoin price is coiling up inside a descending triangle, forecasting an 18% move.

- Due to Bitcoin’s ongoing chop, investors need to wait for a secondary confirmation regardless of the breakout direction.

- A four-hour candlestick close above $0.087 will trigger a bullish breakout and invalidate the bearish thesis for DOGE.

Dogecoin price consolidation continues hand in hand with the reduction of volatility. As DOGE approaches a critical mass, investors need to be careful and expect a volatile move that will shatter immediate barriers or blockades.

Dogecoin price could confuse investors

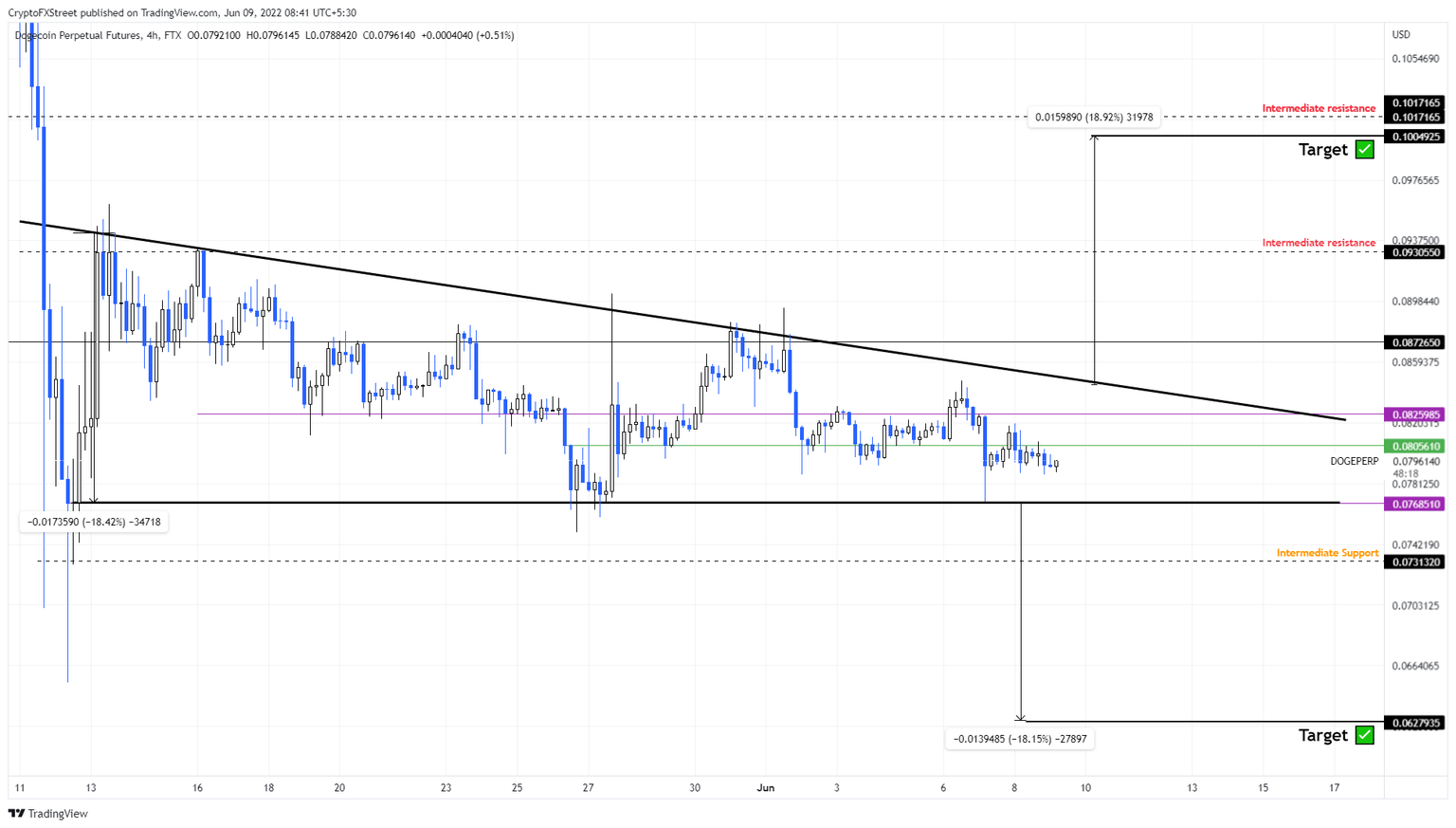

Dogecoin price trades inside a descending triangle formation, which is obtained by connecting the four lower highs and three equal lows formed since May 12 using trend lines. The technical formation projects an 18% move determined by adding the distance between the first swing high and the swing low to the breakout point.

Although descending triangle has a bearish tendency, investors should not prematurely assume the breakout direction. The chances of a fakeout in this choppy market are high. Instead, market participants need to wait for a confirmation of a successful move outside the consolidative formation.

While theoretically, a breakdown of the triangle’s base at $0.076 confirms a breakdown, investors need to wait for a breach of the subsequent support level at $0.073. This secondary confirmation will add credence to the bearish outlook for the Dogecoin price and its move to the forecasted target at $0.062.

DOGE/USDT 4-hour chart

A further look into the transaction data from IntoTheBlock’s Global In/Out of the Money (GIOM) model shows that the immediate support level at $0.043 is relatively strong.

Here, roughly 315,000 addresses that purchased 7.51 billion DOGE tokens at an average price of $0.043 are “In the Money.” These investors might add to their holdings if Dogecoin price slides lower, suggesting that it is a good support level.

On the other hand, the immediate resistance barrier at $0.089 is relatively weak. The 62,000 addresses that purchased nearly 3.9 billion DOGE tokens at an average price of $0.089 are “Out of the Money.”

Hence, a spike in buying pressure that overcomes the selling pressure from these underwater investors could easily surpass this level. Hence, the possibility of a bearish breakout that pushes Dogecoin price well under the forecasted target at $0.062 is lesser.

DOGE GIOM

Unlike the bearish outlook, which seems logical, the bulls have multiple hurdles to overcome. The first two are $0.080 and $0.082. Clearing these blockades will open the path for DOGE to retest and hopefully breach the hypotenuse of the descending triangle.

This move is significant because it will confirm a breakout. However, a secondary confirmation of the bullish breakout will occur only after a four-hour candlestick close above $0.087. This development will invalidate the bearish thesis and trigger a further ascent to the intermediate resistance barrier at $0.093.

Only after overcoming these resistance levels will DOGE be able to reach its forecasted target at $0.100.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.