- Dogecoin price has suffered a reversal since June 2.

- DOGE appears to be trading within upper and lower trend lines of an ascending parallel channel.

- While the meme coin has been able to find outstanding support, the prevailing direction for the asset is sideways in the short term.

Dogecoin price has slumped lower in the past few days, reaching $0.31. Although DOGE is still up by over 55% from its low amid the market crash recorded on May 19, the meme coin has failed to find strength.

Dogecoin price heads lower as bulls lose strength

Dogecoin price is currently down by over 55% from its all-time high of $0.73, failing to recover. On the daily chart, DOGE appears to be trading sideways, forming an ascending parallel channel.

By connecting the continuous higher lows and the slightly higher highs, two trend lines have been formed to create the chart pattern. Dogecoin price is stuck within the inner boundaries of the two trend lines, suggesting that the sideways trend could continue.

While the prevailing trend of the chart pattern is sideways in the short term, it should be noted that yesterday’s candlestick showed that it was a bearish engulfing day, which could raise concern for DOGE.

Speculators should also turn their attention to the Dogecoin 50-day moving average, which adds credence to the bearish outlook as DOGE lost the strength to hold the area as support and subsequently fell below the critical level at $0.39.

DOGE/USDt 1-day chart

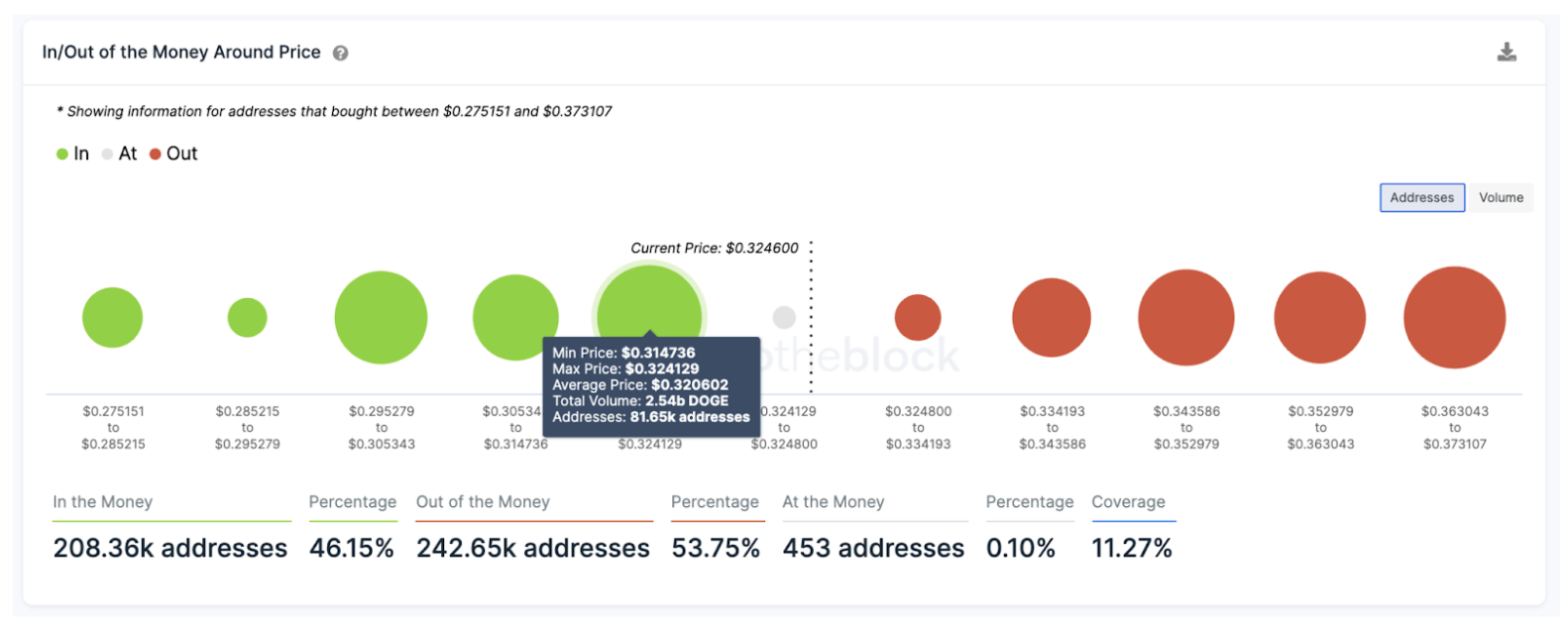

The lower trend line of the parallel channel could act as the direct line of defense for Dogecoin, at $0.30. IntoTheBlock’s In/Out of the Money Around Price (IOMAP) also shows that additional support may be found just beneath the current price, where a total of over 81,650 addresses bought over 2.54 billion DOGE at an average price of $0.32.

Even though lower lows seem unlikely, a breach of the $0.29 support could see Dogecoin price plummet towards the demand zone ranging from $0.23 to $0.14.

DOGE IOMAP

Despite the sideways price action, there is still hope for DOGE bulls, as the ascending parallel channel indicates that Dogecoin could continue making higher highs and higher lows.

Investors should also turn their attention to the Bollinger bands squeeze seen in the price trend, which is indicative of periods of low volatility that are usually succeeded by high volatility. A spike in buying pressure could ignite strength in DOGE, pushing Dogecoin price to break out above the topside trend line of the parallel channel, tagging the 62% Fibonacci extension level at $0.54.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Is Altcoin Season here as Bitcoin reaches a new all-time high?

Bitcoin reaches a new all-time high of $98,384 on Thursday, with altcoins following the suit. Reports highlight that the recent surge in altcoins was fueled by the victory of crypto-friendly candidate Donal Trump in the US presidential election.

Shanghai court confirms legal recognition of crypto ownership

A Shanghai court has confirmed that owning digital assets, including Bitcoin, is legal under Chinese law. Judge Sun Jie of the Shanghai Songjiang People’s Court shared this opinion through the WeChat account of the Shanghai High People’s Court.

BTC hits an all-time high above $97,850, inches away from the $100K mark

Bitcoin hit a new all-time high of $97,852 on Thursday, and the technical outlook suggests a possible continuation of the rally to $100,000. BTC futures have surged past the $100,000 price mark on Deribit, and Lookonchain data shows whales are accumulating.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.