Dogecoin price consolidates while DOGE bulls buy en masse

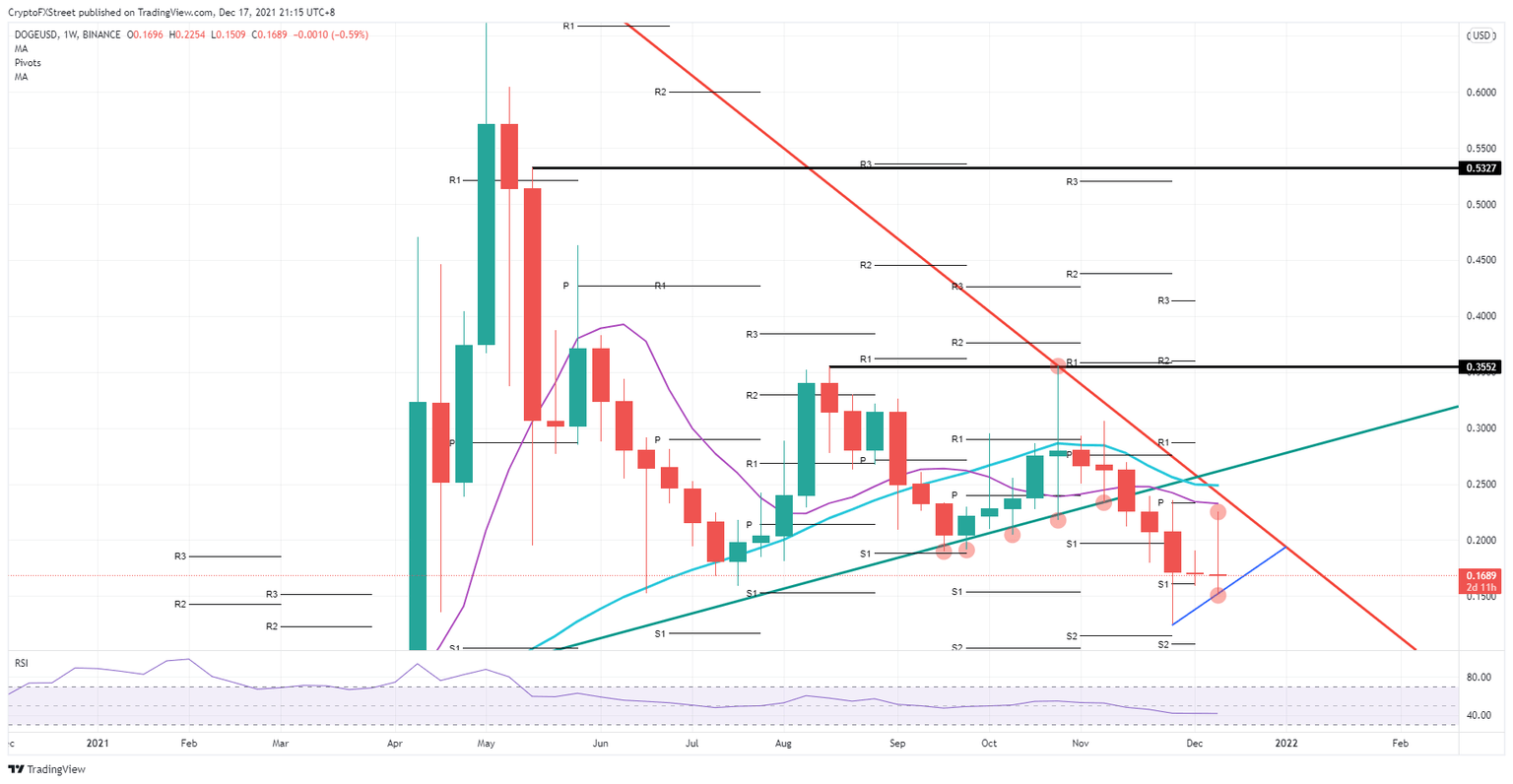

- Dogecoin price is still consolidating with lower highs and higher lows.

- DOGE price sees bulls defining an ascending trend line as support to go long.

- Expect consolidation to be poised for a bullish breakout as bulls already test upside resistance.

Dogecoin (DOGE) price was stuck in a downtrend from November until this week. With a shift in sentiment, DOGE bulls jumped on the opportunity to get in around $0.15 and pushed prices up to a first litmus test of potential resistances. Expect the consolidation to unfold in favor of bulls, with bulls targeting $0.35 to the upside.

A whopping 111% of gains could be in the making if crypto can keep tailwinds into Christmas

Dogecoin price has seen quite some market value evaporate throughout November, but a shift in sentiment looks to be set, with bulls breaking out of the downtrend. The consolidation phase is ongoing, with lower highs and higher lows between the blue ascending trend line and the red descending one. With that said, bulls already dipped their toes in the water to test resistance when a breakout would occur.

Expect the consolidation to continue unless some strong tailwinds emerge that could set price action above the 55-day and the 200-day Simple Moving Average (SMA) at $0.23 and $0.25. A close above the green ascending trend line around $0.27 would be the best scenario and trigger fresh buying volume from investors who want to get in the uptrend.

DOGE/USD weekly chart

From there, bulls have nothing in the way until $0.35 has a critical double top and the monthly R2 resistance just a few cents above. The risk to the downside is that with the litmus test, the 55-day SMA has already proven to be very strong, and the 200-day holds even more importance. As price action got rejected this week, the risk for a break of the blue ascending trend line is possible, which would see a test towards the monthly S2 at $0.10.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.