Dogecoin price coils up for a 10% move north with bullish on-chain metrics to show for it

- Dogecoin price is down 5% after a rejection from $0.07862, the midline of a supply barrier extending from $0.07677 to $0.08039.

- DOGE could climb back north, recovering 10% of ground lost driven by bullish on-chain metrics and rising buyer momentum.

- Invalidation of the bullish outlook will occur after the altcoin breaks and closes below the $0.06756 support level.

Dogecoin (DOGE) price has been on an uptrend over the past few weeks, rallying north beginning October 18, when the broader market pivoted, around the $0.05694 support floor. After a strong pump north, profit bookers took charge and now the bulls are trying to reclaim all that ground lost.

Also Read: Dogecoin Price Prediction: This supply barrier stands between DOGE and its $0.100 target objective

Dogecoin price could rise 10%

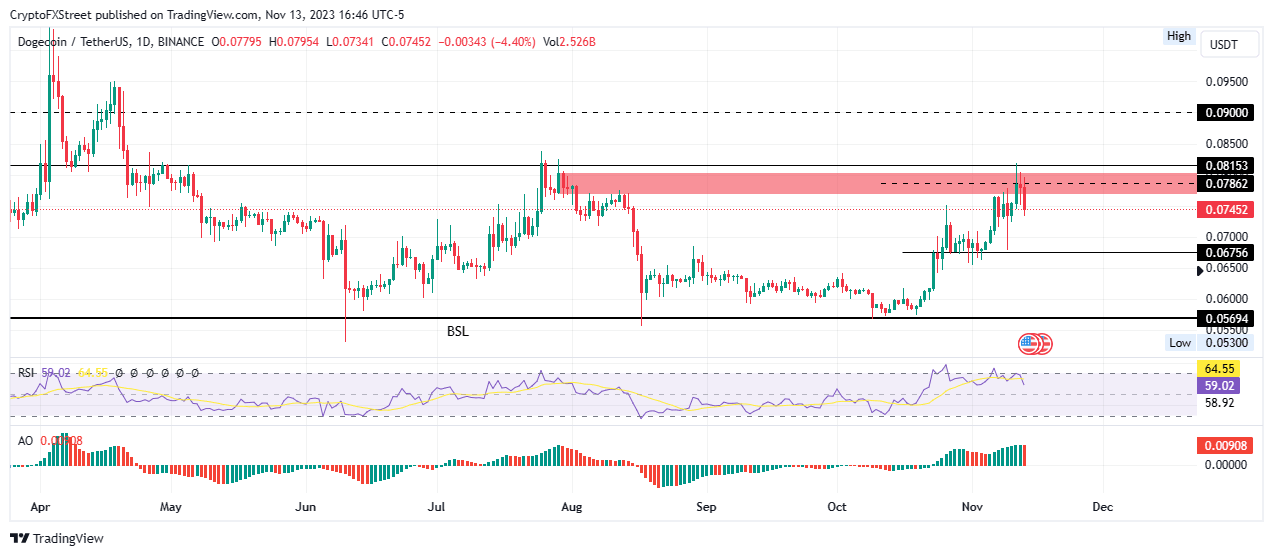

Dogecoin (DOGE) price faced obstruction from selling pressure due to the supply barrier extending from $0.07677 to $0.08039. Despite falling buying pressure and with the bears establishing a presence in the market, DOGE bulls are putting up a strong fight, which could see the meme cryptocurrency potentially recover 10% above current levels to test the $0.08153 resistance level.

In a highly bullish case, the gains could stretch for Dogecoin price to clear the $0.08500 level before extending higher to test the $0.09000 psychological level.

Technical indicators as well as on-chain metrics support the bullish thesis. Regarding the technicals, the Relative Strength Index (RSI) is still above the 50 level, pointing to a strong price strength. The Awesome Oscillator (AO) aligns in the positive territory, showing that the bulls are still at the forefront of the DOGE market. These indicators add credence to the bullish thesis.

DOGE/USDT 1-day chart

Dogecoin on-chain metrics to support bullish outlook

From an onchain standpoint, the number of daily active addresses for DOGE is increasing, showing the number of unique or new addresses involved in DOGE transactions daily. With a growing level of crowd interaction, bolstered by fresh capital inflow illustrated by rising Tether (USDT) market capitalization and active stablecoin deposits, these metrics favor the upside.

DOGE Santiment: Daily active addresses, USDT market capitalization, active stablecoin deposits

Also, the chart below also indicates a growing volume of total open interest in USD for Dogecoin, also pointing to increased crowd interaction. Marrying this to the rising whale transactions for addresses moving more than $1 million, and $100,000 USD worth of DOGE, the odds favor the upside.

DOGE Santiment: Total open interest, whale transactions

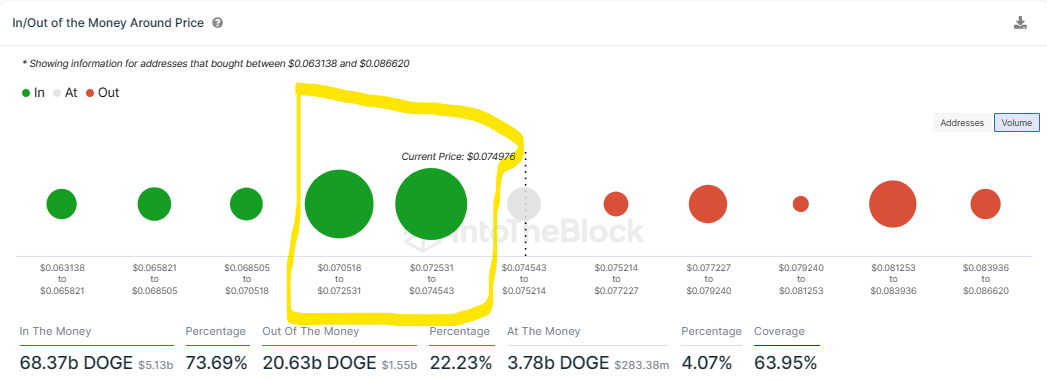

Also, on-chain aggregator IntoTheBlock’s In/Out of the Money Around Price (IOMAP) metric shows that Dogecoin price has more robust support downward. More closely, there is no supply barrier that will prevent the largest meme crypto by market capitalization from achieving its upside potential.

On the contrary, based on this on-chain metric, there are two major areas of interest between $0.070518 and $0.074543 that are filled by a high number of investors that had previously purchased DOGE around these price level. Here, roughly 377,620 addresses are holding nearly 58.02 billion DOGE. Any efforts to push Dogecoin price lower would be countered by buying pressure from almost 400,000 addresses.

DOGE IOMAP

On the flipside, increased selling pressure could send Dogecoin price lower, potentially testing the $0.07000 psychological level. Further south, a break and close below the $0.06756 support level would invalidate the bullish thesis, bringing the $0.05694 support floor into focus.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B00.46.21%2C%252014%2520Nov%2C%25202023%5D-638355202343755352.png&w=1536&q=95)

%2520%5B01.36.56%2C%252014%2520Nov%2C%25202023%5D-638355202194091602.png&w=1536&q=95)