- Dogecoin price is up 13% on the day, charging alongside a widespread meme coin mania.

- DOGE has confirmed support at $0.1290, and could hit $0.2000 if Bitcoin price remains bullish

- A break and close below $0.11451 would invalidate the bullish thesis.

Dogecoin (DOGE) price is trading with a bullish inclination, steadily leading the charge as meme coins go on a tear. While it appears the speculative sector tokens being the main indicator of whether a broader market uptrend is here, it remains to be seen whether the Bitcoin of meme coins will sustain the rally.

Also Read: Meme coins lead way as PEPE, BONK hint at possible marketwide uptrend

Dogecoin price confirms bottom

Dogecoin price has confirmed the bottom at $0.1290 after three successive retests. It is en route north, accompanied by its peers, Shiba Inu (SHIB), Pepe (PEPE), Dogwifhat (WIF), and Floki Inu (FLOKI), which are posting double-digit gains.

TOP 7 TOKENS WITHIN THE BLOCKCHAIN

— Crypt01 Daily (@Crypt01_Daily) May 4, 2024

1⃣WIF - @dogwifcoin

2⃣STX - @Stacks

3⃣FLOKI - @RealFlokiInu

4⃣DOGE - @dogecoin

5⃣GRT - @graphprotocol

6⃣PEPE - @pepecoineth

7⃣RNDR - @rendernetwork#Altcoins #BTCs #Cryptos #ETH pic.twitter.com/pb4EFxOaCP

Investors looking to take long positions on DOGE should exercise caution as Dogecoin price is at an inflection point. This is because:

Dogecoin price has not confirmed a move above the centerline (Simple Moving Average) of the Bollinger indicator on the one-day timeframe.

With the price trending higher and now reaching the centerline, it could indicate a shift in momentum and a possible trend reversal to the downside.

With the Dogecoin price near the centerline, it may indicate that DOGE is experiencing lower volatility. This could precede a period of increased volatility and potentially a strong price movement in either direction.

The Relative Strength Index (RSI) still contends with the mean level of 50, despite rising momentum. At 48 and rising, it shows that no strong trend is currently dominating the market.

Bitcoin price remains below the critical level of $67,133, beyond which it could have a shot a solidified uptrend for the short term.

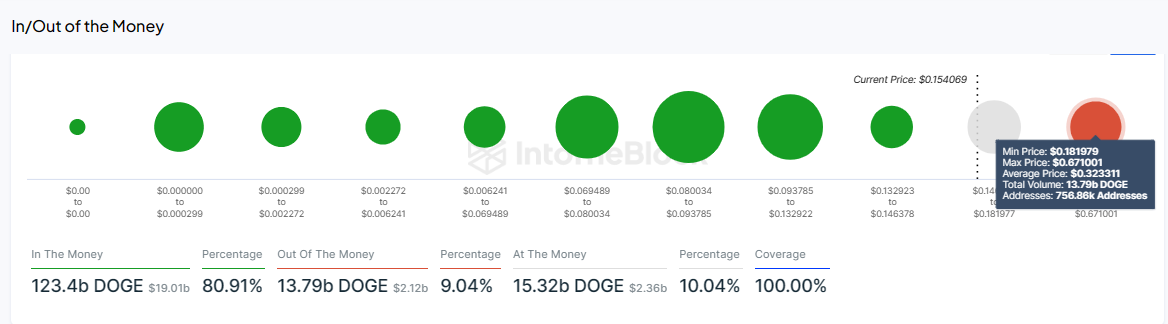

Data from IntoTheBlock’s Active Addresses by Profitability metric shows that a large number of DOGE addresses (81.45%) are 'In the Money'

While this suggests a bullish sentiment, it could hint at potential selling pressure as holders might sell to realize profits.

DOGE active addresses by profitability

Dogecoin price prediction

If DOGE bulls are able to haul Dogecoin price above the $0.1498 centerline of the Bollinger indicator, confirmed by a decisive move of the RSI above the mean level of 50, it would be a good buy. For conservative bulls, however, you may want to wait for a retest of the Dogecoin price above the centerline, and confirmed by a higher high on the RSI.

A strong move above the $0.1649 roadblock would encourage more buy orders, enough to see Dogecoin price move beyond the $0.1800 threshold. In a highly bullish case, Dogecoin price could extend the gains to the $0.2000 psychological level, or higher to the $0.2288 range high, in a highly ambitious turnout where Bitcoin price marks a new all-time high above $73,777.

DOGE/USDT 1-day chart

On the other hand, a rejection from the centerline at $0.1498 could see Dogecoin price pull back, and while losing the support at $0.1290 would be concerning, the bullish thesis would only be invalidated after a candlestick close below $0.1151 on the one-day time frame.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.