Dogecoin price attempts breakout while DOGE bulls eye $0.37

- Dogecoin price gets a massive pump during the Monday trading session.

- Buyers test key resistance zones ahead

- Dogecoin needs to close at or above $0.28 to begin a new bull run.

Dogecoin price has gained as much as 15% during the Monday sessions, outperforming nearly all significant cryptocurrencies. Roughly half of that gain has been retraced, but buyers show resilience in maintaining a stable trading range near the $0.25 value area.

Dogecoin price looks for a 58% gain as bulls target $0.37

Dogecoin price has one of the most potent multi-top setups on its $0.005/3-box reversal Point and Figure chart: the triple top. The hypothetical trade setup is a buy stop order at $0.28 with a stop-loss order at $0.26. The vertical profit target method in Point and Figure analysis gives a hypothetical profit target at $0.37.

$0.005/3-box Reversal Point and Figure Chart

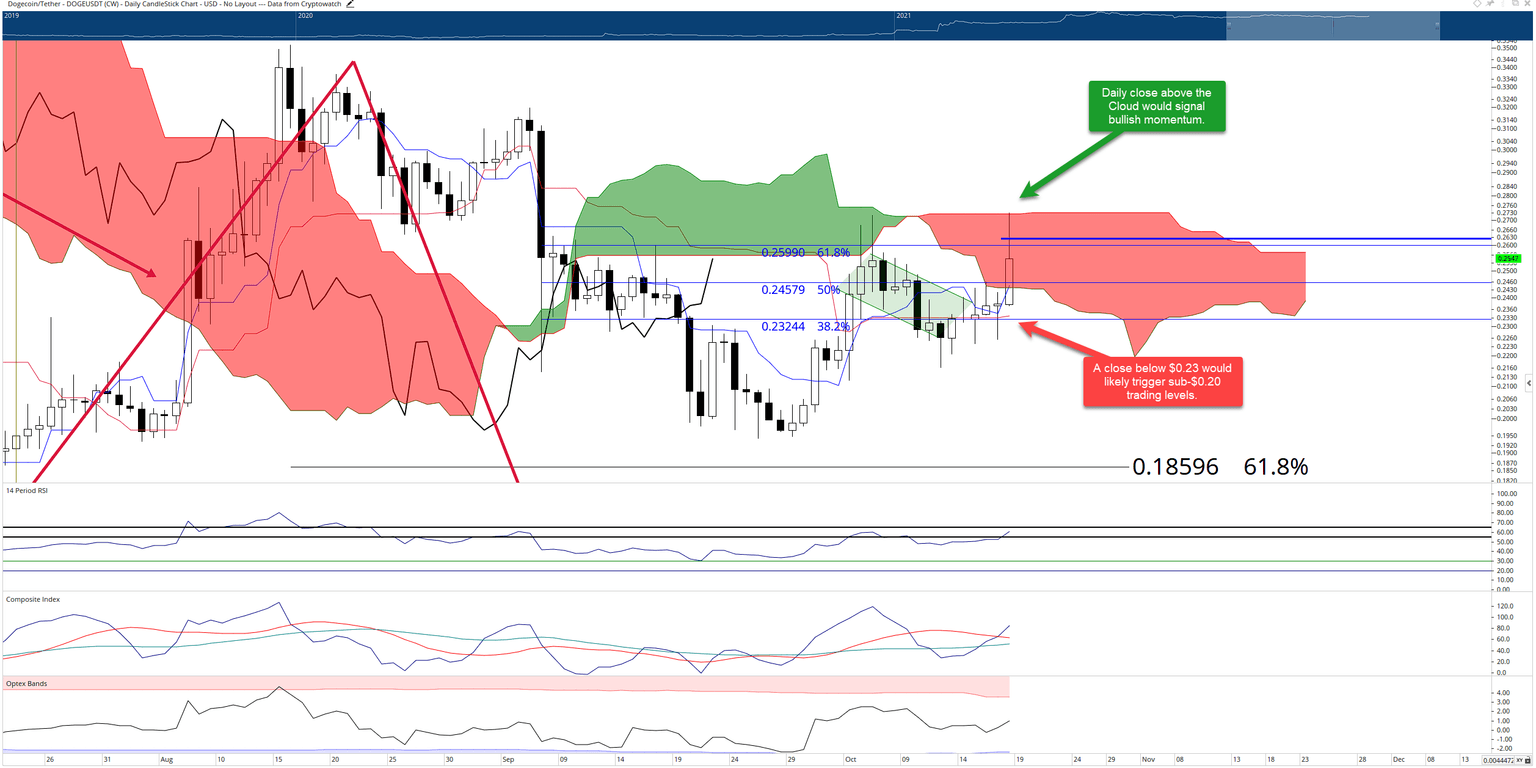

Dogecoin price has two primary resistance levels it needs to close above on the daily chart to continues its present momentum. The first is the weekly Tenkan-Sen and 61.8% Fibonacci retracement at $0.26. The second is the top of the daily Cloud (Senkou Span B) at $0.27.

DOGE/USDT Daily Ichimoku Chart

Bulls and bears will want to observe Dogecoin price as the trading day winds down. If sellers gain momentum and can close Dogecoin below the daily Cloud, then all hope for buyers will likely be destroyed. Many buyers will be trapped and will likely be feeling much anxiety as prices move lower. The critical zone to watch on the daily Ichimoku chart is close below the Kijun-Sen and 38.2% Fibonacci retracement at $0.23. Sub $0.20 trading ranges are likely if $0.23 fails to hold support.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.