Dogecoin Price Analysis: DOGE stabilizes in preparation for rally to $1

- Dogecoin price may close with a second inside day as it tries to maintain April high.

- Daily Relative Strength Index (RSI) shows a bearish momentum divergence.

- IntoTheBlock IOMAP metric shows considerable support just above the April high.

Dogecoin price corrected over 40% from the May 8 high, but outstanding support at the April high keeps bullish aspirations focused on $1.00.

Dogecoin price success lifting the fortunes of many investors

Dogecoin price rests at a pivotal point on the charts, trying to stay above the April high of $0.453. It is also important to note that the 50% retracement of the rally from the April low sits just below the current support at $0.443.

On the upside, the May highs have coincided with the topside trend line drawn from the January high through the April high, granting more importance to the trend line.

Suppose Dogecoin price does close with consecutive inside days. In that case, it will augment the probability that the correction process over the last couple of days is largely exhausted and propose that the altcoin will successfully rally moving forward.

Bullish targets begin with intense resistance framed by the 138.2% extension of the April decline at $0.756 and the topside trend line at $0.775. A resumption of heavy accumulation will be needed to best the range.

A successful breakthrough for Dogecoin price will present an open path to $1.00 and the 161.8% extension of the April decline at $1.014, yielding a gain of 100% based on price at the time of writing.

Based on the tightness of the latest bar on the 12-hour chart, the resolution of the current tight range could occur in the next 24 hours.

DOGE 12-hour chart

Everything changes if Dogecoin price closes below the April high on a daily basis. Immediate support emerges at the 50 twelve-hour simple moving average at $0.397, followed closely by the 61.8% retracement of the April-May rally at $0.371. After that level, Dogecoin price is in a price vacuum, with support waiting at the 78.6% retracement level at $0.269.

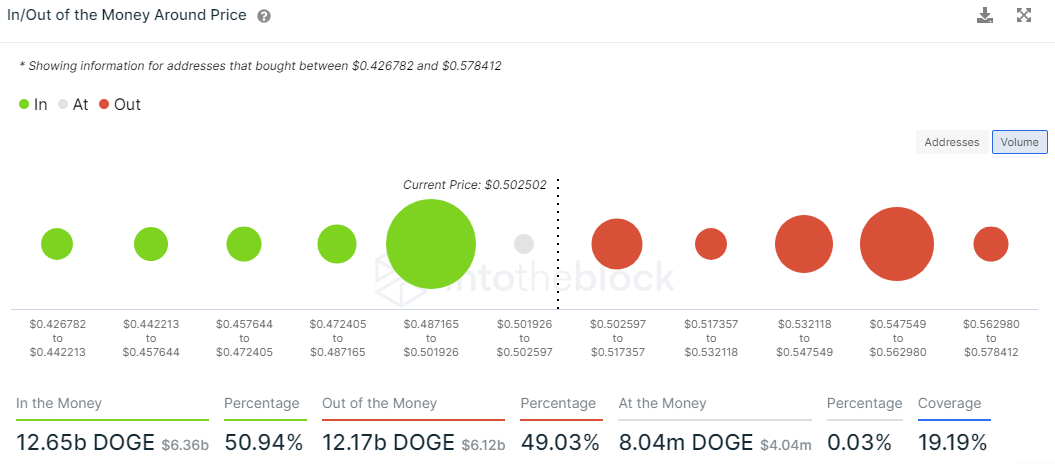

The latest IntoTheBlock In/Out of the Money Around Price (IOMAP) data shows a cluster of support between $0.487 and $0.501, representing 58.22k addresses owning 10.71 billion DOGE. The cluster of support (In the Money) rests very close to the current price and further states the importance of the April high in determining the fate of Dogecoin price, particularly considering there is almost no support down to $0.426 based on the IOMAP data.

DOGE IOMAP data

To be sure, Dogecoin price is at a critical point, and the future of several unrealized small fortunes rests on the resolution of the tightening price action above the April high at $0.453.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.