- DOGE bulls face three strong resistance barriers upfront, as per the IOMAP.

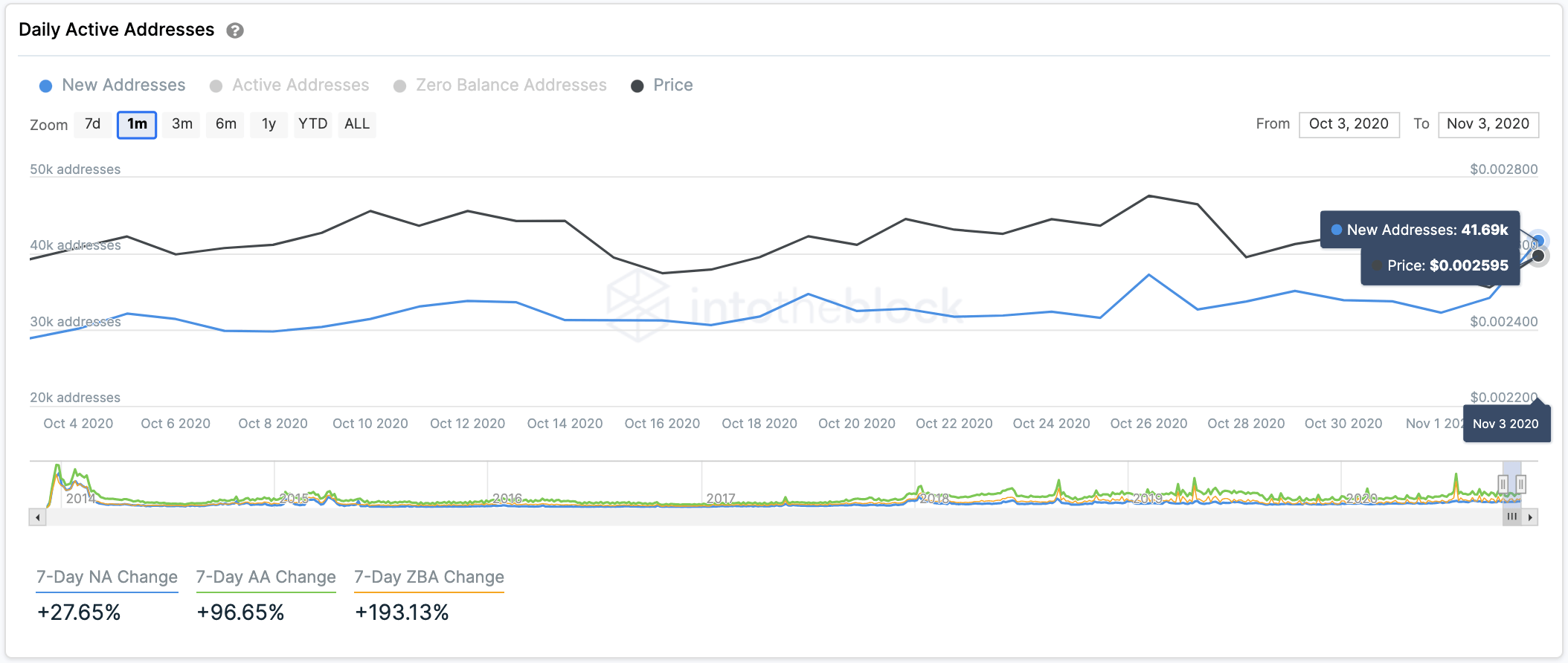

- Since the beginning of the month, the number of new daily Dogecoin addresses has steadily risen.

Between October 26 and November 3, Dogecoin dropped from $0.0027 to $0.00248. However, it looks like the fortunes are about to change.

Dogecoin to climb up

The TD Sequential index presented a buy signal on DOGE’s 1-day chart with a green-nine candlestick. A spike in buying pressure could lead to a one to four daily candlesticks upswing.

DOGE/USDT daily chart

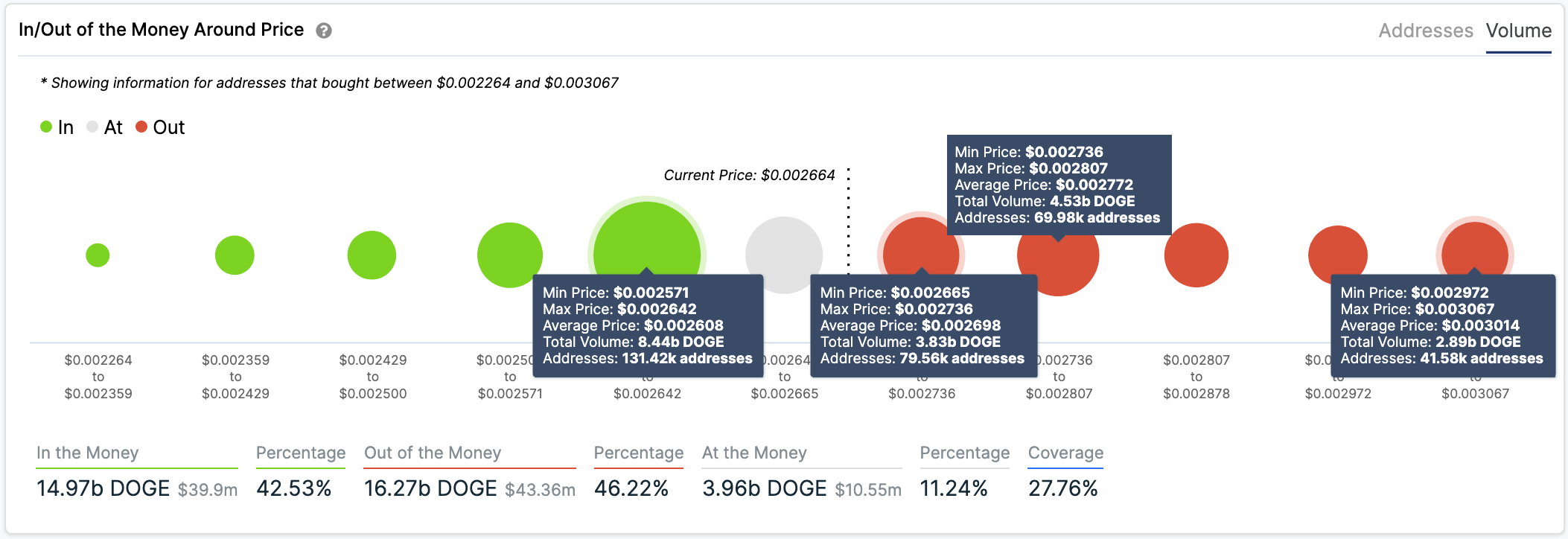

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) presents multiple bullish targets, but the $0.0026 support must hold for the optimistic outlook to be validated. The buyers have three targets upfront at $0.002665-$0.002736, $0.002736-$0.0028 and $0.002972- $0.003067. Upon breaking past these barriers, DOGE buyers should be able to consolidate their position above $0.003.

DOGE IOMAP

When looking at Dogecoin’s network growth, the bullish thesis holds. Since the beginning of the month, the number of new daily DOGE addresses has steadily risen. Roughly 32,000 addresses were joining the network on a daily basis around November 1. This number surge to 41,700 a day, representing a 30% increase.

The uptrend trend in network growth is a positive sign for price growth in the near future. Usually, a sustained increase in network growth is a leading indicator of rising prices.

DOGE new addresses

It should be kept in mind that this bullish action can only be validated if the $0.0026 support wall holds. The IOMAP shows a lack of strong support below this wall. If the sellers manage to break below $0.0026, they should be able to take the price down to $0.0020.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637401407104234741.png)