- Dogecoin has been among the top trending cryptocurrencies in the past 24 hours following Elon Musk's post.

- DOGE is on the verge of reclaiming a major support level that could lead to either of two key outcomes.

- DOGE could see a massive rally if it overcomes the $0.110 key resistance.

Dogecoin (DOGE) is up more than 8% on Monday, as it's leading the entire meme coin sector on a rebound. The top meme coin could see a massive rally if it completes a key move within a falling wedge.

DOGE trends following Musk’s post

Dogecoin has been one of the top trending tokens in the crypto market within the last 24 hours, per Santiment data. The increased social volume of DOGE centers around a post from Tesla and X CEO Elon Musk, in which he referenced the Department of Government Efficiency, abbreviated as DOGE.

Dogecoin community members seized the opportunity to draw connections between Musk's tweet and the DOGE meme coin.

Popular Dogecoin enthusiast @cb_doge quickly posted a Lion King-inspired DOGE meme, which captured the attention of Musk:

Naturally, our official mascot will be the Doge

— Elon Musk (@elonmusk) September 9, 2024

Musk's post seemed to have triggered positive sentiment toward DOGE, which led the entire meme coin sector into recovery with an 8% rally in the past 24 hours.

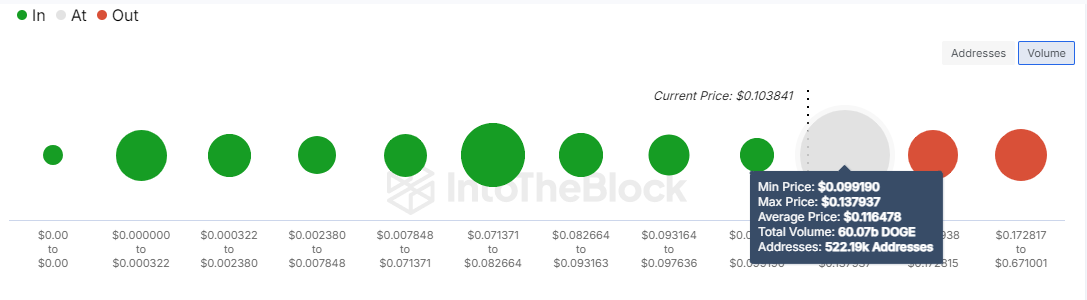

The rise has seen DOGE gradually enter a major accumulation zone where investors purchased over 60 billion DOGE tokens. If DOGE sustains a rise above this key zone, it could serve as a major support level.

DOGE Global/In Out of the Money

Conversely, it could also lead to a correction as some investors may want to sell immediately if they break even.

DOGE could trigger massive rally if it overcomes key resistance

Dogecoin is trading around $0.103 on Monday, up 8% on the day. In the past 24 hours, DOGE has seen $2.45 million in liquidations, with long and short liquidations accounting for $175,450 and $2.27 million, respectively.

DOGE is trading within a falling wedge on the 12-hour chart. This pattern, marked by even lower tops and lower bottoms, suggests that bears are losing momentum and buyers are gradually stepping into the market.

DOGE/USDT 12-hour chart

A crucial price level to watch as the top meme coin attempts a rally is the $0.111 price resistance. If DOGE overcomes this level and fails to see a correction, it could rally toward the next resistance around $0.142. A successful move above this level could see DOGE tackle a six-month resistance around $0.175.

A crucial indicator to watch amid the quest for a rally is DOGE's open interest (OI). Open interest is the total number of unsettled long and short positions in a derivatives market.

DOGE's OI is around $480 million at the time of writing, but it needs to grow to support the buying momentum.

The Relative Strength Index (RSI) is above its midline at 59, indicating rising bullish momentum.

The Stochastic Oscillator has moved into the oversold region, suggesting a potential brief price correction.

A daily candlestick close below the $0.088 support level could strengthen the bears and invalidate the bullish thesis.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

PEPE Price Forecast: PEPE could rally to double digits if it breaks above its key resistance level

Pepe (PEPE) memecoin approaches its descending trendline, trading around $0.000007 on Tuesday; a breakout indicates a bullish move ahead.

Tron Price Prediction: Tether’s $1B move triggers TRX ahead of US Congress stablecoin bill review on Wednesday

Tron price defied the broader crypto market downtrend, surging 3% to $0.25 on Monday. This bullish momentum comes as stablecoin issuer Tether minted another $1 billion worth of USDT on the Tron network, according to on-chain data from Arkham.

Ethereum Price Forecast: Short-term holders spark $400 million in realized losses, staking flows surge

Ethereum (ETH) bounced off the $1,800 support on Monday following increased selling pressure from short-term holders (STHs) and tensions surrounding President Donald Trump's reciprocal tariff kick-off on April 2.

BlackRock CEO warns Bitcoin could replace US Dollar as global reserve currency, crypto ETFs witness inflows

BlackRock CEO Larry Fink stated in an annual letter to investors on Monday that the US national debt could cause the Dollar's global reserve status to be replaced with Bitcoin if investors begin to see the digital currency as a safer asset.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.