The broader crypto market recorded its second day of growth ahead of a U.S. Federal Reserve (Fed) statement on Wednesday. Prices of bitcoin, ether and other major cryptocurrencies rose as much as 7% in the past 24 hours, with memecoin Dogecoin leading gains among the biggest assets by market capitalization.

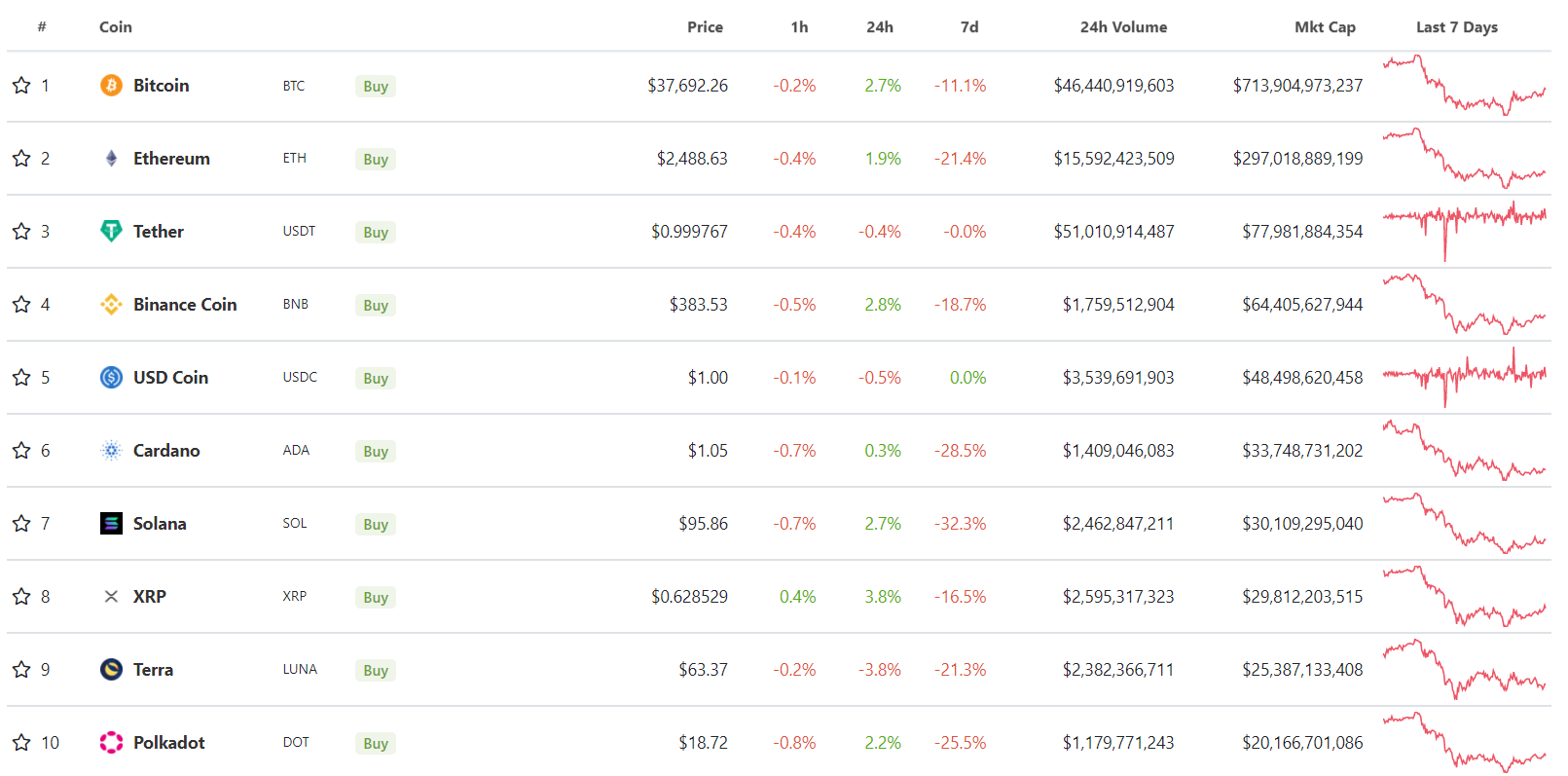

Terra's LUNA tokens were among the only losers, posting a 4.6% decline, data from analytics tool CoinGecko showed.

Major cryptocurrencies continued the second day of recovery on Wednesday. (TradingView)

Wednesday’s Fed meeting may reveal the bank's stance on the timing of an interest-rate increase that many observers expect will come in March. The Fed has said it will tighten monetary policy with up to four hikes this year to keep inflation in check, prompting a sell-off in asset markets across the globe during the last few months. Bitcoin fell as much as 25% in the past month, while the crypto market has lost upward of $1 trillion in market capitalization in the same period.

Some analysts say a tightened policy could see investors flee into safer assets, which could, in turn, lead to a further drop in cryptocurrency prices.

“If the regulator tightens its rhetoric and announces the upcoming rate hike as early as March, all risky assets, including cryptocurrencies, could suffer significantly,” Alex Kuptsikevich, a senior financial analyst at FxPro, said in an email to CoinDesk.

Bitcoin held above $37,000 in European morning hours on Wednesday after dropping to under $33,500 on Monday, a move that caused the majors to fall as much as 25% at the time. The market has since recovered, with bitcoin, Solana (SOL) and ether rebounding to last week’s price levels.

Tokens of some layer 1 blockchains led gains outside of the top 10 cryptocurrencies by market capitalization. Polygon (MATIC) and Near (NEAR) have surged over 11% in 24 hours as investor demand rebounded after Monday’s drop.

Prices of MATIC were buoyed by the appointment of ex-Youtube gaming head Ryan Wyatt as CEO of Polygon Studios, a development lab that supports the creation of blockchain games and non-fungible tokens on the Polygon network. Wyatt previously led YouTube's virtual- and augmented-reality projects and is expected to structure partnerships and investments in the Polygon ecosystem.

MATIC hit resistance at $1.60 after a surge in the past 24 hours. (TradingView)

Some traders said a correlation between crypto prices and risky assets such as technology stocks exists as they share a similar set of investors.

“Crypto is owned by the same people that own growth stocks," Haseeb Qureshi, founder of crypto investment fund Dragonfly Capital, said in a telephone interview. "When they start cutting risk, they cut back on crypto. That’s how the correlation is built.”

Cause for concern may be short lived. “[There are] lots of reasons to believe that the secular macro rate of interest is still low. Interest rates are low because of incremental technology growth. Crypto is one of the few things that people realize has broad growth potential,” Qureshi said.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

XRP chart signals 27% jump after SEC-Ripple appeals pause and $50 million settlement

Ripple (XRP) stabilized above $2.00 exemplifying a similar pattern to the largest cryptocurrency by market capitalization, Bitcoin (BTC), which holds firmly above $84,000 at the time of writing on Thursday.

Bitwise lists four crypto ETPs on London Stock Exchange

Bitwise announced on Wednesday that it had listed four of its Germany-issued crypto Exchange-Traded products (ETPs) on the London Stock Exchange. It aims to expand access to its products for Bitcoin (BTC) and Ethereum (ETH) investors and widen its footprint across European markets.

RAY sees double-digit gains as Raydium unveils new Pumpfun competitor

RAY surged 10% on Wednesday as Raydium revealed its new meme coin launchpad, LaunchLab, a potential competitor to Pump.fun — which also recently unveiled its decentralized exchange (DEX) PumpSwap.

Ethereum Price Forecast: ETH face value- accrual risks due to data availability roadmap

Ethereum (ETH) declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.