- Shiba Inu price continues to display a massively bullish trade reversal opportunity ahead.

- Bulls are likely salivating while anticipating a repeat of October’s price action.

- The anticipated profit target is just shy of the current all-time high.

Shiba Inu price has been consolidating since the December 5 flash-crash. Support is holding just above the 88.6% Fibonacci retracement at $0.00003200.

Shiba Inu price buying opportunity could see a greater than 100% gain

Shiba Inu price action has been a source of frustration for many hodlers and bulls who remain on the sidelines. But changes are developing. The Relative Strength Index on the daily chart has moved above the last oversold level in a bull market (40). Additionally, the Composite Index has crossed above both of its moving averages.

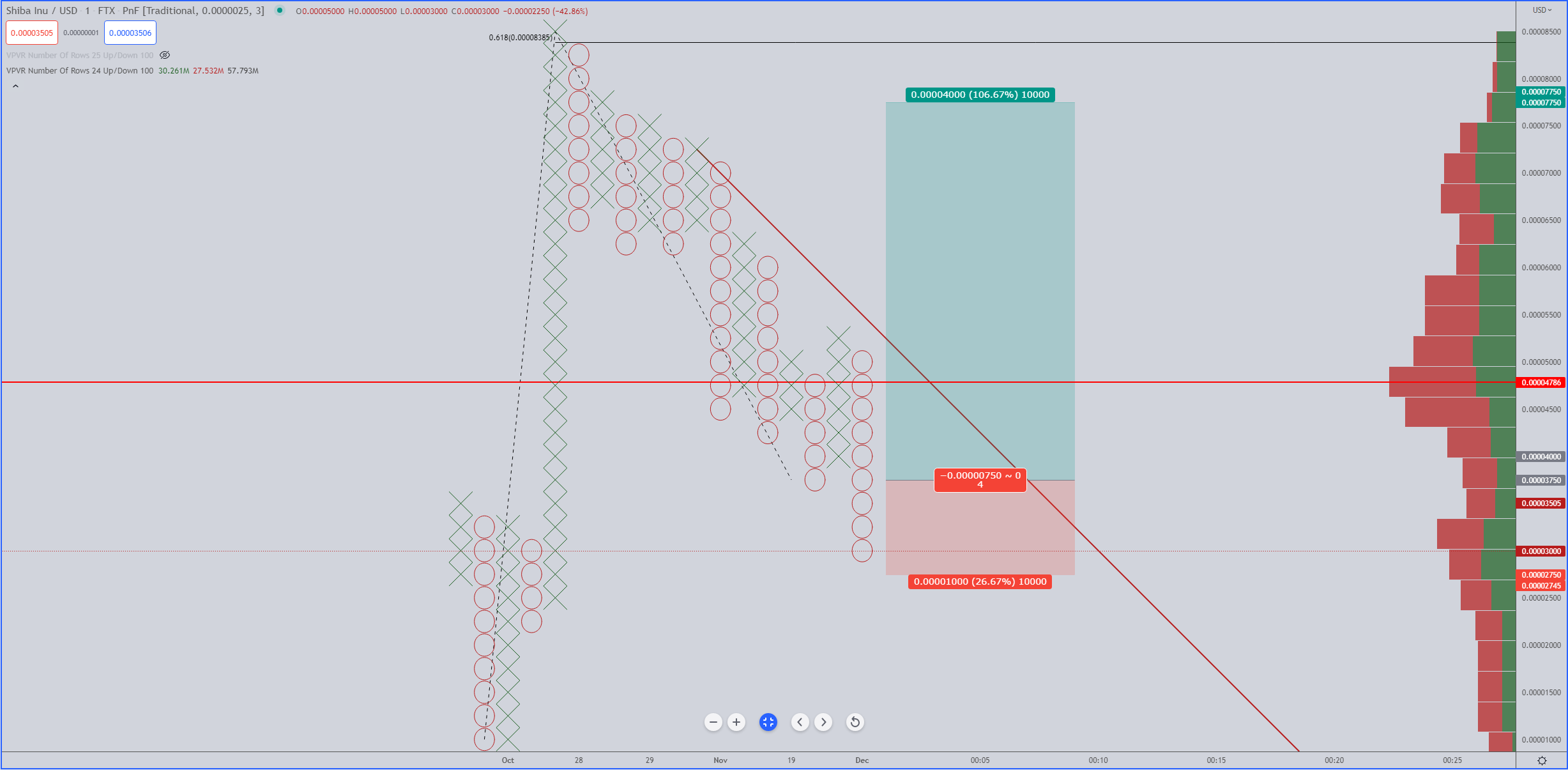

One of the most sought-after reversal patterns in Point and Figure Analysis is the Shakeout Pattern. Unfortunately, this pattern doesn’t show up often, and it is only valid if an instrument is already in a broader uptrend. The Bullish Fakeout Pattern forms after a long column of Os drops below a multiple bottom by at least two, but no more than three, Os.

SHIBA/USDT $0.0000025/3-box Reversal Point and Figure Chart

The hypothetical long setup for Shiba Inu price is a buy stop at the 3-box reversal ($0.00003750), the stop loss is a 4-box stop (currently at $0.0000270), and a profit target at $0.00007750. The profit target is derived from the Vertical Profit Target Method in Point and Figure Analysis. A trailing stop of two to three boxes would help protect any implied profits post entry.

There is no invalidation entry for Shiba Inu with this hypothetical long setup. If Shiba Inu continues to print more Os in the current column, the buy stop and stop loss shift lower in tandem with Shiba Inu’s drop.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.