Dogecoin-killer Shiba Inu holds critical support as SHIBA maintains a $0.0000775 target

- Shiba Inu price has held on to the same support structure for the past month.

- Despite solid selling pressure over the past few weeks, SHIBA is relatively unchanged.

- Upside potential is significant; downside potential is minimal.

Shiba Inu price has done very well over the past two weeks. Yes, it has faced some intense selling pressure along with the rest of the cryptocurrency market, but SHIBA bulls have thus far kept prices stable.

Shiba Inu price defends the $0.0000300 value area, eyes return to breakout conditions

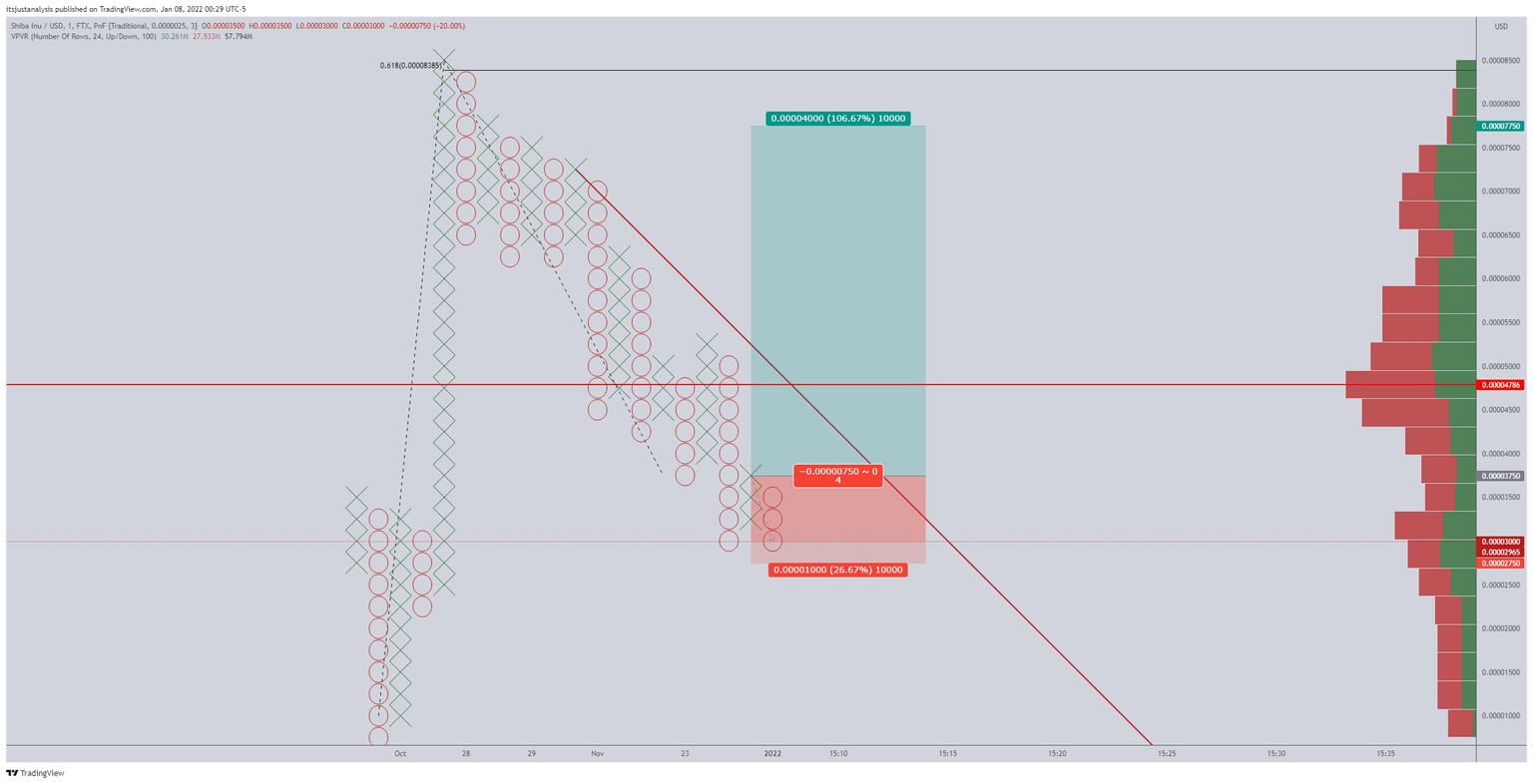

Shiba Inu price action on the $0.0000025/3-box reversal Point and Figure chart is mostly unchanged from the prior analysis. A theoretical long trade setup on the Point and Figure chart first identified in early December 2021 remains active. For traders who missed the entry, there is an opportunity to enter soon.

The theoretical long trade for Shiba Inu price is a buy stop order at $0.0000375, a stop loss at $0.0000275, and a profit target at $0.0000775. This trade idea represents a 4:1 reward/risk setup with an implied profit of over 100% from the entry. A two to three-box trailing stop would protect any profit generated post entry.

SHIBA/USDT $0.0000025/3-box Reversal Point and Figure Chart

The trade is based on a Point and Figure pattern known as a Bullish Shakeout – a form of a bear trap. However, the Bullish Shakeout pattern is only valid when it appears at the bottom or beginning of a new uptrend that is part of a broader uptrend. Shiba Inu price action fulfills all those requirements.

The theoretical long trade setup is invalidated if Shiba Inu price drops below the $0.00002500 value area.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.