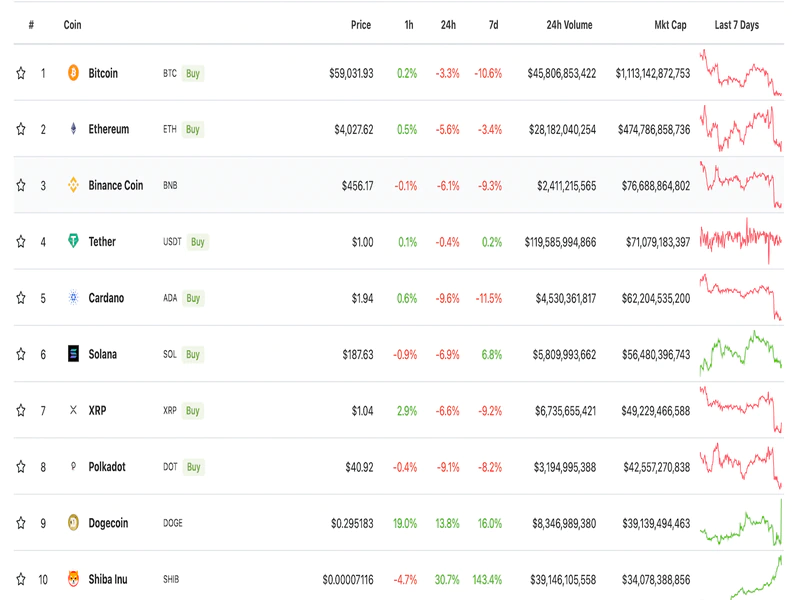

It’s an intense dogfight in crypto skies as dogecoin (DOGE) and Shiba Inu (SHIB), two of the most popular meme coins, battle it out for the ninth spot on the list of top digital assets by market capitalization. Some traders are profiting from the action by taking spread trades.

DOGE has come alive, having lagged SHIB by a significant margin earlier this month. The joke cryptocurrency surged to $0.335 on Coinbase on Thursday, hitting the highest level since Aug. 20, and was last seen trading near $0.30, representing a 22% gain on the day.

Meanwhile, SHIB crashed as much as 30% to $0.00006 earlier today, having chalked out a three-fold rally to $0.00009 in the seven days to Oct. 27.

Diverging price trends are helping DOGE consolidate its position as the ninth biggest coin. However, with a market capitalization of $34 billion, SHIB doesn’t appear to be far behind DOGE’s $39 billion market cap. The self-proclaimed dogecoin-killer briefly topped its rival in rankings on Wednesday.

The price action observed in the past several hours is perhaps reflective of the rotation of money out of SHIB and into the relatively undervalued DOGE. The latter is still down over 60% from its all-time high of $0.74 in May.

“It’s hard to deny that money could be moving to DOGE,” pseudonymous trader and self-proclaimed JPEG collector Kano The Giga Chad said while revealing his position to CoinDesk in a Twitter chat.

“Being short SHIB and long DOGE feels nice,” the trader said. “I took the position about two hours.”

Retail investors account for almost the entire volume in meme coins. A surge in activity in this crypto market sub-sector is often taken to represent excess greed often observed at market tops.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.