Dogecoin futures open interest jumps to 7b DOGE, indicating risky bets

-

Trading interest in DOGE bets rose over 40% in the past 24 hours to reach the most since April.

-

An increase in leveraged bets came after a 12% surge on Thursday as one company said it planned to send a physical Dogecoin token to the moon.

-

However, a spike in DOGE prices could be considered a generally bearish indicator.

A key metric of Dogecoin (DOGE) futures jumped about 40% in the past 24 hours, an indication of higher risk-taking behaviors among traders and one that has historically marked local price tops in crypto markets.

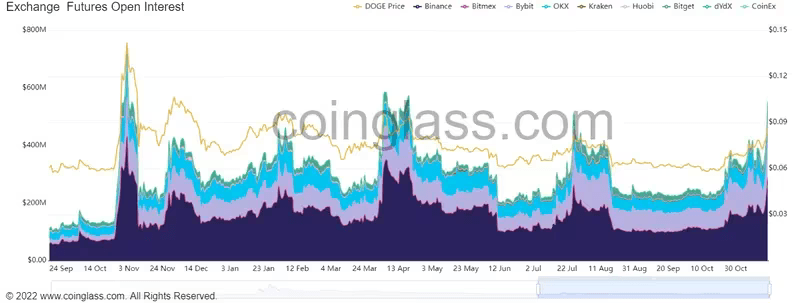

Open interest, or the number of unsettled futures bets, spiked to more than 7 billion DOGE tokens on Friday, reaching levels previously seen in April. These positions are worth $600 million at current prices.

DOGE futures OI has reached April levels. (Coinglass)

Nearly half of the bets, $275 million worth of futures positions, are placed on Binance, followed by Bybit at $134 million and OKX at $85 million. The longs-to-shorts ratio is 50% on either side, implying traders may have hedged all their bets.

Rising open interest usually signals a bullish bias among futures traders. However, if it grows too high or spikes suddenly, it can be a bearish signal that indicates a coming change in market trends as traders may be building short positions.

The increase in DOGE open interest is an outlier to the general market. Futures tracking major tokens, such as bitcoin (BTC) and ether (ETH), saw a 5% drop.

DOGE prices jumped over 12% on Thursday amid reports of a space payload mission planned by Pittsburg-based firm Astrobotic to take a physical dogecoin token to Earth’s moon in a December mission.

Moreover, some traders say sudden jumps in meme coins such as DOGE are generally bearish events that indicate heightened risk-taking behavior synonymous with the end of a broader crypto rally.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.