Dogecoin, Floki bullish bets rise on X payments speculation

Dog-themed meme tokens Dogecoin (DOGE) and floki (FLOKI) rose as much as 12% before retreating, as an @xpayments profile on social app X sent adoption hopes flying among crypto circles.

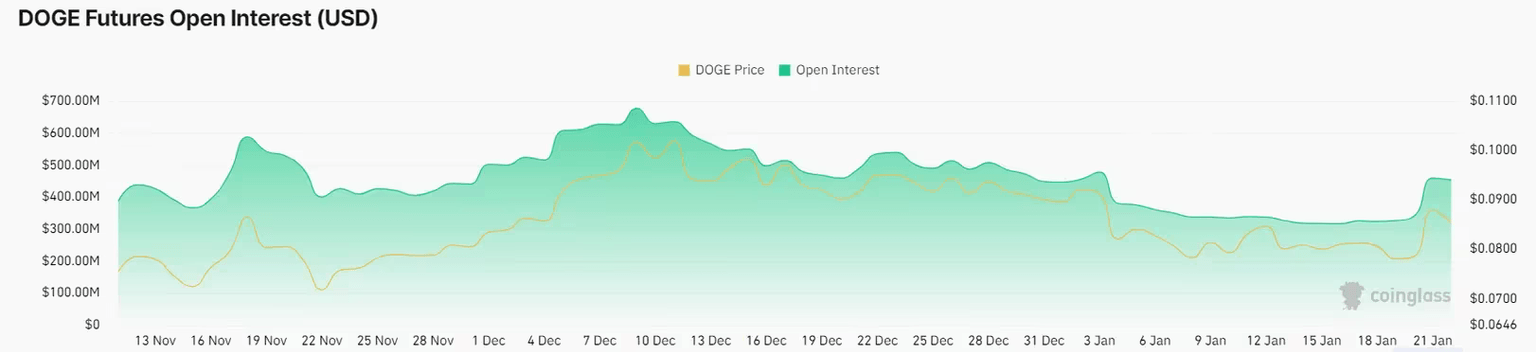

Trading volumes for both tokens shot up 200% over the weekend, CoinGecko data shows, even as broader crypto volumes remained relatively lower amid little volatility. Elsewhere, futures tracking the tokens saw open interest rise to a cumulative $430 million from $200 million, indicative of rising bets.

DOGE open interest spiked Saturday. (Coinglass)

DOGE has the tendency to surge on payments-related developments at any Elon Musk-owned companies, such as X or Tesla. Floki, named after Musk’s dog, moves as a beta bet among midcap traders.

“The speculation is that advertisers could be able to pay DOGE for ads and for other uses on Twitter,” Simon Schaber, CBDO of Spool DAO, explained to CoinDesk in a Telegram message last July.

“We have seen the same happening when Tesla revealed the ability to pay for its goods with DOGE. So the speculation could be around Musk’s businesses and stakeholdings starting to accept crypto, as Tesla does,” Schaber added.

The @xpayments account has already garnered over 100,000 followers since its late Friday setup.

Earlier in January, X said in a blog post that it would launch peer-to-peer payments capability on the application this year, and Musk has previously stated it could feature cryptocurrencies.

There has been no official communication on whether DOGE will feature as a payment option, compared to bitcoin (BTC) or ether (ETH), but such speculations aren’t entirely unfounded. In April 2023, Musk teased DOGE payments on Twitter in a tweet, proposing dogecoin as one of the payment options for Twitter Blue, the site’s subscription service with premium features.

Musk’s electric car company, Tesla, already accepts DOGE payments for merchandise purchases in the Tesla Store.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.