Dogecoin extends gains as traders assess Elon Musk’s role in upcoming Trump administration

- Dogecoin price extends the gains on Monday following a rally of over 83% in the previous week.

- DOGE’s open interest hit a new all-time high on Monday, while its daily trading volume reaches a yearly high.

- Elon Musk’s support of DOGE fuels interest in the meme coin as the tech billionaire is expected to play a pivotal role in Trump’s new administration.

Dogecoin (DOGE) extends its gains on Monday and trades around $0.28 after rallying over 83% in the previous week, buoyed by the victory of crypto-friendly candidate Donald Trump in the US presidential election and its promotion by Trump supporter Elon Musk.

Elon Musk’s continued support for Dogecoin has reignited interest in the dog-themed meme coin. DOGE’s open interest reached a new all-time high of $2.26 billion on Monday, signaling a surge of new capital, while its daily trading volume also hit a yearly high of $13.96 billion.

Elon Musk’s support for DOGE

Elon Musk’s involvement has reignited interest in Dogecoin, particularly following his co-founding of the “Department of Government Efficiency” (DOGE), a concept aimed at streamlining US government operations and reducing waste.

Last week, Donald Trump’s victory in the US presidential election sparked renewed attention on Musk’s proposed initiative. During a campaign rally in New York on October 27, Musk claimed the formation of the “Department of Government Efficiency” could save the United States $2 trillion in tax spending. Elon Musk’s continued support for Trump’s campaign and Trump’s victory has increased the likelihood of forming such a department.

The initiative’s initials, DOGE, align with the Dogecoin ticker, fueling discussions and speculation on social media about the token’s future and enhancing bullish sentiment for the meme coin.

Dogecoin bulls eye for October 2021 highs

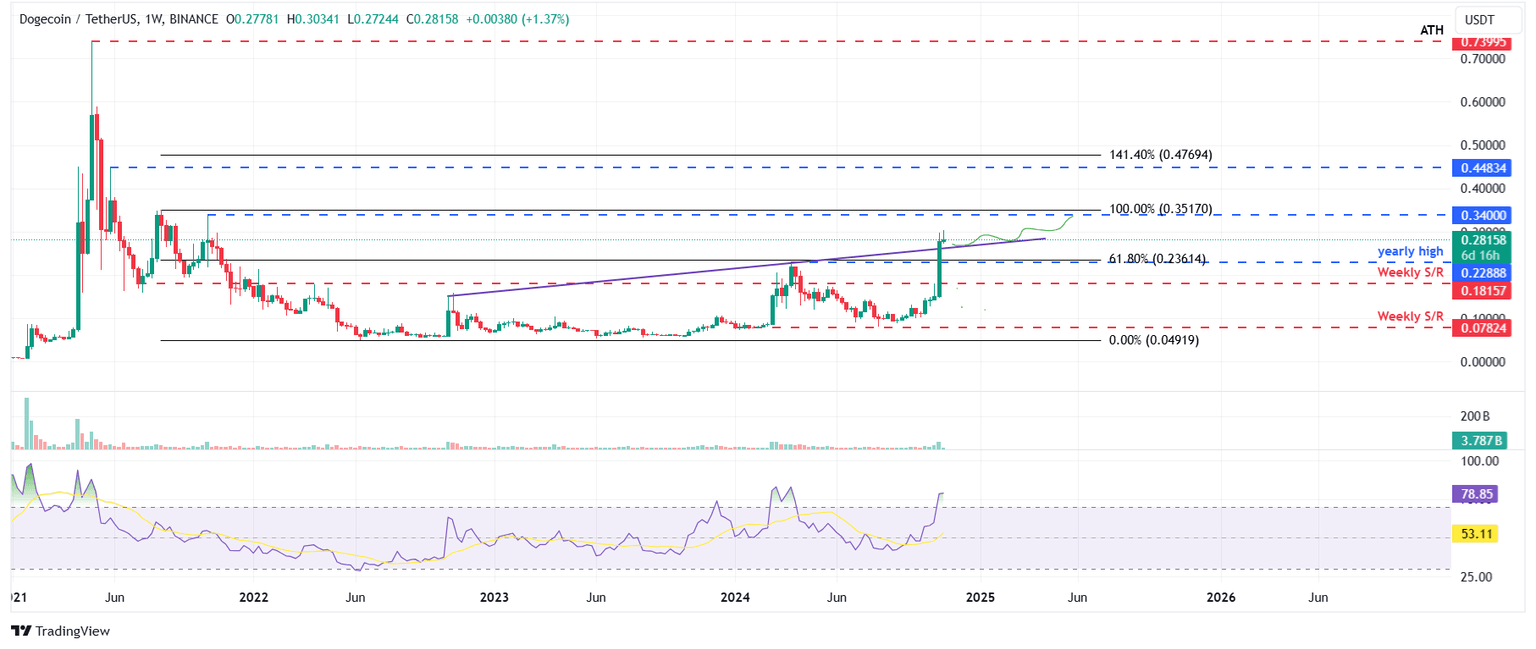

Dogecoin’s weekly chart has broken and closed above the ascending trendline, which had previously acted as resistance. The breakout from this trendline, which was drawn by connecting multiple highs since October 2022, favors bulls. As of Monday DOGE trades slightly higher around $0.278.

If DOGE’s upward momentum continues or the ascending trendline holds as support, it could extend the rally by another 21% to retest its October 2021 high of $0.34.

The Relative Strength Index (RSI) on the weekly chart is currently at 78, above the overbought threshold of 70, signaling caution as the likelihood of a pullback increases. However, the RSI may also dip slightly but maintain its bullish momentum by staying above the overbought level and continuing its ongoing rally. An exit from overbought territory would give a sell signal.

DOGE/USDT weekly chart

Dogecoin’s on-chain data further supports the bullish thesis. Coinglass’s data shows that the futures’ Open Interest (OI) in Dogecoin at exchanges is increasing. Increasing OI represents new or additional money entering the market and new buying, which suggests a bullish trend.

The graph below shows that DOGE’s OI roughly doubled from $1.16 billion on November 5 to a new all-time high of $2.26 billion on Monday.

Dogecoin Open Interest chart. Source: Coinglass

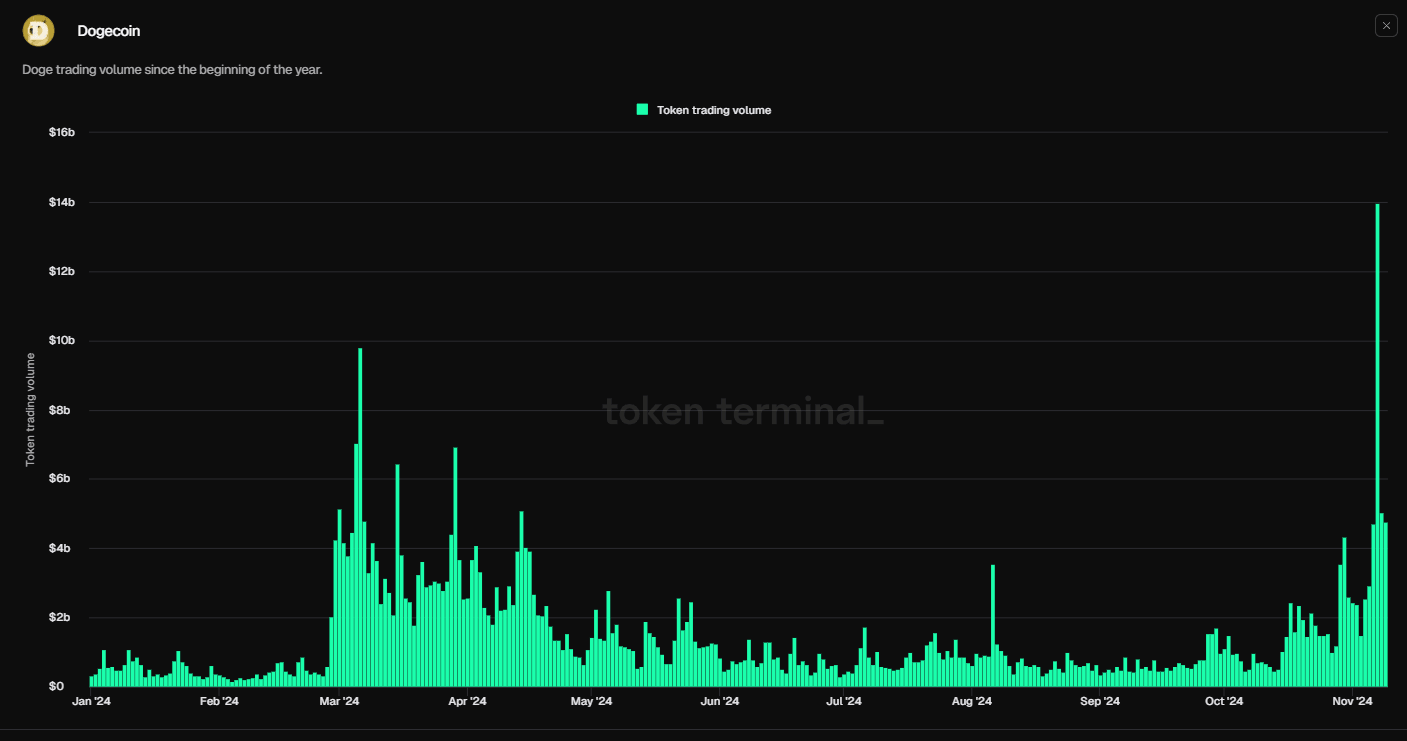

Another aspect bolstering the platform’s bullish outlook is a recent surge in traders’ interest and liquidity in Doge’s ecosystem. Token terminal data shows that DOGE’s daily trading volume rose from $1.49 billion on November 3 to $13.96 billion on Thursday, the highest daily trading volume this year.

Dogecoin daily trading volume chart. Source: Token Terminal

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.