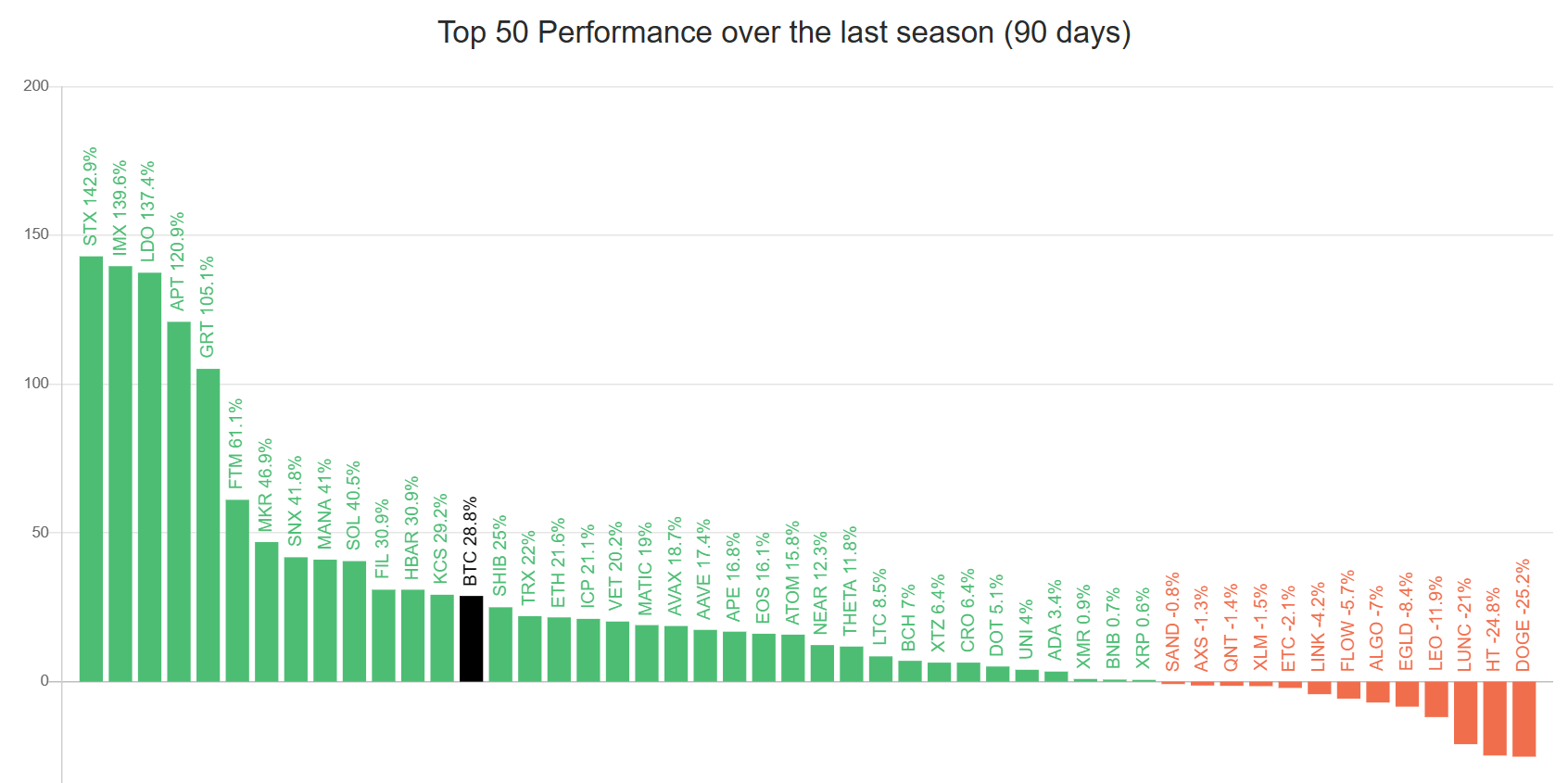

- Dogecoin price declined by over 26% in the last season of 90 days, performing worst than the likes of Luna Classic and Huobi Token.

- The last altcoin season was observed back in August - September 2022, when Bitcoin price fell by 23% in three weeks.

- If DOGE falls any further below $0.067, the altcoin would become vulnerable to slipping to September 2022 lows.

Dogecoin has anchored the altcoins in terms of growth, as the meme coin itself has noted no growth over the last couple of months. The impact of this lack of rise on the market has been pretty significant when compared to the rest of the cryptocurrencies in the list.

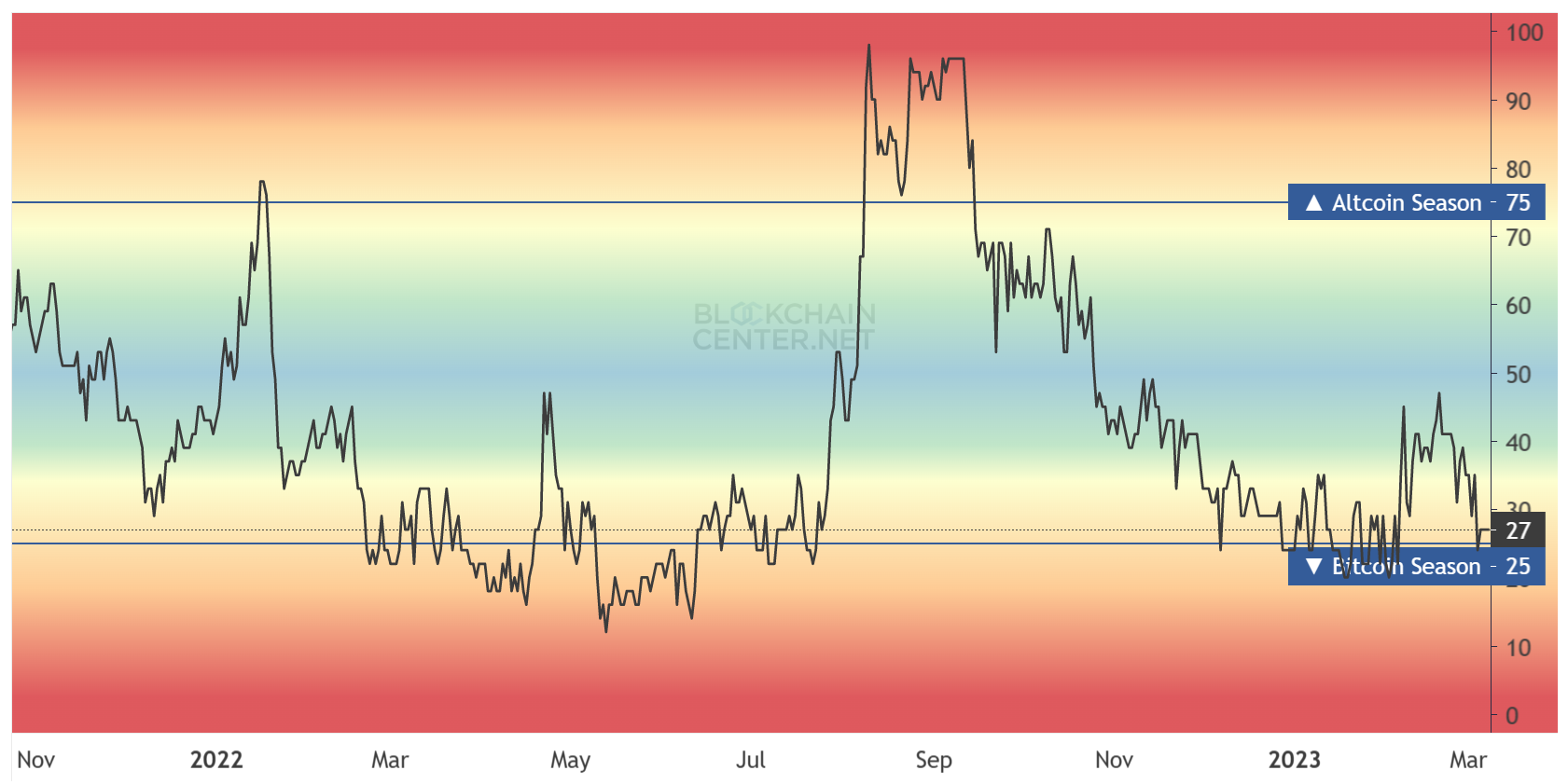

Alt-season stands far away

Alt-season, put simply, is considered to have arrived when 75% of the top 50 altcoins happen to perform better than Bitcoin. This performance is measured over the period of one season, which constitutes 90 days.

Although Bitcoin surpassed most of the altcoins on the list, a few of them ended up not only performing worse than Bitcoin but terribly in general. The leading cryptocurrency on that front is Dogecoin.

Alt-season index

Down by nearly 26% in the span of three months, Elon Musk’s favorite cryptocurrency has fallen behind the likes of Luna Classic (LUNC) and Huobi Token (HT). Both LUNC and HT declined by just 21% and 24%, respectively. This is despite LUNC being the token of a once-collapsed blockchain.

Performance of top 50 cryptocurrencies

With Dogecoin pulling the altcoins down, the crypto market has descended into experiencing a Bitcoin season at the moment. The last altcoin season was observed from August to September 2022, when BTC happened to decline by more than 23% in the span of three weeks.

Where Dogecoin price stands right now

Dogecoin price can be seen trading at $0.072 at the time of writing. Despite having fallen about 25% over the last month, DOGE holds slightly above the 2023 opening price. Still, the meme coin is inching closer to the critical support level at $0.067, which also marks the year-to-date low.

If DOGE falls through this support level, it will become vulnerable to falling right away to $0.057. These lows were last witnessed by Dogecoin holders back in September 2022, and such a plunge would result in a 20% crash.

The chances of the same seem likely since main Exponential Moving Averages (EMA) are acting as resistance levels. The Parabolic Stop and Reverse (SAR) indicator is also highlighting an active downtrend, evinced by the presence of the blue dots above the candlesticks.

DOGE/USD 1-day chart

But the Relative Strength Index (RSI) is nearing the oversold zone below the 30.0 mark. This area is historically known to trigger a trend reversal, which might result in a recovery in the Dogecoin price.

However, in order to invalidate the bearish thesis, DOGE would need to rally by about 16% and breach the critical resistance at $0.082. This would allow the altcoin to eventually rise to the year-to-date highs of $0.095 and even tag the $0.100 mark.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs.

Binance Coin price nears $600 breakout as CZ reacts to BNB listing on Kraken

Binance Coin price posted considerable gains on Thursday, fuelled by investor optimism tied to its upcoming listing on the U.S.-based crypto exchange Kraken.

Binance CEO affirms company's involvement in advising countries on Bitcoin Reserve

Binance CEO Richard Teng shared in a report on Thursday that the cryptocurrency exchange has advised different governments on crypto regulations and the need to create a strategic Bitcoin reserve.

Slovenia moves to impose 25% tax on crypto traders

Slovenia has become the latest European Union member state to crack down on untaxed crypto gains, unveiling a proposal to impose a 25% tax on personal profits from digital asset disposals starting in 2026.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.