Dogecoin (DOGE/USD) Elliott Wave technical analysis

Dogecoin (DOGE/USD)

Elliott Wave Analysis TradingLounge Daily Chart, 2 August 2022,

DOGE/USD Elliott Wave technical analysis

Mode: Motive

Structure: Impulse

Position: Wave 5

Direction Next higher Degrees: wave C of Zigzag

Details: Wave 5 may have finished, and prices are rising.

Wave Cancel invalid Level: 0.04963

Dogecoin Trading Strategy: As the forecast wave (IV) is over, we are looking for opportunities to join the uptrend by looking for throwbacks in wave II and IV sub-wave of (V). But the price must not reverse past 0.04963, which is the beginning of wave 1.

Dogecoin Technical Indicators: Bullish Divergent signal on both MACD and MACD Histogram

TradingLounge analyst: Kittiampon Somboonsod

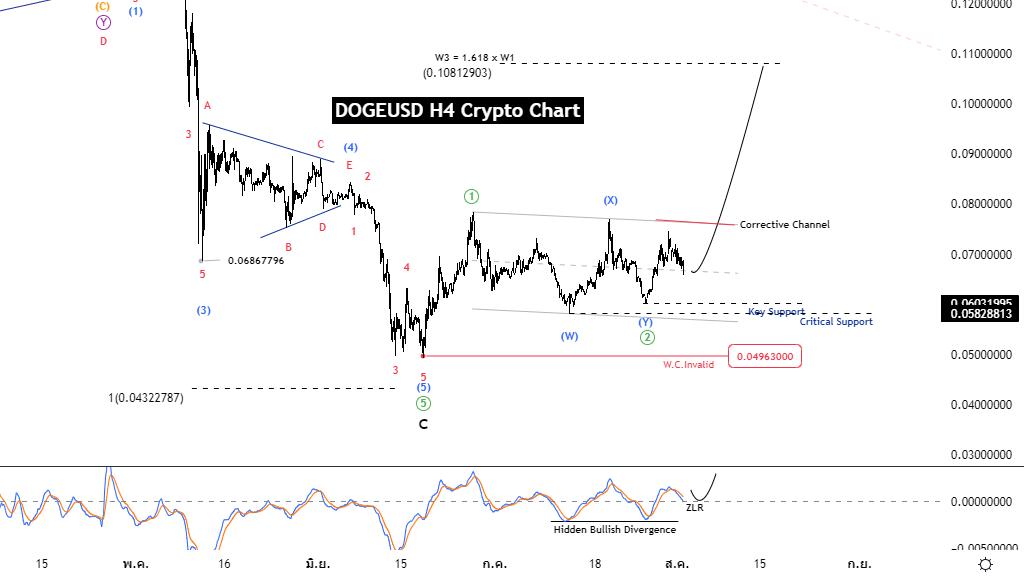

Dogecoin (DOGE/USD)

Elliott Wave Analysis TradingLounge 4H Chart, 2 August 2022.

Mode: Motive.

Structure: Impulse

Position: Wave 2

Direction Next higher Degrees:

Details: may be rising again in Wave 3.

Wave Cancel invalid Level: 0.04963.

Dogecoin Trading Strategy: The price structure has begun to form an uptrend, with wave ((1)) over and wave ((2)) moving sideways with a double corrective pattern. May have to wait for the Break Corrective Channel to be confirmed. but price must not reverse past 0.04963, which is the beginning of wave 1.

Dogecoin Technical Indicators: Hidden Bullish Divergent signal, wait for a reversal at the 0 line of the MACD to confirm.

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.