- Dogecoin price rose 3% on Friday, crossing the $0.28 level for the first time in 10 days.

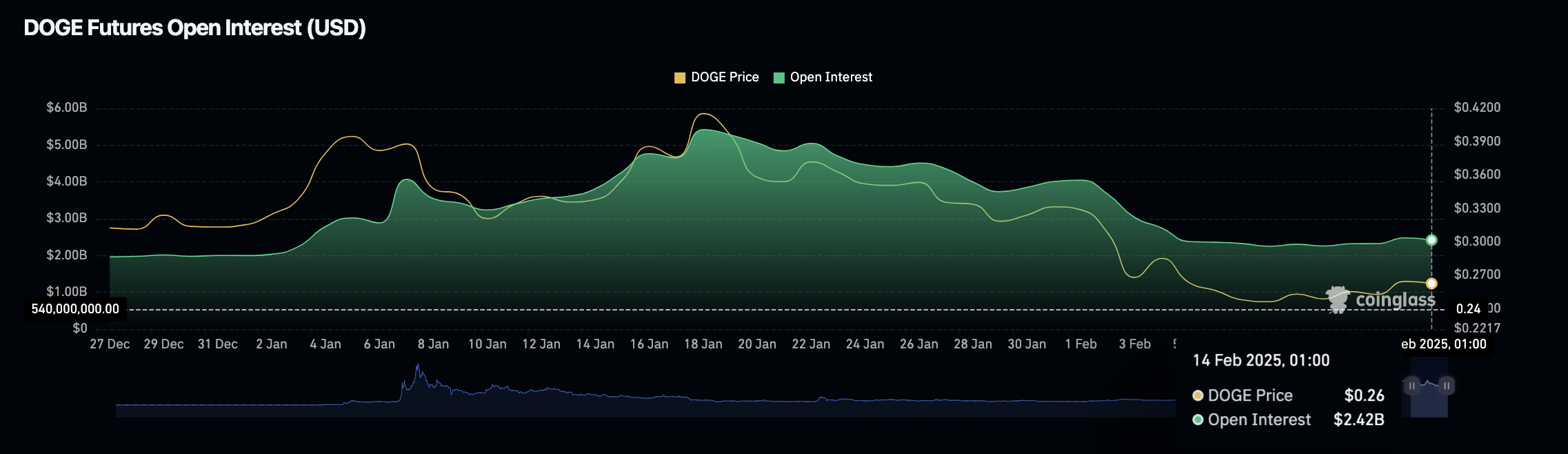

- Dogecoin open interest at $2.42 billion declined by $60 million in the last 48 hours, signaling short traders closing positions.

- Technical indicators suggest the DOGE rally could enter another leg-up in the days ahead.

Dogecoin price surged 3% on Friday, extending its weekly timeframe gains to 17% as ETF speculation gains traction. The acknowledgment of Grayscale’s XRP and Dogecoin ETF applications by the U.S. Securities and Exchange Commission (SEC) fueled the latest bullish DOGE price breakout.

Dogecoin (DOGE) Hits 7-Day Peak as SEC Acknowledges Grayscale ETF Filings

Dogecoin price action has been on an uptrend in recent months amid a shift in the presidential regime. Elon Musk’s increasing involvement in Donald Trump’s administration and the establishment of the D.O.G.E. (Department of Government Efficiency) has amplified media awareness around Dogecoin. The bullish narrative strengthened on Friday after the SEC formally acknowledged Grayscale’s ETF filings for XRP and DOGE.

While the recognition is part of the SEC’s routine process, it signals a potential shift in the agency’s approach to altcoin-related ETFs. Under former Chair Gary Gensler, similar filings were dismissed outright. However, the current acknowledgment suggests a changing regulatory landscape under Trump’s leadership, which has included promises to relax crypto regulations.

“This is a good sign for altcoins,” Bloomberg Intelligence analyst Eric Balchunas noted on X. “In the past, these assets were told to withdraw immediately after filing. The fact that they remain on the table slightly increases our already optimistic odds of approval.”

Dogecoin (DOGE) Price Action | Feb 15

Dogecoin’s price jumped over 3% within the daily timeframe, extending its weekly gains to 17.3%. The cryptocurrency crossed $0.29 for the first time in 10 days, signaling renewed market optimism.

As of press time, Dogecoin’s market capitalization stands at $41.4 billion, reflecting heightened investor interest and ETF-driven speculation.

DOGE Open Interest dip signals short traders’ $60M capitulation

Despite Dogecoin’s 3% gains in the spot market, derivatives market trends suggest even more upside potential ahead. Data from Coinglass reveals that Dogecoin’s open interest has declined by $60 million over the last 48 hours, settling at $2.42 billion.

Dogecoin Open Interest vs. DOGE Price

Open interest represents the total value of outstanding futures contracts. A sharp decline in this metric often suggests short traders are closing out their positions—a phenomenon known as short capitulation. This occurs when bearish traders exit en masse to mitigate losses, reducing selling pressure and paving the way for further price appreciation.

Short capitulation is often a precursor to major price upswings. When leveraged short positions get squeezed out, it allows for stronger upward momentum, especially when paired with bullish fundamentals such as the DOGE ETF acknowledgement by the US SEC.

If ETF-driven enthusiasm continues and open interest remains suppressed, Dogecoin could see further gains in the days ahead, potentially targeting new local highs above $0.30.

Dogecoin Price Forecast: $0.30 breakout could trigger further upside

Dogecoin price has climbed 15.88% over the past seven days, now trading at $0.27991 after testing resistance at $0.28328. The uptrend is supported by a steady increase in trading volume, indicating strong market participation.

The price is approaching the midline of the Keltner Channel at $0.28185, a potential pivot zone that could determine the next directional move. A breakout above this level could see DOGE pushing toward the upper band at $0.33012, aligning with the next major resistance.

Dogecoin Price Forecast (DOGEUSDT)

Momentum indicators are leaning bullish but remain in a cautious zone. The Relative Strength Index (RSI) stands at 45.63, still below the 50 neutral mark but climbing from oversold conditions. This signals improving buying pressure but leaves room for further accumulation before confirming a full bullish reversal. If the RSI breaches 50 alongside increasing volume, DOGE could sustain its breakout, potentially testing $0.30 and beyond.

However, failure to hold above the midline of the Keltner Channel could invite bearish pressure. If DOGE retraces below $0.28, support at $0.23358 may be revisited, invalidating the immediate bullish outlook.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP soars upon announcement that SEC will drop its appeal against Ripple

Ripple CEO Brad Garlinghouse announced that the SEC will drop its appeal against Ripple. The victory follows rumors of Ripple's lawyers negotiating more favorable terms than the company got in Judge Torres' ruling last August.

Dogecoin on-chain metrics signal a potential turning point once the crypto market stabilizes

Dogecoin price hovers around $0.168 on Wednesday after bouncing off its 200-week EMA last week. Santiment’s data shows that DOGE’s utility and whale wallets are rising, hinting at a potential rally for the dog-themed memecoin.

Bitcoin stabilizes below key resistance, risk-off sentiment persists

Bitcoin (BTC) trades around $83,300 at the time of writing on Wednesday after facing resistance around its 200-day Exponential Moving Average (EMA) at $85,500 since last week, with a break above this level suggesting a potential recovery.

Ripple's XRP futures signals increased bearish sentiment despite long-term holders seeing strong gains

XRP open interest and funding rates have remained largely negative in recent weeks. Investors remained calm despite the high bearish sentiment in the futures market, likely due to their large profits.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.