-

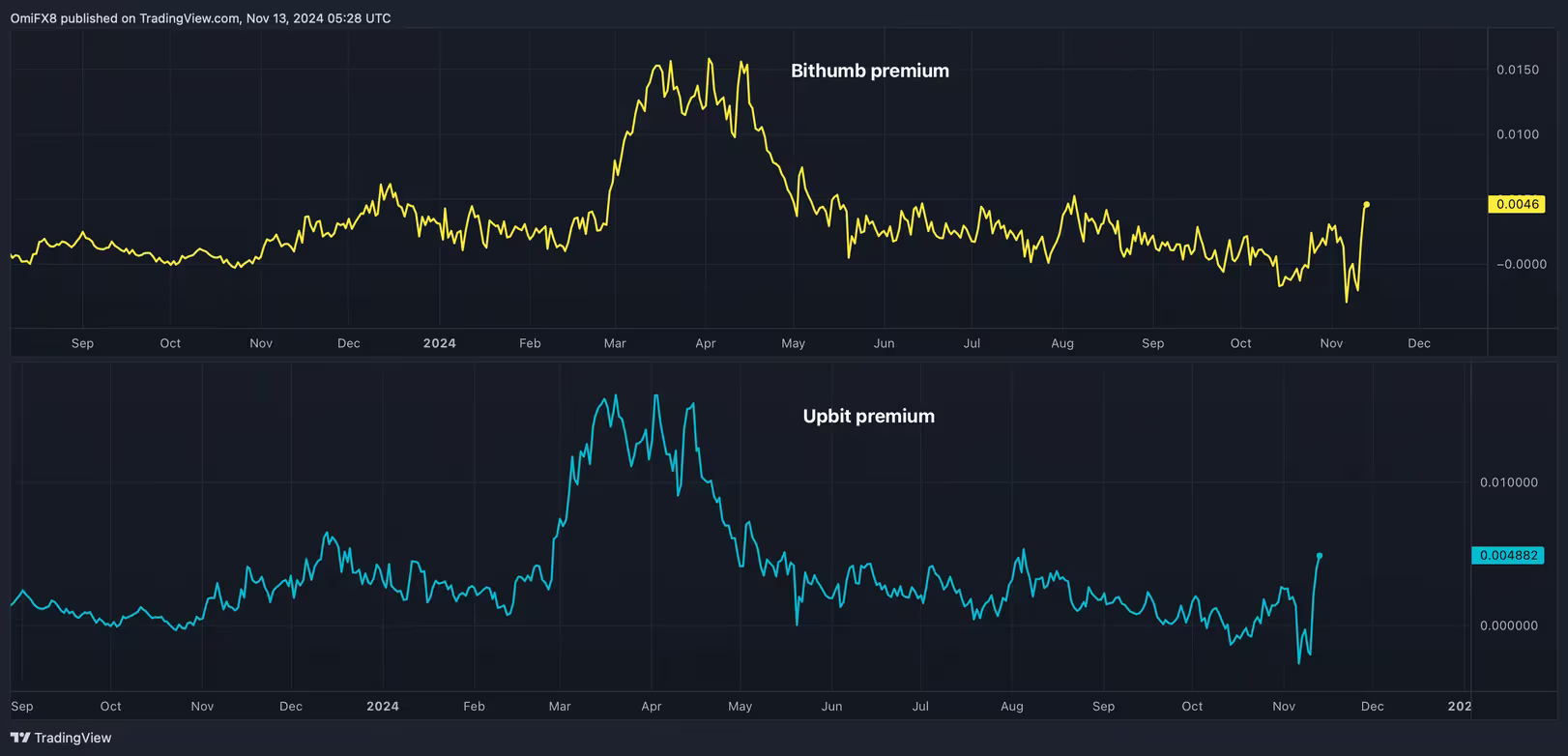

DOGE trades at premium on Upbit and Bithumb relative to Binance.

-

The price differential is still noticeably lower than the previous bull market peaks.

When it comes to trading alternative cryptocurrencies such as dogecoin (DOGE), South Korea, known as the "Land of the Morning Calm," is often in stark contrast to its tranquil image.

Today is just that day as Koreans seem to be jumping into the DOGE market, driving prices higher and creating a noticeable premium on local exchanges Upbit and Bithumb relative to global giant Binance.

At press time, Upbit and Bithumb's DOGE/KRW pairs, adjusted for the USD/KRW exchange trade, traded 1.5% higher than Binance's DOGE/USDT, drawing the largest premium in three months, according to data source TradingView.

Premiums reflect renewed Korean appetite for DOGE, which has surged 78% since pro-crypto Donald Trump won the U.S. Presidential election a week ago.

Trading volume data suggests the same. According to 10x Research, DOGE has topped the charts as the cryptocurrency with the highest trading volume on Upbit and Bithumb since Trump's victory. The latest 24-hour trading volume for DOGE pairs tallies a remarkable $8 billion, equivalent to 57% of the total market capitalization of all stocks in Korea, Markus Thielen, founder of 10x Research said in a note to clients Wednesday.

DOGE has gained 227% in 30 days amid long-time crypto fan and billionaire tech entrepreneur Elon Musk's plans to start the "Department of Government Efficiency, a new wing in the Trump administration, abbreviated as D.O.G.E in a homage to the meme cryptocurrency.

On Tuesday, President-elect Donald Trump appointed Elon Musk and Vivek Ramaswamy to lead the D.O.G.E department.

DOGE's premium on Bithumb and Upbit. (TradingView/CoinDesk) (TradingView/CoinDesk)

A spike in Korean demand is typically associated with speculative fervor, often seen at market peaks. However, current premiums on local exchanges are noticeably lower than the highs recorded in March and are significantly less than the double-digit price differentials observed in early 2021.

So, there is excitement, but without the speculative frenzy observed at the bull market peaks and other things being equal, prices may continue to rise.

Options traders bet on the $1 breakout

Options activity on PowerTrade, a crypto exchange focused on derivatives tied to alternative cryptocurrencies (altcoins), points to expectations of DOGE's price topping the $1 mark by the end of January.

"A client has bought 10K DOGE call options at the $1 strike expiring on Jan. 25 for $0.058 per contract," PowerTrade told CoinDesk Tuesday, explaining a similar outsized bet in the December expiry options.

A $1 call option is essentially a bet that prices will surpass that level by the settlement date.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC demand and liquidity conditions remain weak

Bitcoin price has been consolidating between $94,000 and $100,000 since early February. US Bitcoin spot ETF data recorded a total net outflow of $489.60 million until Thursday.

Sonic (prev. FTM) rallies as TVL hits record high and market capitalization surpasses $3.1 billion

Sonic (S), previous Fantom (FTM), rallies over 20% in the last 24 hours and trades around $0.90 at the time of writing on Friday after rising almost 64% this week. The migration of FTM to S token at a 1:1 ratio was completed on January 17.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC gears up for volatility while ETH and XRP fight to stay afloat

Bitcoin price has been consolidating between $94,000 and $100,000 since early February; this consolidation phase could soon end. Ethereum price shows signs of strength while Ripple price fights to stay afloat.

Crypto Today: BTC tops $98K on US-Russia diplomacy, while NEAR and Bittensor lead AI tokens’ $30B rally

The global crypto market rose 3% on Thursday, adding $45 billion to reach an aggregate market cap of $3.2 trillion. The crypto AI sector witnessed a 15% rally, with Bittensor (TAO) and NEAR emerging as top performers on the day.

Bitcoin: BTC demand and liquidity conditions remain weak

Bitcoin (BTC) price has been consolidating between $94,000 and $100,000 since early February, hovering around $98,000 at the time of writing on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.