Dogecoin buyers nowhere to be seen as DOGE price dips lower

- Dogecoin has undergone a correction after the break of an important trend line.

- Buyers have supported price action at the monthly R1 resistance of $0.27

- Price action is fading again, and buyers need to step in.

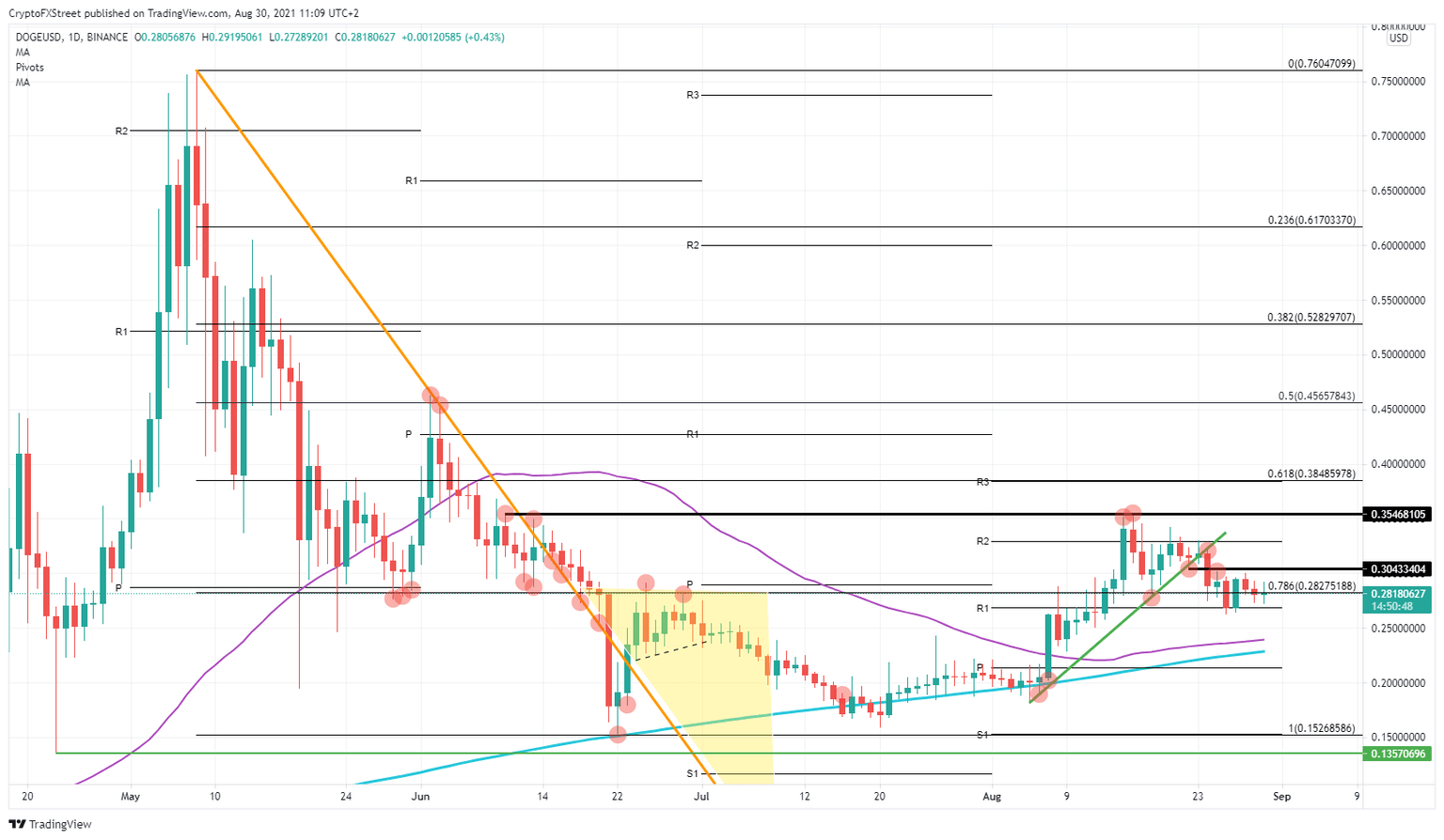

Dogecoin (DOGE) is in a bit of pause mode as buyers have not been able to push prices above $0.30. After the correction DOGE had on August 24, price action has refrained from paring back those losses with the break of the green ascending trend line. Instead, price action is going sideways and does not show much sign of improvement as it looks to be stuck between $0.30 to the upside and $0.27 to the downside.

There is, however, an essential takeaway from looking at the chart of DOGE, and that is that buyers need to step up their game and make trades count. The monthly R1 resistance level at $0.27 was held for now. As price action starts to fade again, however, buyers will need to create more buying into DOGE. Otherwise, the risk is that the R1 resistance level will not survive the third test.

The monthly R1 resistance level will not withstand a third test to the downside

A break of the R1 resistance level will bring DOGE back toward $0.25. That level will not only be of psychological importance but additionally the first level for buyers to defend. Buyers will be cautious here as already on the first test, price action broke slightly below this level. It is not excellent technical support.

If that does not do the trick, the next ace up the sleeve of buyers is both the 55-day and 200-day Simple Moving Average (SMA) that are hovering just below $0.25. Expect heavy buying just below $0.25 as buyers will look to get in for a long and push DOGE price back toward that R1 resistance level at $0.27.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.