Dogecoin bulls set for a bounce-off or fade-in trade next week

- Dogecoin has bears drilling for a third week on $0.125, trying to break to the downside.

- DOGE price sees bulls defending the level as a squeeze gets underway.

- Expect either $0.125 to hold or offer a perfect bandwidth for a fade-in trade next week.

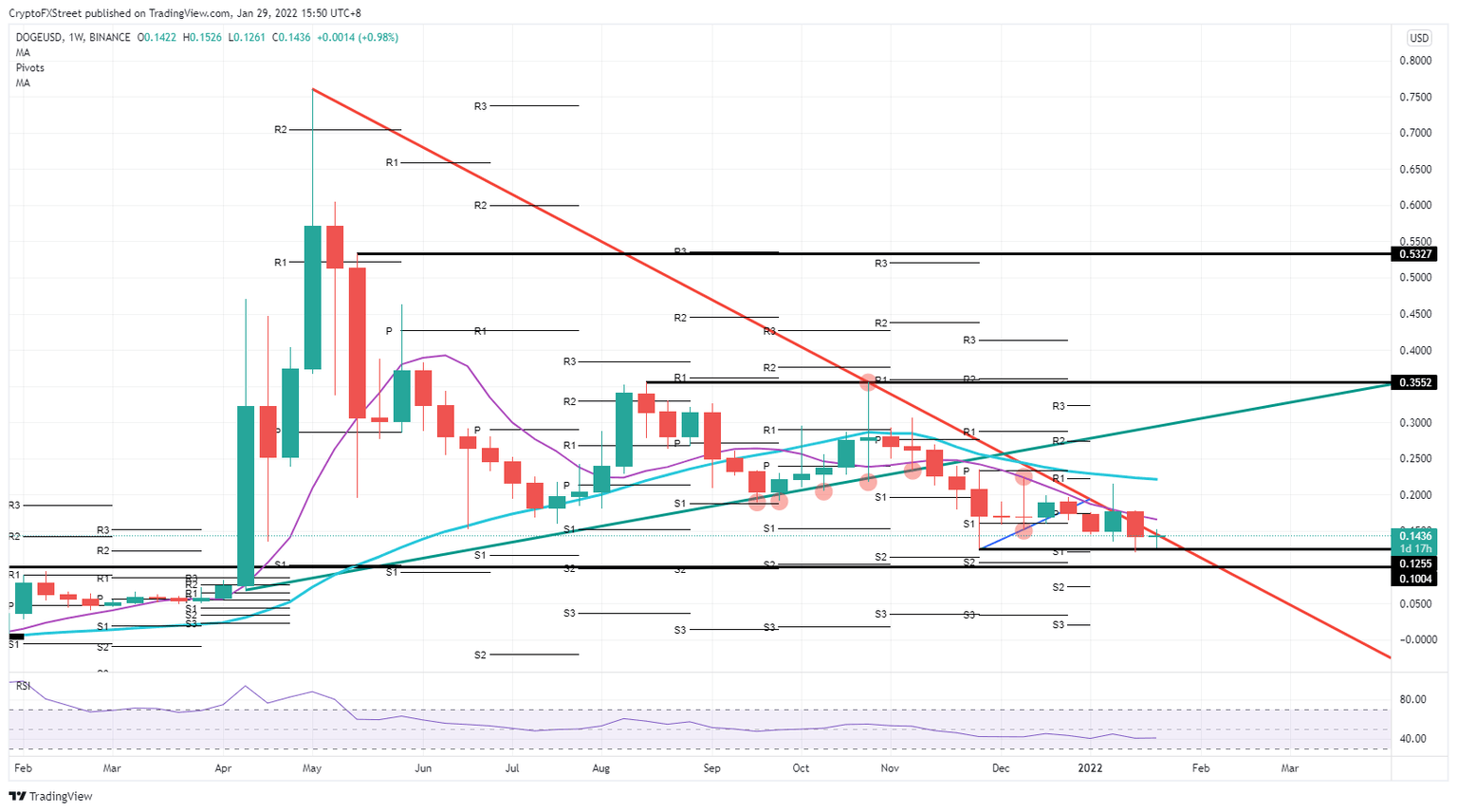

Dogecoin (DOGE) price sees its downtrend starting to flatline a bit as bears look unable to break below $0.125, a level that was tested last week as the week and back in December. As the price bounced up again each time after hitting that level, it looks to be set to do the same as the Relative Strength Index (RSI) shows no signs of any bears overpowering bulls. With that, next week could be a make or break for the mentioned level, or bulls could start to buy DOGe coins in the bandwidth between $0.10 - $0.125.

Dogecoin is set for a bullish candle next week or the week after that

Dogecoin price saw bulls trying to breakout towards the 200-day Simple Moving Average (SMA), but bulls got stopped short in their tracks and even had to give way to bears as the Fed, and geopolitical themes decided otherwise. With these headwinds, investors were not interested in parking their money in cryptocurrencies, resulting in another downbeat week.

But DOGE price is currently trading at exciting areas, as bulls defended for a third week the level at $0.125. As it each time triggers a rebound, it will be essential to see if investors can shake off the negative mood from this week and start the trading week next week with some positive sentiment. Expect to target the $0.17 level that holds the 55-day SMA as a cap to the upside. In case that does not unfold, expect a slight dip lower, entering a perfect bandwidth between $0.10 - $0.125 where bulls can play the fade-in trade, which will trigger then the week after that a bullish candle towards $0.17-$0.20.

DOGE/USD weekly chart

DOGE price could see a break below $0.10 should market sentiment continue to roll over, and US indices would collapse as hedge funds and speculators start to repatriate their funds out of risk assets fully. The pressure would mount towards $0.07 around the monthly S2 support level as support and holds historical importance as it started the significant uptrend in April. With that, the RSI will trade intensely in oversold, limiting further incentive for bears to stay short DOGE.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.