Dogecoin bulls are gearing up to push DOGE higher

- Dogecoin price is fading further after a rejection by the 200-day SMA on Wednesday.

- DOGE price is still in its uptrend and saw bulls already reacting in a buy-the-dip mentality.

- Expect the price to correct first a little bit further, which offers bulls a better window of opportunity for going long.

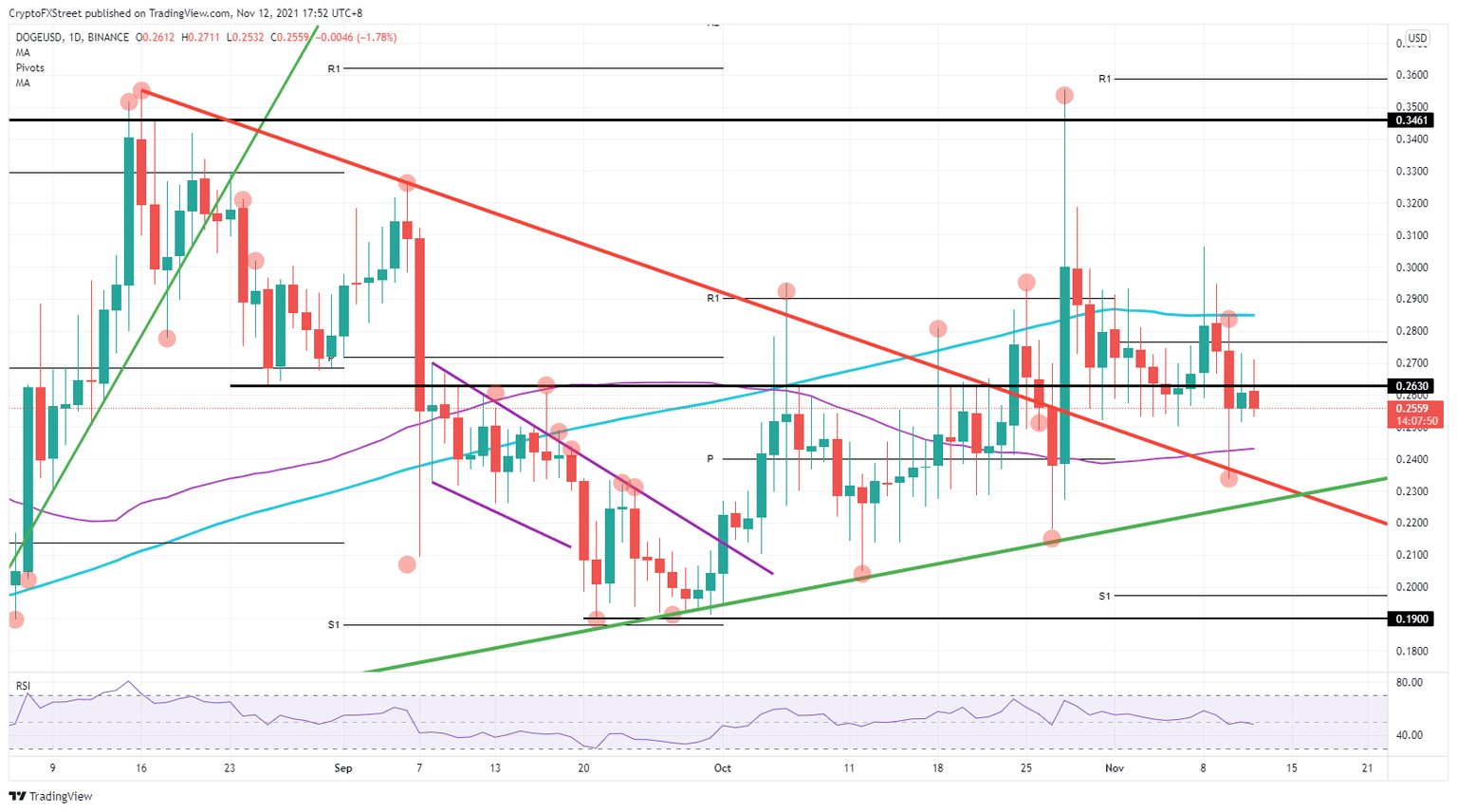

Dogecoin (DOGE) price is in a consolidation phase as the daily price candles are shrinking in size, but a clear price pattern, in the form of a pennant or a flag is not visible yet. Although DOGE price looks heavy, expect further downside to be limited with bulls standing ready for buying any dip that could occur. Expect bulls to defend the $0.24-region and by next week, to pop above the 200-day Simple Moving Average (SMA) at around $0.29.

Dogecoin price is in buy-the-dip strategy with a bullish breakout imminent

Dogecoin price is fading further today after the nosedive on Wednesday. Following that, bulls were eager to step in and buy the dip at around $0.24, reflected in the bounce off the red descending trend line. As DOGE price has corrected quite quickly intraday and returned to more moderate levels, the length of the candles has started to decline. This points to consolidation as bears are getting pushed out of their attempts to run price action further to the downside.

DOGE/USD daily chart

With the Relative Strength Index (RSI) broadly balanced, bulls should have enough reason and support to build long positions in DOGE price further, as the upside offers a return to $0.35. The only struggle bulls could face on their way up would be the 200-day SMA, which is, for the moment giving resistance towards any test from below. Bulls will need to pick up buys-side volume to match and squeeze bears out of their short positions. If any tailwinds emerge, expect the rally to pick up speed and maybe even begin a steep ascent.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.