- Dogecoin price, after crashing by more than 16%, fell back to $0.0789, rising by just 1% since March 24.

- DOGE holders’ participation has seen a remarkable rise, with the active address ratio rising above 2%

- Whales continue to act bullish, with addresses accumulating over 80 million DOGE in the span of five days.

Dogecoin price took quite a hit over the last few days as the meme coin followed in the footsteps of the leader of cryptocurrencies, Bitcoin. However, surprisingly, DOGE investors did not jump shit and claim whatever profits they could but instead stood firmly to prevent a major crash.

Dogecoin investors hold back

Usually, after hitting peaks, DOGE holders tend to cash out before a streak of red candles is formed on the charts. Although this time around, Dogecoin investors decided to take the other route and instead decided to lean in on the altcoin even more deeply.

Dogecoin price between April 19 and April 23 fell by nearly a little more than 16.5% to trade at $0.0789 at the time of writing. This crash, at one point in the day, brought the altcoin back to the same price it was exactly a month ago.

Interestingly, the Relative Strength Index (RSI) also dipped slightly lower than its position from March 24 in the bearish zone, suggesting that some pessimism persists at the moment.

DOGE/USD 1-day chart

However, investors are attempting to subdue this by maintaining a bullish outlook for the meme coin. The network continued noting high interest from DOGE holders as new addresses rose to 4.49 million, preserving the streak which led to the addition of 230,000 investors this month.

But it is not just the new investors that are exhibiting bullishness as older Dogecoin holders are also consistently active at the moment.

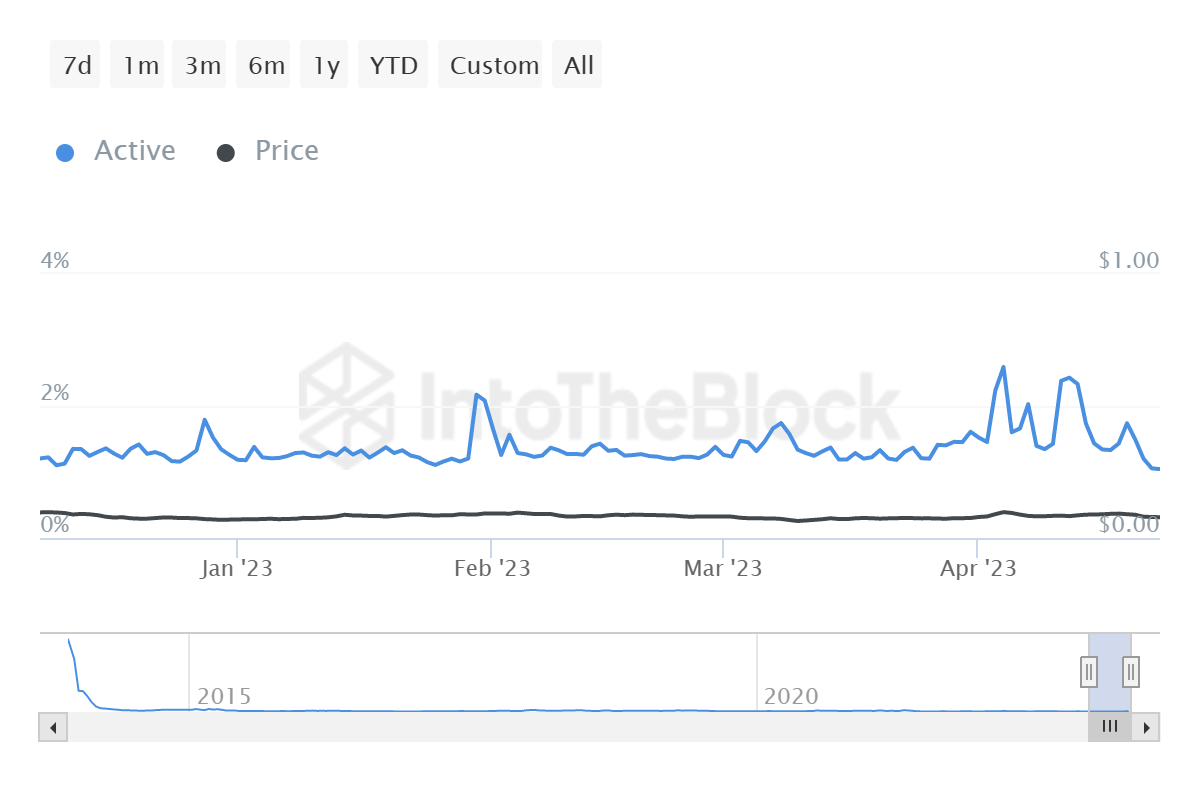

Addresses conducting transactions over the past three weeks have risen, bringing the active address ratio to an average of 1.8%, even touching 2.43% at one point. The ratio measures the number of active addresses against the total addresses holding a balance which currently stands at 4.49 million.

Dogecoin active address ratio

Furthermore, as always, whales continue to play an important role in DOGE’s performance. As the Dogecoin price fell, cohorts holding a balance of 1 million to 10 million, DOGE began accumulating the meme coin. In the span that the altcoin dipped by 16.5%, these whales amassed more than 80 million DOGE worth over $6.3 million.

Dogecoin whale activity

Such actions tend to prevent larger crashes and support quicker recovery for the digital asset, which is quite necessary for Dogecoin price. This is because, unlike other altcoins, DOGE is yet to mark a new high for 2023 and for the same it would need to breach the barrier at $0.0959.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

White House Crypto Summit could boost adoption across financial markets: Binance exec Rachel Conlan

Trump’s White House Crypto Summit is hours away, and executives maintain optimism and a positive outlook on crypto adoption. Rachel Conlan of Binance expects increased institutional and retail participation.

Bitcoin Weekly Forecast: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin (BTC) remains under pressure and continues its decline, trading around $88,900 at the time of writing on Friday and falling over 5% this week.

Solana’s co-founder says ‘No Reserve’ to SOL as a part of Trump’s Crypto Strategic Reserve

Solana price stabilizes and trades around $142.8 at the time of writing on Friday after falling nearly 20% this week. Solana co-founder Anatoly Yakovenko raised concern about SOL as part of the US Crypto Strategic Reserve on his social media X.

BTC, ETH and XRP struggle despite Trump’s Bitcoin Reserve order

Bitcoin price is extending its decline on Friday after falling more than 7% so far this week. Ethereum price is retesting its key support level at around $2,125; a close below would extend the correction.

Bitcoin: BTC bloodbath continues, near 30% down from its ATH

Bitcoin (BTC) price extends its decline and trades below $80,000 at the time of writing on Friday, falling over 15% so far this week. This price correction wiped $660 billion of market capitalization from the overall crypto market and saw $3.68 billion in total liquidations this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[00.01.56,%2025%20Apr,%202023]-638179580719159854.png)