Do Ripple bulls have enough fuel to propel XRP price by 45%?

- XRP price is in a pullback mode after rallying nearly 100% in the last three months.

- Investors can expect accumulation to pick up steam between the $0.469 and $0.426 levels.

- A daily candlestick close below the March 12 swing low at $0.347 will invalidate the bullish thesis.

XRP price shows a slowdown in upward momentum after a massive rally in the last week. This move comes as the crypto markets, in general, cool down. For Ripple, however, a pullback will be an opportunity for long-term holders before it breaks out from its multi-month consolidation phase.

Read More: Ripple price nears pivotal area that could trigger 20% uptrend

XRP price coils up for another explosive move

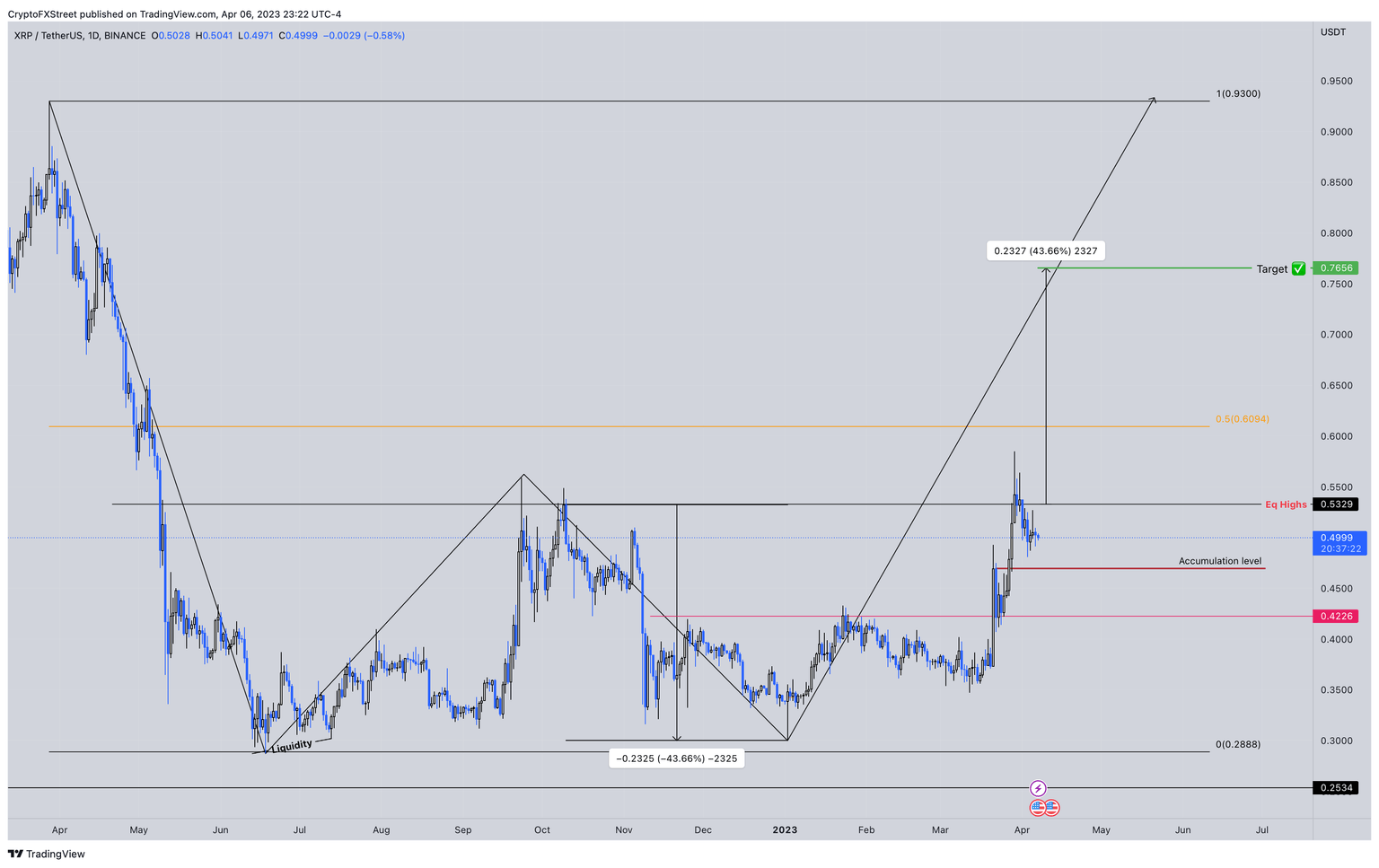

XRP price has been consolidating between the $0.532 and $0.288 levels for nearly a year. This massive accumulation phase saw an explosive surge in buying pressure in the last three months. As a result, Ripple exploded by nearly 100% from the $0.300 swing low formed on January 2.

This impressive rally formed a local top at $0.585 and has since retraced 15% to where it currently trades – $0.502.

Due to the sheer nature of this consolidation, a breakout from the $0.532 hurdle will be a highly volatile move, mostly to the upside, considering the current state of the crypto markets.

The second reason is that the recent upswing has created pockets of inefficiencies that are likely to be filled during the pullback. These areas will serve as reaccumulation levels for long-term holders. The range between $0.496 and $0.422 will be a good place for sidelined buyers to step in.

These technical reasons are why XRP price is more than likely primed for an impressive bullish move on the breakout of $0.532. The conservative target, as explained in the previous article, is a 43% upswing to $0.765. An optimistic target is the retest of the $0.930, constituting nearly a 100% gain for investors.

XRP/USDT 1-day chart

Additionally, the third and most significant reason why XRP price will likely rally is the activity of whales. Investors holding between 1 million to 10 million and 10 million to 100 million XRP tokens have been busy buying the remittance token for the last year.

The number of whales holding between 1 million and 10 million dropped from 131 to121 between May 12, 2022, and February 19, 2023, but shot up to 171 in the last month.

The number of investors holding 10 million to 100 million XRP tokens has been consistently growing from 1,310 to 1,585 since May 12, 2022.

Due to the massive accumulation spree from these investors, market participants can expect XRP price to see a burst of buying pressure on the breakout of the $0.532 hurdle.

XRP supply distribution

While the bullish outlook for XRP price remains valid, investors need to note that things will start to go downhill if the $0.426 support floor is breached. A daily candlestick close below the March 12 swing low at $0.347 will create a lower low and invalidate the bullish thesis.

In such a case, XRP price could potentially crash 16% to the range low of $0.288.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%2520%5B08.22.05%2C%252007%2520Apr%2C%25202023%5D-638164366758116470.png&w=1536&q=95)