Do Litecoin (LTC) and Stellar (XLM) have enough power to grow against the falling Bitcoin (BTC)?

The market is trying to recover the lost positions as all of the top 10 coins have come back to the green zone.

Top coins by CoinMarketCap

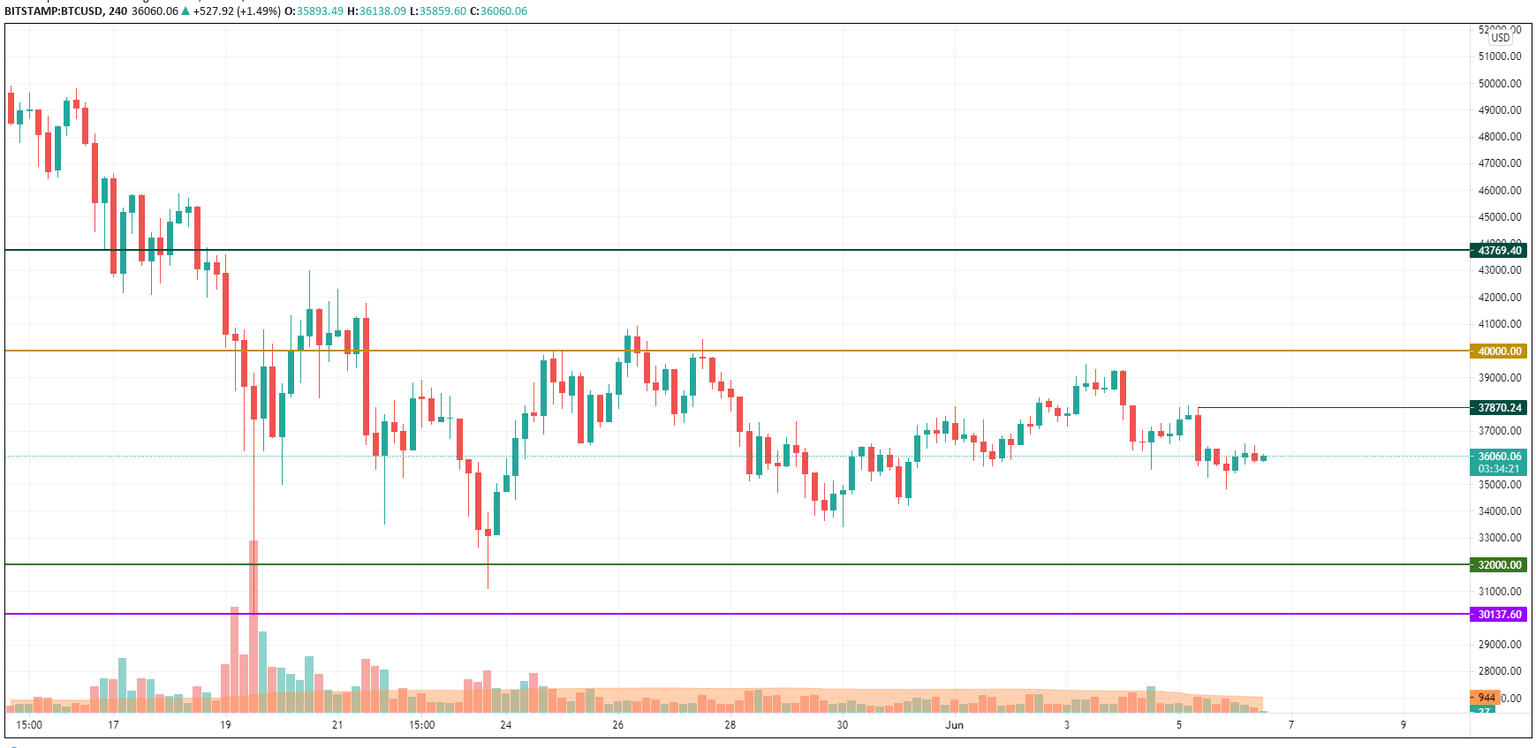

BTC/USD

The rate of Bitcoin (BTC) is almost unchanged over the last seven days.

BTC/USD chart by TradingView

Bitcoin (BTC) keeps trading in a narrow range as neither bulls nor bears have seized the initiative so far in the long-term scenario. However, on the 4H time frame, the selling trading volume has declined, as well as the volatility, which means that a short-term rise may happen soon.

In this case, the growth can get the rate of the chief crypto to $37,780.

Bitcoin is trading at $35,916 at press time.

XLM/USD

The price of Stellar (XLM) has gone down by 0.29% since yesterday, while the price change over the last week is +1.39%.

XLM/USD chart by TradingView

After a false breakout of the resistance at $0.45, the price has come back to the support at $0.36. At the moment, bears are more powerful than bulls even though the selling trading volume has declined. If the support at $0.3620 is broken, there are high chances to get to the next level at $0.30.

XLM is trading at $0.3786 at press time.

LTC/USD

The rate of Litecoin (LTC) is also almost unchanged over the last seven days.

LTC/USD chart by TradingView

On the daily chart, the "digital silver" is trading in the zone where most of the liquidity is focused, supported by low trading volume. The selling volume has decreased, confirming the rising potential. In this case, buyers may return to the resistance at $239 if they fix above $200.

Litecoin is trading at $175.52 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.