Dissecting the $4.6 billion Bitcoin ETF debut: New capital or clever shuffle?

After the successful launch of 11 Bitcoin spot ETFs on Thursday, all eyes were set on the flows. In other words, how much capital would come into the ETFs after the historic approval from the US Securities and Exchange Commission (SEC) on Wednesday. While many analysts were waiting for ETFs to start trading to analyze the flows, the issuers were working on attracting investors by cutting the management fees and donating some of the proceeds toward Bitcoin's open-source development.

In the post-ETF-approved world of cryptocurrencies, let’s see if something has changed.

Bitcoin spot ETF wars

Even before the US SEC announced its decision on Bitcoin spot ETF, it was broadly clear that all 11 ETFs would get approval in a single go. This outlook became apparent a few days before the decision came as issuers started reducing their management fees to attract new capital.

As the approval date neared, many issuers started filing amended 19b-4s and S-1s, which revealed a reduction in their management fees. In the sixth amendment of the S-1 form, the largest asset manager in the world, Blackrock, set the fees at 0.20% for the first $5 billion of the iShares Bitcoin Trust’s assets.

BlackRock’s amended S-1 filing

Grayscale Investments, with $27 billion assets under management in its Bitcoin trust, also dropped their management fees from 2% to 1.5%.

Grayscale’s amended S-3 filing

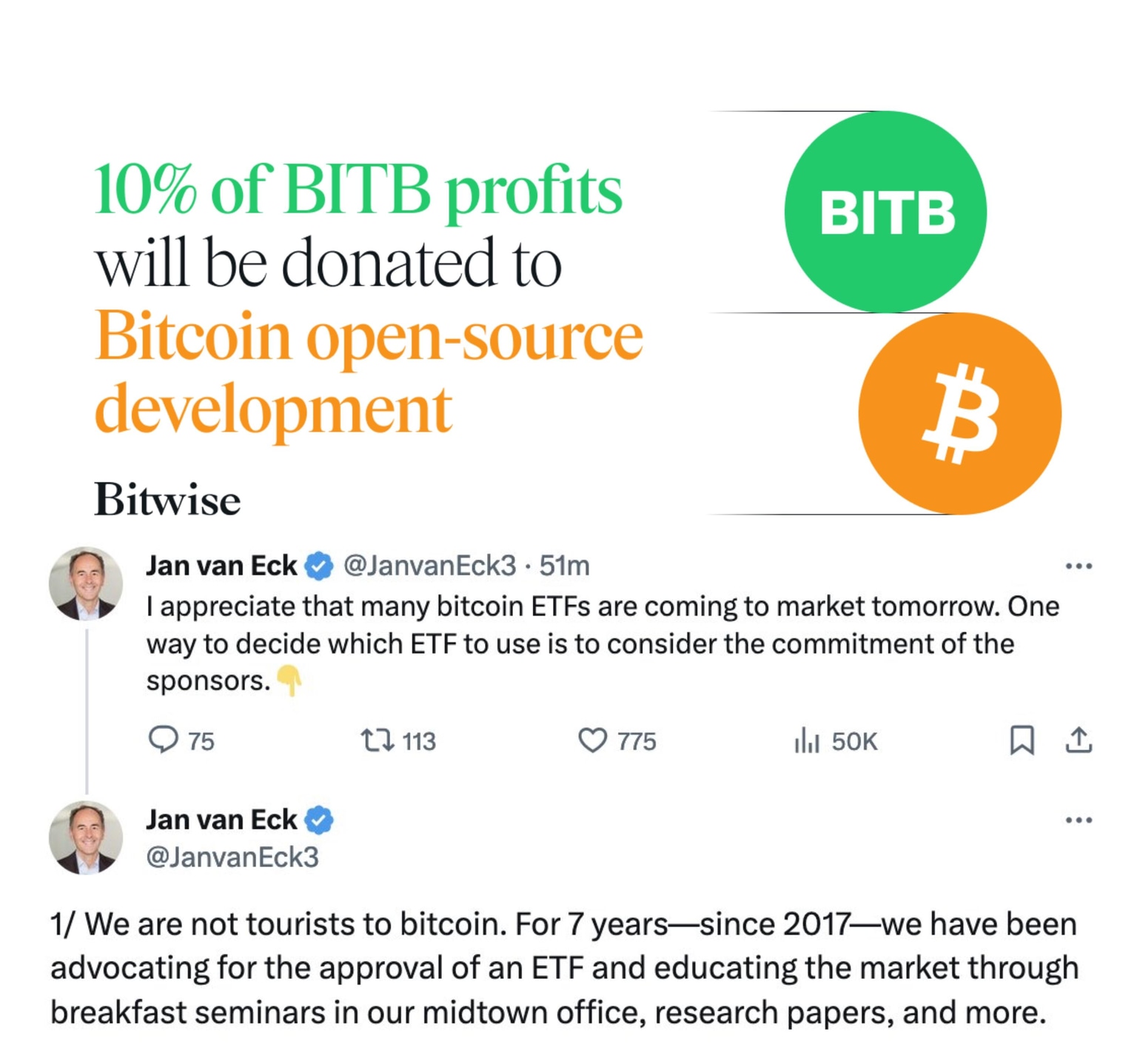

Some issuers tried to sweeten the pot even more by posting tweets on social media platform X (formerly Twitter). Others cut straight to the point by announcing donations worth 10% of the ETF profits to Bitcoin open-source development.

Bitwise, VanEck campaign

With each competitor trying to attract capital and investors, what actually happened after the ETFs started trading?

New capital or capital rotation?

Many prominent analysts started tracking the pre-market ETF trades. The ETFs trading in the pre-market through Coinbase pushed the Bitcoin spot price to trade at a premium compared to other exchanges.

A popular crypto analyst, CL207, noted on social media platform X that at one point, the Coinbase Bitcoin price was 12 basis points ahead of Binance. But the analyst also added that this wasn’t impressive due to the sheer volume difference between the two exchanges in the futures trading category.

coinbaes now 12 bps ahead of binance - this isnt super impressive cus its pre mkt and volume is thin, dosnt take ton of $ to push price atm pic.twitter.com/9WHrxTijSr

— CL (@CL207) January 11, 2024

After the US markets opened and more sophisticated actors started to come in, the Coinbase premium on Bitcoin price eventually diminished. But even at this point, analysts and speculators were unsure if this was capital inflow or rotation.

This distinction is extremely important considering that investors holding Grayscale’s GBTC were essentially stuck due to the underlying instrument trading at a discount for years. After the US SEC approved ETFs, these GBTC investors now have a chance to either rotate their capital into other ETFs or book profits. The decision from these investors will likely be pivotal in determining if the ETF approval will mark the local top for Bitcoin price or the start of the 2024 bull rally’s next leg.

When the ETF approval news broke out, Bitcoin price was trading at $46,240, but soon set up a local top at $48,969 after a near 6% rally.

BTC/USDT 5-minute chart

First ETF trading day observations

But one conclusion that most investors came to after the US markets closed and the dust settled, analysts concluded a few things:

- The Bitcoin spot ETF volume on the first day of trading hit a whopping $4.6 billion.

- Bloomberg Eric Balchunas added that the 11 approved ETFs saw 700,000 individual trades, which is double that of Invesco’s QQQ trust.

- Bloomberg’s James Seyffart chimed in, saying that a “very easy argument” can be made that “a ton of this volume was selling of GBTC and buying of other ETFs for now!”

- Balchunas attributed this to a “retail stampede” out of Grayscale’s GBTC since the trade sizes on the first ETF trading day were small.

Crypto analyst TradFiWhale.eth forecasts that out of the $4.6 billion volume, $3.5 billion could be attributed toward creates, meaning creating shares (buying), while $1.5 billion of the flows could see redeems (selling).

There will be some large creates that don’t show up in the volume.

— TardFiWhale.eth (@TardFiWhale) January 11, 2024

So, predicting creates will be difficult for first day. My guess is that we will see ~3.5bn in total creates and 1.5bn in redeems from GBTC.

The analyst also cautioned users that not all of the $3.5 billion in creates are buying since some of these investors could be “swapping their BTC into the ETF.”

Concluding thoughts and what to expect next

The Bitcoin spot ETF approval is a historic win for the cryptocurrency industry. But the lackluster performance of Bitcoin price on the first trading day could quickly flip on its head as more retail investors flock to ETFs due to misleading ETF inflow headlines.

Roughly five hours before the US SEC approved Bitcoin spot ETF, Hsaka, a popular crypto analyst, aptly forecasted that the market reaction would be in three stages.

- In the first stage, the crypto space would be bullish due to the headlines and conclusions from most analysts would include record-breaking numbers.

- As the trading session concludes, the market outlook would go from “euphoria” to “doom,” says Hsaka, because analysts would note that these “record-breaking” numbers are just rebalanced flows and not fresh capital inflows.

- The third stage would be bullish by association, i.e., since the initial numbers were record-breaking, it would attract more funds. This is in line with what TradFiWhale.eth forecasted that big numbers would attract retail investors, so the bearish outlook could quickly change.

Although the outlook is bearish in the short term, it might take a longer time before for it to flip bullish. In the meantime, many investors are looking toward Ethereum, which largely underperformed in the weeks leading up to the Bitcoin spot ETF approval.

Ethereum ecosystem altcoins noted double-digit growth on January 11, and this narrative is likely going to stay due to the upcoming Dencun upgrade.

Read more: Ethereum Dencun testnet set to activate on January 17, ETH price eyes $3,000

(This story was corrected on January 12 at 14:18 GMT to say that Grayscale Investments has $27 billion assets under management in its Bitcoin trust, not $27 million.)

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.