- DigiByte gets ready for hefty price action if the short-term hurdle is pulled down at $0.022.

- An increase in volume supports DGB/USD uptrend, hence the bullish outlook.

DigiByte seems to be getting ready for an upswing following extended declines since September. The downtrend has been constrained in a descending parallel channel. Meanwhile, support at $0.18 in conjunction with the channel’s lower boundary allowed the bulls to take back control, commencing the undergoing recovery.

At the time of writing, DGB is doddering just below $0.022 after taking down the resistance at the descending channel middle boundary. All eyes are glued on breaking past the upper border, which coincides with the 50 Simple Moving Average (SMA).

If the cryptoasset closes above the 50 SMA, DigiByte buyers will shift their focus to the 100 SMA around $0.024. Such a move would be massive for the token and is bound to attract attention, in turn, creating the volume required for an enormous uplift, perhaps above $0.03.

The Moving Average Convergence Divergence (MACD) doubles down on the bullish outlook as it grinds towards the midline. A positive divergence is incoming above the MACD, which adds credence to the uptrend.

DGB/USD 12-hour chart

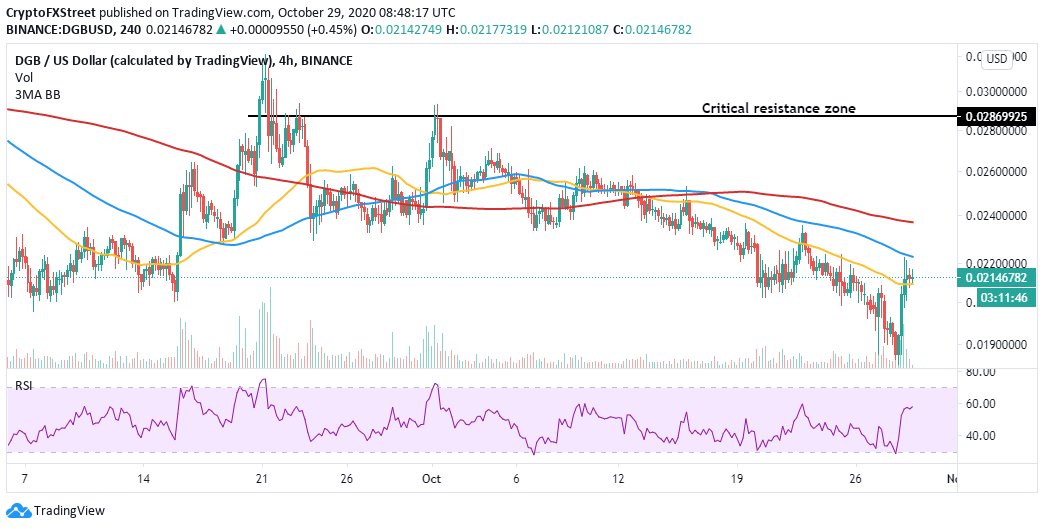

The 4-hour chart shows DigiByte sitting above the 50 SMA, hence the likelihood of a rally past $0.022 occurring. DGB might take a breather before continuing with the uptrend, as observed with the Relative Strength Index (RSI).

The rest of the journey to $0.03 will depend on the crypto’s ability to take down the seller congestion at the 100 SMA, 200 SMA, and the critical level at $0.287. Nonetheless, buyers still have control over the price.

DGB/USD 4-hour chart

According to Santiment, the volume is already building in support of the DGB/USD growing uptrend. A correlation exists between volume and price action for this token. Therefore, as long as the volume surges, the rally above $0.022 and towards $0.03 would start to materialize.

DGB volume chart

Looking at the other side of the picture

It is worth mentioning that if DGB/USD fails to hold above the 50 SMA in the 4-hour time frame, a correction will come into play, sending the price downstream towards $0.02. Besides, rejection at the 100 SMA may jeopardize the expected outcome. The volume must also continue to build in support of the uptrend; otherwise, losses might come into the picture.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TON Foundation appoints new CEO after $400M investment: Will Toncoin price reach $5 in 2025?

The TON Foundation has named Maximilian Crown as its new Chief Executive Officer following a wave of strategic restructuring. Crown joins TON amid heightened focus on scaling blockchain adoption via Telegram’s vast user base.

SEC postpones decision on several crypto ETF filings after Paul Atkins assumes leadership

The SEC released several documents on Thursday stating that it is delaying its decision on crypto exchange-traded fund filings from Grayscale, Bitwise and Canary Capital as it seeks more time to conclude whether or not to approve the applications.

Ondo Finance hits $3B market cap as CEO Nathan Allman meets SEC to discuss tokenized US securities

Ondo Finance met with officials of the SEC and the law firm Davis Polk to discuss the regulation of tokenized US securities. Topics included registration requirements, broker-dealer rules and proposed compliant models for tokenized securities issuance.

Tron DAO announces $70B USDT supply: Here's how TRX price could react

TRON’s USDT circulation just surpassed $70 billion, signaling rising network utility as TRX price approaches a technically significant breakout. On Wednesday, TRON DAO confirmed that the circulating supply of Tether (USDT) on its blockchain has surpassed $70 billion.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

[11.57.27, 29 Oct, 2020]-637395607923617784.png)