Despite Uniswap price marking a 17% rally, investors' activity continues to decline

- Uniswap price trading at $4.70 is just another opportunity for investors to bag the token to gain profits.

- UNI holders' presence in the market and activity are still under the bearish influence, which is why new addresses have declined significantly.

- These investors are desperate for profits as they are currently part of the 82% UNI holders underwater.

Uniswap price is doing well in comparison to other altcoins in the market whose bullish momentum that was just building up was destroyed by sudden corrections. Although UNI was among these tokens, it had still amassed enough bullishness to push through the bearish phase, but investors' skepticism seems to have the upper hand.

Uniswap price to continue its uptrend

Uniswap price took a break in its incline 24 hours ago before painting a green candlestick at the time of writing. Trading at $4.74, the altcoin's break was a good opportunity to rack up some UNI to gain profits as the price recovers over the next few days. However, this idea was not an opinion among the existing investors as their bearishness topped the expected bullishness from them.

UNI/USD 1-day chart

The first evidence of this declining optimism was found in the rate at which the new addresses were being formed. The network growth after peaking on June 12 has been sharply decreasing, suggesting investors have not been looking at UNI as a lucrative asset. Investors are more focused on offsetting their losses, considering the volatility in the market.

Uniswap network growth

Although the recent 17% rally did increase the optimism and value of the altcoin, UNI still seems likely to potentially concede to the investors' bearishness. The Market Value to Realized Value (MVRV) ratio indicate that the investors are currently in profit in comparison to a few days ago. But they are also vulnerable to a decline if the price runs up further.

The altcoin would then be in the danger zone marked above 10% on the indicator, which, historically, has been a trigger for corrections. However, there is a chance investors might push through these corrections and maintain their bullish outlook.

Uniswap MVRV ratio

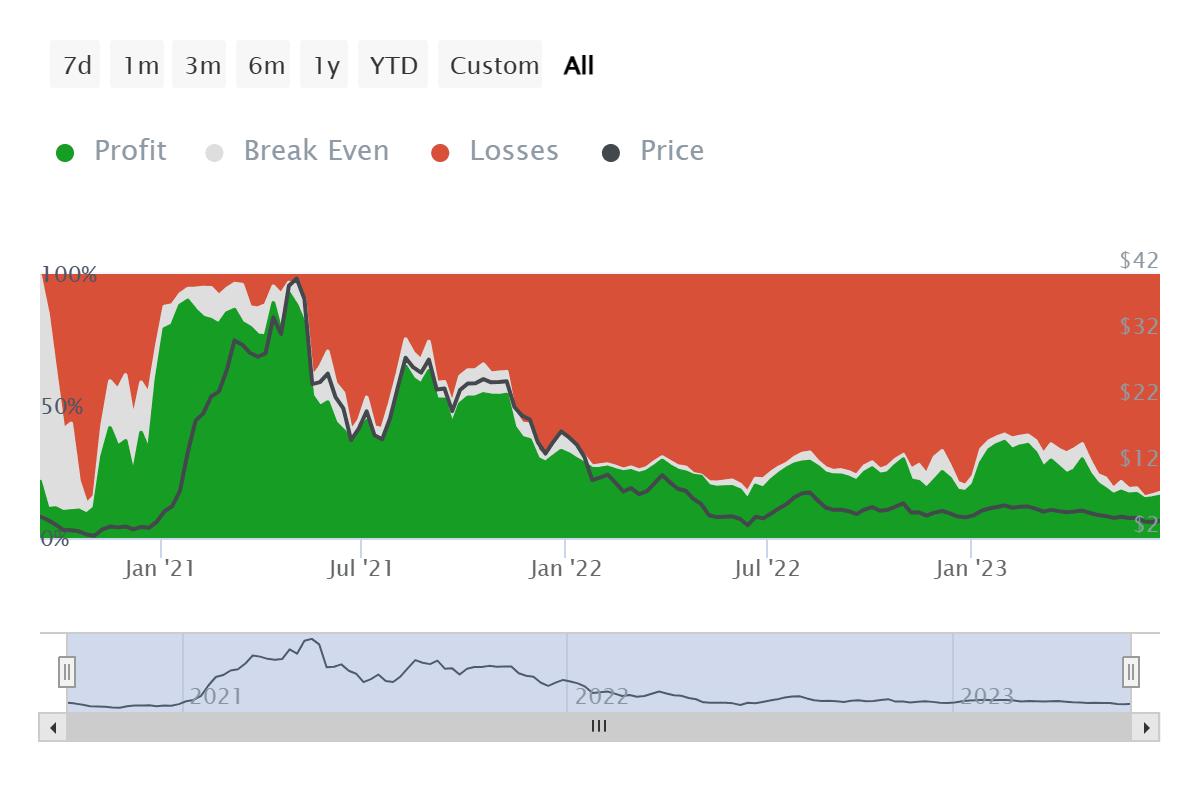

The reason behind this is the fact that about 82.8% of UNI holders are currently underwater and would most likely hold onto their assets until profits are guaranteed. For about 8,000 investors, this would be around the $5.09 mark, as their 5.88 million UNI supply worth $27.9 million would become profitable.

Uniswap holders at a loss

Whether UNI holders decide to sell after that is yet to be seen, but a recovery of the recent crash would surely serve as a dose of bullishness for the rest of UNI holders, awaiting recovery, to hold on to their assets until profits arrive.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B05.25.21%2C%252023%2520Jun%2C%25202023%5D-638230779565414526.png&w=1536&q=95)

%2520%5B06.03.13%2C%252023%2520Jun%2C%25202023%5D-638230779765887321.png&w=1536&q=95)