Despite India’s uncertain regulatory climate regarding crypto assets, nationwide investments in digital assets have increased by roughly 19,900% over the past year.

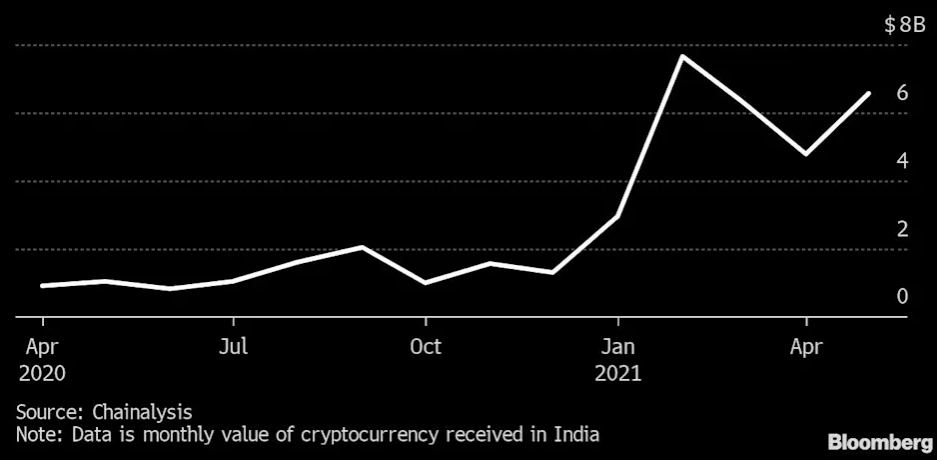

According to data from blockchain analytics firm Chanalysis that was reported by Bloomberg on June 28, crypto investments increased during mid-2020 before going parabolic as the markets surged into new all-time highs towards the end of the fourth quarter.

Chainalysis estimates the total invested in crypto across India grew from $200 million to $40 billion over roughly the past year, with the firm estimating 15 million Indians are exposed to cryptocurrency.

Monthly value of fiat invested into crypto by Indians: Chainalysis

The data illustrates the positive impact of the Indian Supreme Court’s March 2020 decision to overturn the Reserve Bank of India’s ban on financial institutions providing banking services to firms operating with digital assets.

However, it has not been entirely smooth sailing for India’s crypto sector since the Supreme Court repealed the RBI ban last March, with lawmakers frequently threatening new legislation prohibiting crypto assets over the past 15 months.

In spite of the persistent threats of a renewed regulatory crackdown, Sandeep Goenka, the co-founder of local exchange ZebPay, highlighted growing appetites for digital assets among Indian’s aged 18 to 35, noting a preference to invest in crypto over gold. He told Bloomberg:

“They find it far easier to invest in crypto than gold because the process is very simple. You go online, you can buy crypto, you don’t have to verify it, unlike gold.”

32-year-old local entrepreneur, Richi Sood, is among those who have pivoted away from gold in favor of cryptocurrency. Sood has invested more than $13,000 in digital assets since December, having cashed out a portion of her position when BTC broke above $50,000 in February before reinvesting amid the recent crash.

“I’d rather put my money in crypto than gold. Crypto is more transparent than gold or property and returns are more in a short period of time,” she said.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.