DeFi protocol Bancor to release V3, introducing lower gas fees, multichain support

- Decentralized trading protocol Bancor will be launching its third version, introducing significant upgrades to its platform.

- The update will introduce lower gas fees, multichain support and auto-compounding for staking rewards for its users.

- BancorDAO will be voting for the activation of the first phase, Dawn.

Decentralized exchange platform Bancor has recently revealed new details of the third version of its protocol. Bancor 3 will introduce new features including lower fees and auto-compounding for staking rewards among others.

Bancor to launch third version of its protocol

Decentralized trading protocol Bancor will focus on creating a “set and forget” ecosystem for staking tokens on the platform. The upgrade will introduce auto-compounding for staking rewards. Liquidity providers on the exchange will be able to earn more Bancor Network Token (BNT) and tokens staked.

Users on the platform will get access to full impermanent loss protection on Bancor 3 as soon as they start staking their tokens. The current version only offers the feature after 100 days of staking.

Bancor 3 will also see the addition of an Omnipool that will allow all trades on the platform to be carried out in one transaction which could see an uptick in efficiency and reduce gas fees. BNT was previously required to process transactions. The Omnipool feature will enable liquidity-providing strategies on the protocol to become more capital-efficient.

An “Infinity Pools” concept will also be introduced, and Bancor will remove the size limits for all liquidity pools on the protocol. The new feature will put an end to deposit limits while it establishes trading liquidity used for market-making and superfluid liquidity which will be used for internal and external fee-earning strategies.

Bancor 3 will also witness the addition of multichain and layer 2 support, as well as third-party impermanent loss protection. Chainlink Keepers will also be integrated into the protocol to enable efficient token burning.

There will be three distinct phases for the V3 launch, called Dawn, Sunrise and Daylight. The first phase will see all the new features go live as soon as it is deployed. The code for Dawn is expected to be open-sourced in the coming weeks through a public bug bounty and will be activated through a vote by BancorDAO.

BNT price locked within tight range

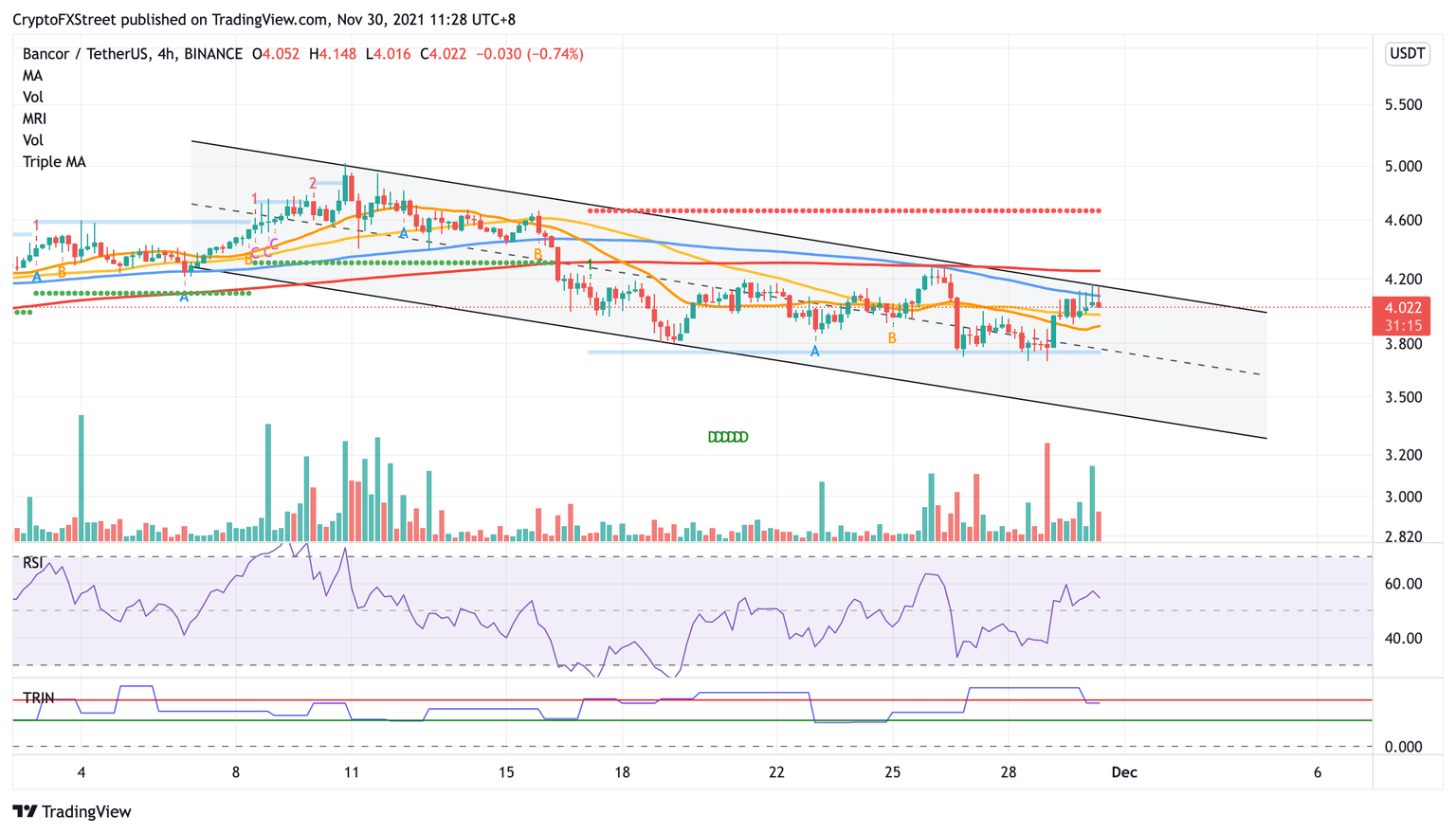

BNT has formed a descending parallel channel pattern on the 4-hour chart, suggesting a short-term downtrend. The Bancor Network Token is struggling to slice through resistances, resulting in further consolidation.

The prevailing chart pattern suggests a slightly bearish outlook for BNT as it was unable to break above the upper boundary of the parallel channel.

It appears that the first line of defense for the token is at the 50 four-hour Simple Moving Average (SMA) at $3.98, then at the 21 four-hour SMA at $3.90, before additional support emerges at the middle boundary of the governing technical pattern at $3.74.

BNT/USDT 4-hour chart

However, if BNT manages to reverse the period of underperformance, the first resistance barrier will emerge at the 100 four-hour SMA at $4.09, then at the topside trend line of the chart pattern at $4.16.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.