DeFi market woes take a toll on Ethereum price

- Ethereum price shows signs of stabilization around a vital support barrier at $1,986.

- A minor uptrend to $2,200 might originate before bears resume control.

- The DeFi ecosystem seems to be bleeding, taking ETH down with it.

Ethereum price has been dropping for quite some time and has found its way to levels that were last seen almost ten months ago. This pressure is further exacerbated by the crumbling DeFi ecosystem that is starting to take a toll on ETH’s market value.

The ecosystem falls under pressure

Ethereum price was close to hitting $5,000 roughly six months ago but has dropped more than 50% since then. This is the stark duality of the crypto ecosystem that is a testament to its volatility.

While Ethereum follows Bitcoin’s footsteps, the DeFi ecosystem, which is built on top of the ETH blockchain, is also facing the brunt of this negative outlook. As a result, the projects in this space are taking a huge haircut, both in terms of the underlying token’s price and the total value locked (TVL).

DeFi Total Value Locked

The TVL of the DeFi ecosystem built on Ethereum has dropped from a massive $107.50 billion to $55.30 billion. This 48.5% downswing indicates that users are panicking and pulling their funds out of DeFi products.

The state of DeFi

Curve Finance is a decentralized exchange and is ranked fifth based on the TVL has seen a 21% decline in the funds on the platform. Aave, Uniswap, Convex Finance and other DeFi platforms are barely breaking even.

Further painting a picture of the DeFi ecosystem’s bleeding is DeFi Pulse's DeFi Index. This index is a capitalization-weighted index that tracks the performance of decentralized financial assets across the market.

The DeFi index contains a total of 14 assets like UNI, AAVE, MKR, LRC, YEARN and more to track the tokens’ performance within the Decentralized Finance industry, and can be used synonymously to represent the health of the DeFi ecosystem.

This index is currently trading at $99 after hitting an all-time high of $656 in May 2021, denoting an 85% decline in its value. Such an immense nosedive represents the crumbling of investors’ trust.

DeFi Pulse Index

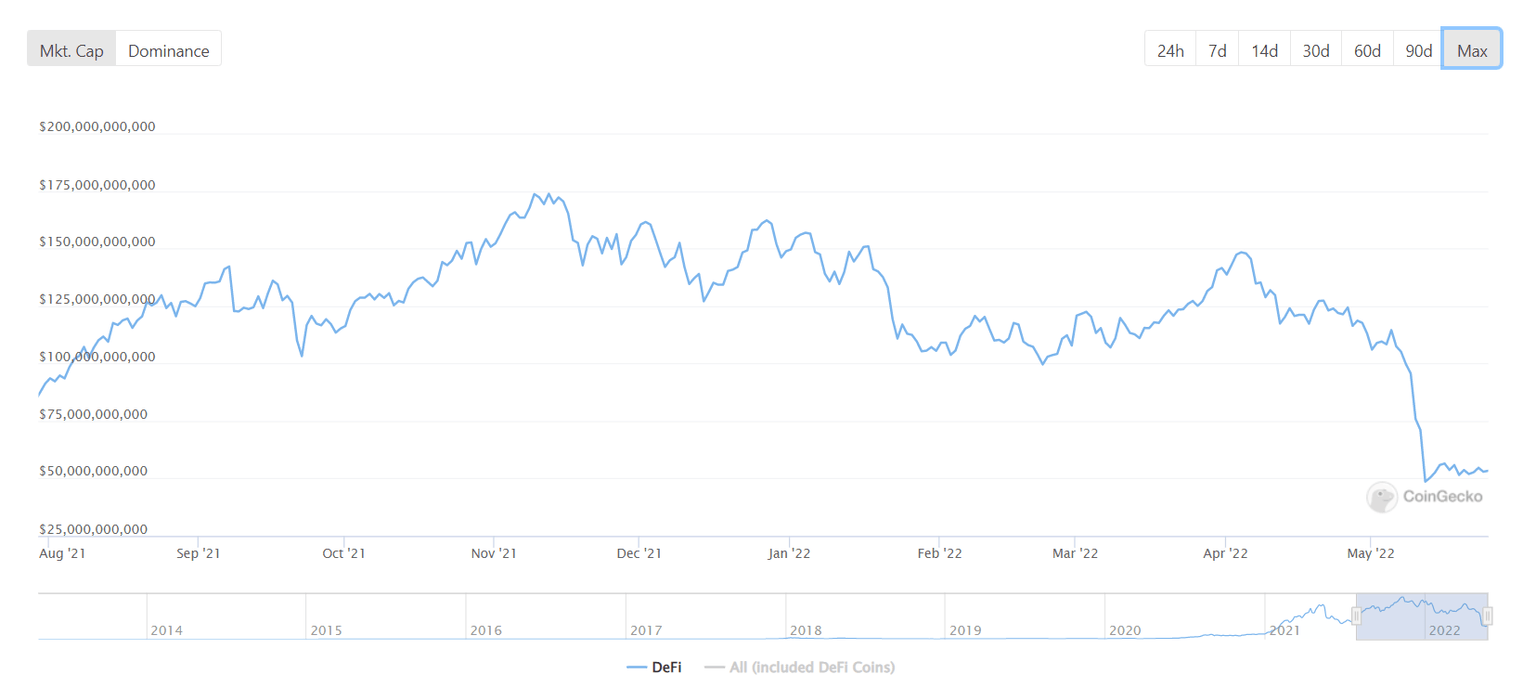

While the 14 assets might not represent a full picture of the DeFi ecosystem, Coingecko’s DeFi index tracks the market capitalization of the top 100 DeFi tokens. This index has also seen a massive collapse from $173 billion in November 2021 to $53 billion as of this writing, which constitutes a 70% slump.

DeFi top 100 coins by market capitalization

Regardless of the potential that the DeFi markets and the projects hold, the recent crash in the LUNA-UST ecosystem has caused Bitcoin and the crypto markets to tumble. The ripple effect of this is the crash in DeFi markets, which is tugging on Ethereum price, helping bears continue their descent.

Ethereum price and the weakening macro outlook

Ethereum price is traversing a bear flag pattern, also known as the bearish continuation pattern. ETH crashed by nearly 55% between November 9, 2021, and January 22, 2022, forming the flagpole of a bear flag pattern. A range-bound movement in the form of higher lows and higher highs that ensued after the sharp drop is termed a flag.

The technical formation target is obtained by adding the flagpole’s height to the breakout point at $2,747. This measure rule reveals that the Ethereum price could crash another 34% to reach its forecasted target at $1,305.

For now, ETH is hovering around the weekly support level at $1,986, a breakdown of which, will send it lower to retest the significant barrier at $1,730. A sweep below this foothold will allow smart money to collect liquidity formed in May and July 2021.

However, a failure to recover quickly above this level will open the path for bears to crash ETH to its target at $1,305.

ETH/USDT 3-day chart

While the theoretical aspects of Ethereum price are bearish from a logical standpoint, developers, as always, have chosen to ignore the short-term market conditions. Immutable X, a Layer 2, 3 scaling solution for NFTs, announced an extension of the cross-rollup liquidity platform for NFTs, built on StarkNet.

NFT projects built on different Ethereum Layer 2 and 3 roll-ups have liquidity fractionalization problems and the recent expansion of Immutable X’s cross-rollup liquidity solution will help solve this.

The announcement added,

Immutable X will lead the charge in offering L3s to games with more than 10 million active users who require dedicated throughput and don't want to compete for capacity with others.

Under these conditions, if Ethereum bulls manage to produce a daily candlestick close above $3,700, it will create a higher high on a macro outlook and invalidate the bearish outlook. In such a case, ETH will likely rally and set a new all-time high at $5,000.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.