Decentralized exchange GMX votes to use Chainlink low-latency oracles

-637336005550289133_XtraLarge.jpg)

Chainlink’s (LINK $7.01) low-latency oracles will integrate with the decentralized exchange (DEX) GMX following a successful governance proposal that sought to provide more “granular” real-time market data to GMX v2.

Voting ended on April 25 at 12:00 am UTC, with over 96% of participating GMX tokenholders voting in favor of the proposal.

The new Chainlink oracles — which were built with the input of GMX core contributors — were brought in to improve upon the functionality of perpetual DEXs and price-sensitive trading on GMX, the author of the proposal explained.

In addition, the low-latency oracles are said to strengthen security, further decentralize the protocol and improve upon the user experience, Johann Eid, the head of integration at Chainlink Labs, said.

While these new oracles utilize the same oracle node operators and data aggregation mechanisms used in existing Chainlink reference feeds, Eid explained that the new oracles extract data at a “higher frequency.”

“The new Chainlink low-latency oracles will utilize the same set of oracle node operators and multi-layered data aggregation mechanism currently deployed in existing Chainlink reference feeds, but operate via a pull-based mechanism to meet the speed requirements of DeFi derivatives.”

Eid explained the strengthened security will come from the low-latency oracles providing a “strong degree of tamper-resistance when settling user trades.”

Another Twitter commentator, Aylo, explained to their 62,600 followers on April 8 that the integration would “reduce exposure to stale price execution and value extraction” for GMX derivative traders.

A beta version of the GMX-tailored, low-latency oracle feeds — which have been in the works since 2022 — are now available on the Arbitrum testnet.

In return for the service, Chainlink will receive 1.2% of protocol fees generated by the low-latency oracles from the GMX protocol.

Protocol fees include the fees paid by users from margin trading in addition to standard borrow fees and swap fees.

Eid stated that Chainlink would continue to refine its oracle services to GMX as the protocol continues to “expand” and “evolve.”

Related: Smooth and secure crypto trading? This perpetual DEX is up for the challenge

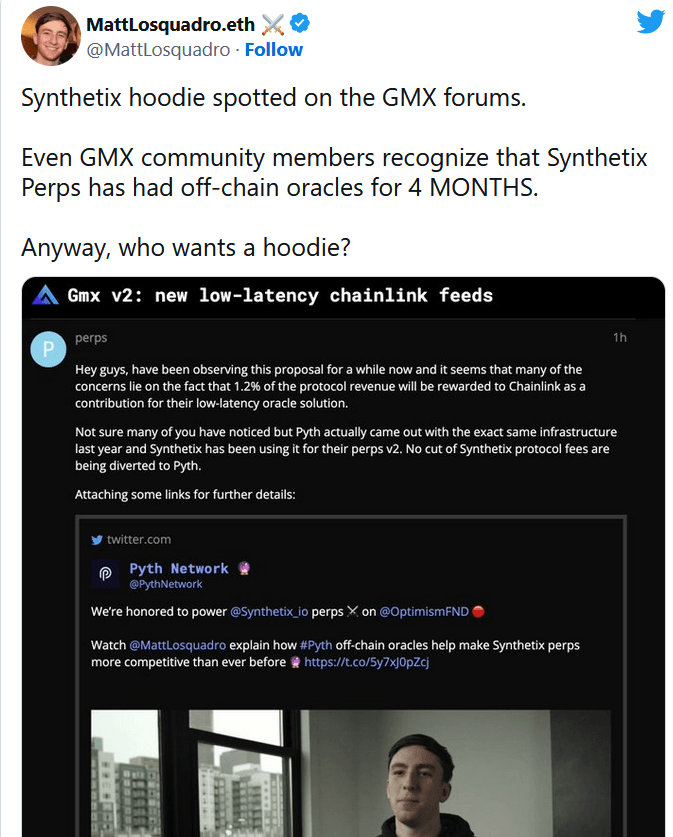

It appears as though GMX isn’t the first perpetual DEX to get on board with the new type of oracle though.

Matt Losquadro, a former ambassador of on-chain derivatives platform Synthetix, said it integrated a similar solution first, which was observed by a member of the GMX community prior to the proposal being put forward:

The Aribitrum-native GMX also launched on Avalanche (AVAX $16.95) in January 2022. It currently has a combined total value locked (TVL) of $669 million on the two networks, according to data from DeFiLlama.

It is currently the largest protocol on Arbitrum, which itself is the largest Ethereum layer 2 network by TVL.

Chainlink oracles were launched on Arbitrum in August 2021.

USD Coin (USDC $1.00), wrapped Ether (wETH) and wrapped Bitcoin (wBTC) are the three largest tokens held on GMX, with shares of 43.6%, 23.2% and 16% respectively.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.