Decentralised economics: How DeFi will change the way money works

Could DeFi grow to become a more exciting prospect for global finance than Bitcoin? Decentralized finance applications are growing with the power to create wealth for billions of people around the world built on a revolutionary framework that could ultimately replace banks and other financial institutions.

With the numerous platforms and projects that offer the kinds of low-interest rates that banks wouldn’t dare consider as well as borrowing, lending, margin trading and investing, DeFi has laid the foundations for the world of cryptocurrencies to finally realise its potential and deliver universal access to a financial system free of corruption and silos.

What is DeFi?

DeFi stands for decentralized finance, and its primary goal is to offer universal access to traditional financial services by providing a working model that features a borderless, permissionless and uncensored financial ecosystem built on blockchain technology.

Traditional financial applications like lending, borrowing, trading, payments and insurance can be generated through smart contracts and executed by specialist Decentralized Applications (DApps) to create a fully peer-to-peer financial system.

With the arrival of DeFi, people have access to financial services while retaining full control of their financial assets. Since most of the code used by DApps are in Ethereum smart contracts, they can be accessed and viewed by anyone - generating full transparency.

The main application of DeFi revolves around investors depositing their digital currencies into smart contracts - which are untamperable and built to be automatically executed once a set of pre-determined conditions are met - and when someone borrows the money, they earn interest. Essentially, the smart contracts can connect borrowers and lenders while intelligently allocating the interest accrued.

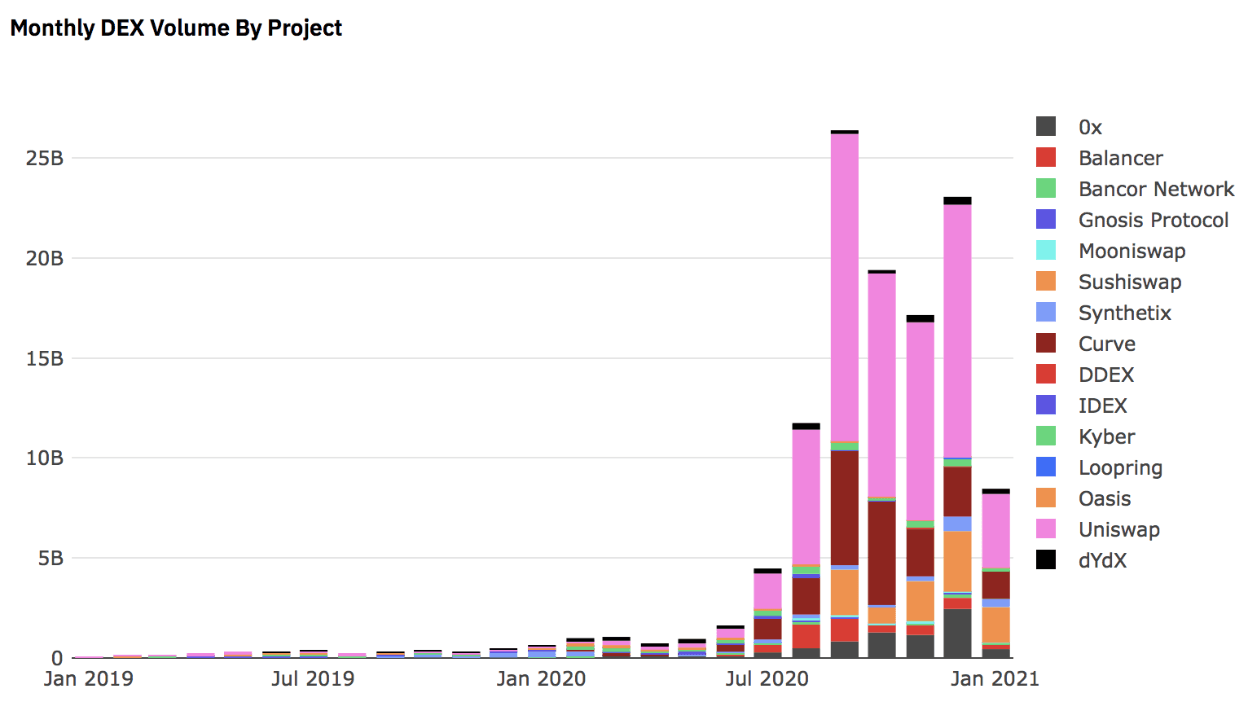

As we can see from the chart above, DeFi adoption exploded in the summer of 2020 and has seen significant investment pumped into its many applications moving into 2021.

The Path to Mainstream Adoption

DeFi has the potential to go further with blockchain technology than cryptocurrencies. This is because it promises a fully open, peer-to-peer financial system that focuses on including those why otherwise have little-to-no access to traditional financial markets.

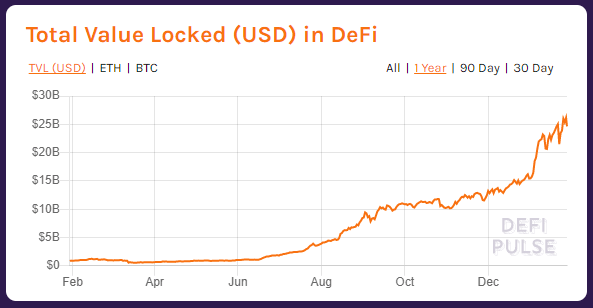

(Image: DeFi Pulse)

According to DeFi Pulse, the total value locked in DeFi platforms has already surpassed $25 billion US dollars - a mind-boggling figure considering it wasn’t until August 2020 that we saw DeFi surpass the $5bn mark. This indicates that the former sub-sector has now made itself known to mainstream financial institutions.

Naturally, as the space grows alongside its various use cases, it’s logical that we’ll see DeFi become an increasingly dominant talking point not only in cryptocurrency financial circles but that of traditional finance, too.

Diverse Applications

The relationship between DeFi and cryptocurrencies is close, after all, it could be argued that Bitcoin was the first DApp. As an application, it enabled users to lend their computing power to verify transactions and ‘mine’ more coins - which could subsequently be stored independently without passing through a centralized institution. From the early cryptocurrencies, the DApp ecosystem has expanded significantly as more developers create financial products to attract users.

The next big ‘killer app’ in fintech could theoretically already exist within the DApps ecosystem. Success will come down to the teams that can best execute on a proven idea that has the runway for growth. While many apps are centered around lending and borrowing, there is plenty more that can be done within this ecosystem.

With half of the UK struggling to pay their bills, DeFi will undoubtedly continue to challenge traditional financial systems in their entirety. Where traditional finance would require users to consult with banks to broker loans or create debt management plans, decentralized finance applications can automatically generate smart contracts where sums are transferred between lenders and borrowers at much more generous rates without any centralized power taking a share for themselves. The possibilities in terms of managing debt, utilizing loans and generating wealth are virtually limitless.

Each time the DeFi ecosystem develops a viable decentralized alternative to existing applications, it registers a new challenger to traditional finance.

The Power to Challenge the Status Quo

DeFi doesn’t only pack the power to challenge the established status quo of the current financial system, it also creates a wide range of new possibilities that have never truly existed for citizens around the world before.

DApps are globally available and transparent, they remove the need for reliance on central banks and governments and increase the level of access that people have to their finances. DeFi doesn’t rely on third-parties or intermediaries and operates purely on a peer-to-peer basis.

No companies or employees manage DeFi because of the intelligence of the smart contracts deployed on the blockchain, so there’s no meddling from centralized forces.

Decentralized finance has the power to change how money works, and we can expect it to result in greater levels of financial inclusivity and transparency for everyone.

Author

Dmytro Spilka

Solvid

Dmytro is a tech, blockchain and crypto writer based in London. Founder and CEO at Solvid. Founder of Pridicto, an AI-powered web analytics SaaS.