Decentraland price to revisit $4 as MANA approaches a launch pad

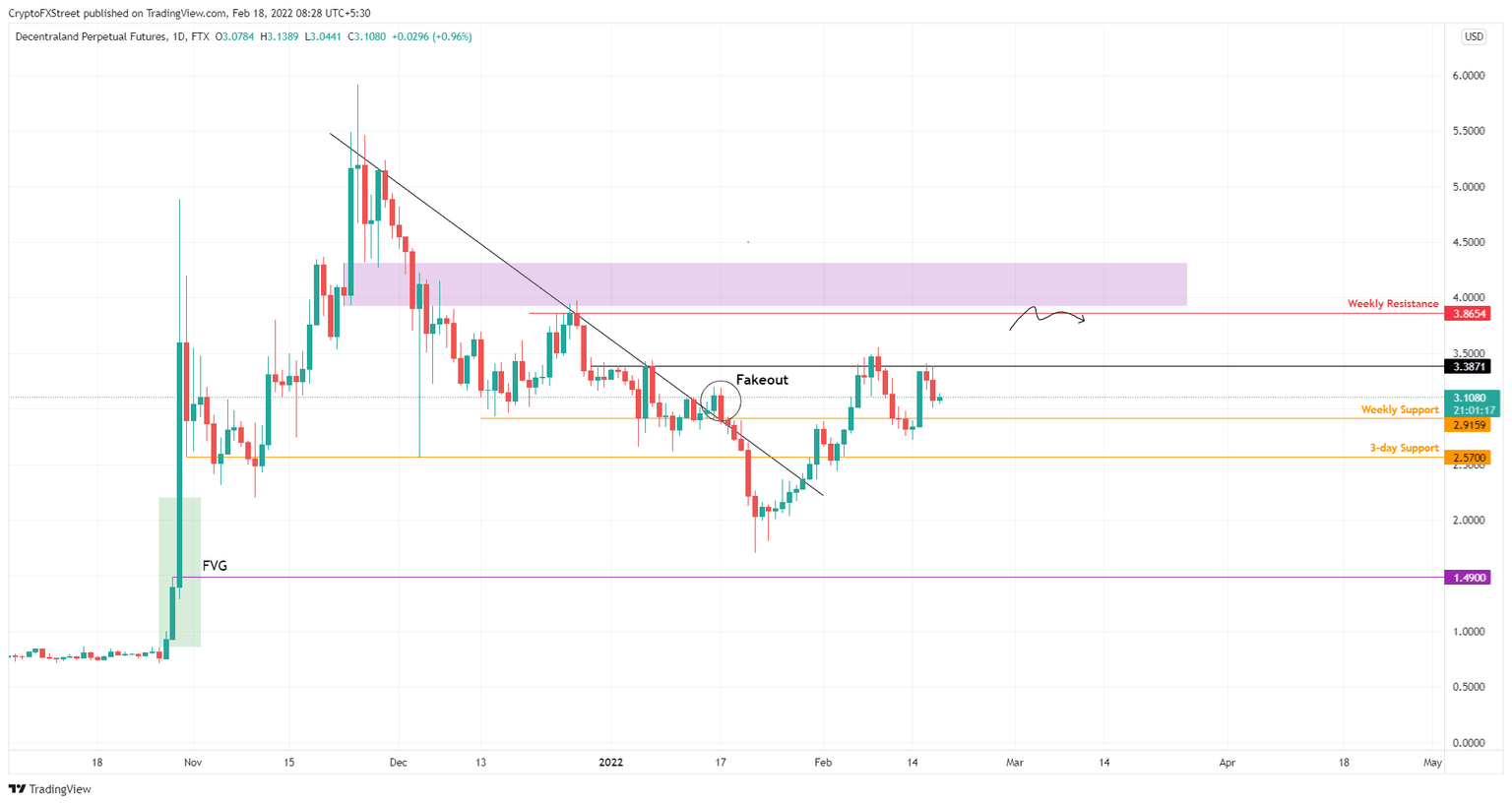

- Decentraland price eyes a retest of $2.92 after rejection at the $3.39 resistance barrier.

- This downswing will allow MANA to trigger an ascent to the weekly resistance level at $3.86.

- A breakdown of the February 14 swing low at $2.72 will invalidate the bullish thesis.

Decentraland price has been on a downswing for the past two days and is currently attempting to make a U-turn. There is a good chance MANA will slide lower before triggering a quick run-up.

Decentraland price looks to set up higher highs

Decentraland price dropped 10% as it set a lower high after rejection from the $3.39 resistance barrier. However, MANA has shown bullishness by creating multiple higher lows since January 22.

The recent rejection or the inability of buyers is a temporary setback. So, investors can expect Decentraland price to slide lower and retest the weekly support level at $2.92. This move will allow bulls to recuperate and provide MANA a base for its next leg-up.

The resulting upswing will likely propel Decentraland price to slice through the $3.39 hurdle and make its way to the weekly resistance level at $3.86, coinciding with the daily supply zone, extending from $3.92 to $4.31.

In total, MANA could be preparing for a 35% ascent to $4.00

MANA/USDT 4-hour chart

Interestingly, the Decentraland price IntoTheBlock’s Global In/Out of the Money (GIOM) model aligns perfectly with the technical outlook. This on-chain index shows that the next hurdle for MANA extends from $3.37 to $3.74. Here, roughly 15,210 addresses that purchased 244.75 million tokens at an average price of $3.57 are “Out of the Money.”

Therefore, any spike in bullish momentum is likely to be met with resistance from the selling pressure of investors trying to break even.

MANA GIOM

Moreover, the number of large transactions worth $100,000 or more has increased from 94 to 272 in the last month. This 189% spike in transfers suggests that high networth investors are interested in Decentraland at the current price levels and serves as a proxy of their investment interests.

MANA large transactions

While things are looking up for Decentraland price, a breakdown of the February 14 swing low at $2.72 will create a lower low and potentially tilt the odds in bears’ favor and invalidate the bullish thesis.

If this scenario plays out, MANA could revisit the 3-day support level at $2.57 before attempting another leg-up.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.