Decentraland price rally hits curb at $2.70, with uptrend still intact

- Decentraland price pops above $2.56 but gets cut short at $2.70 with rejection.

- MANA price could see bulls eking out a close above $2.70, opening room for $3.00 into the weekend.

- As tailwinds start to add more positive elements, expect to see the uptrend continue into the end of the week.

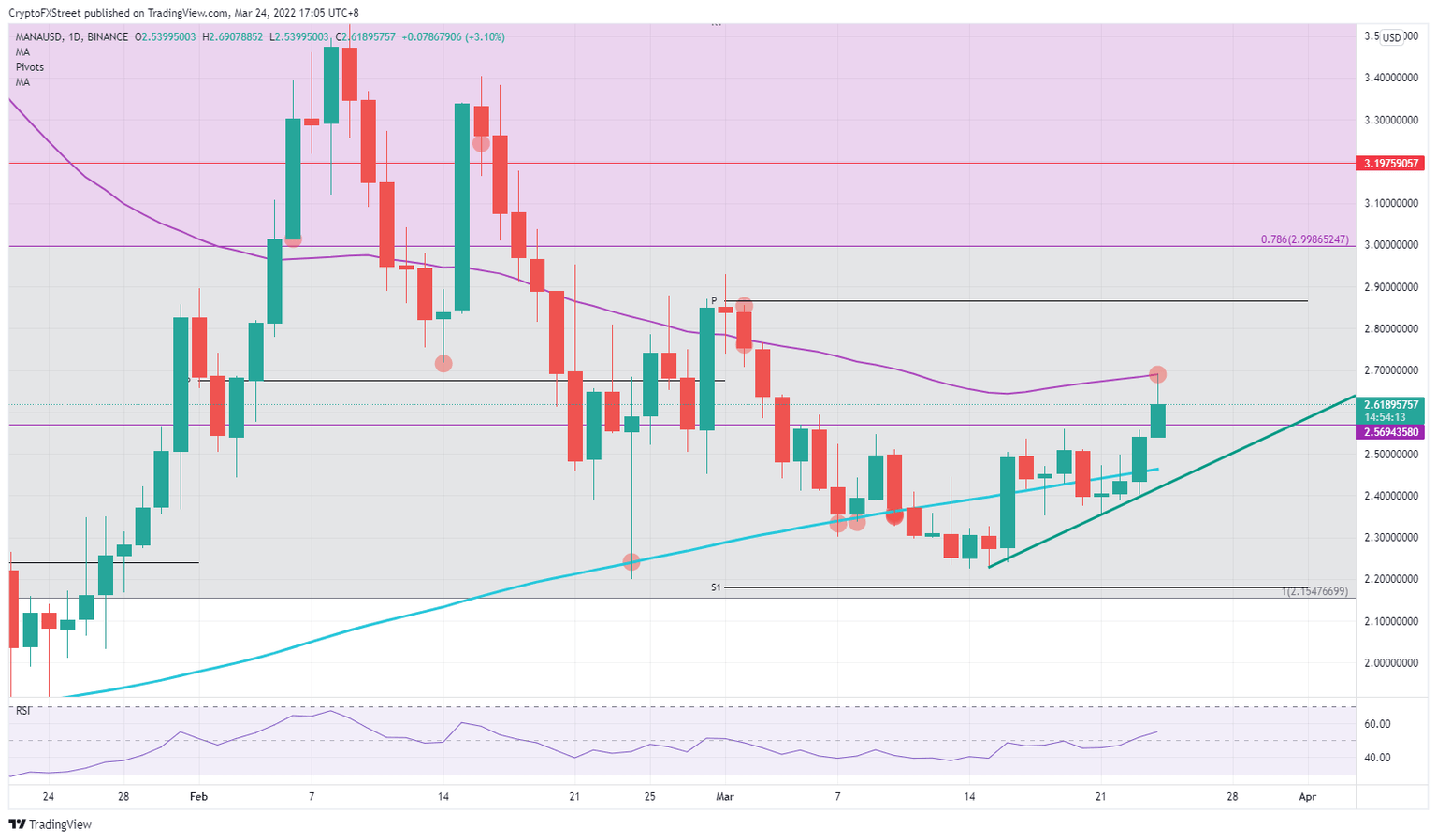

Decentraland (MANA) price is on a winning streak after booking a fourth consecutive day of gains. This morning, bulls tried to break the 55-day Simple Moving Average (SMA) at $2.70 but failed after receiving a firm rejection. Although a fade is quite normal after such a rejection, assuming bulls can eke out gains, the rally is still likely to be considered live and more bulls will want to join price action as tailwinds persist with the Nasdaq leading the charge.

Decentraland price in tandem with Nasdaq for booking new highs for March

Decentraland price is on the cusp of turning a four-day consecutive rally into an uptrend as bulls push forward again. Unfortunately, the current top got cut short against the 55-day SMA at $2.70. With the Relative Strength Index still quite a fair bit below being ‘overbought,’ bulls have plenty of room in the tank to punch through the 55-day SMA and could be set for either $2.90 or $3.00 going into the weekend.

MANA price, in the meantime, sees support building from below as well, adding to tailwinds as more upward momentum builds. Turning this rally into an uptrend will depend on the Nasdaq as over the past few days the correlation between cryptocurrencies and Nasdaq has kicked back into gear. As investors are regaining trust in global equities, MANA price will likely undergo a similar pattern, and thus with Nasdaq on the front foot, MANA price will likely see its next tailwind coming from the correlation with the Nasdaq, providing a second driver for price action and pushing price up to $3.00.

MANA/USD daily chart

After MANA price got rejected by the 55-day SMA, the risk is that the price collapses back to $2.46 where the 200-day SMA will come in as support, or $2.40, which is on the green ascending trend line. Should bearish pressure weigh further on that green ascending trend line, the risk at hand could be of bears breaking it back down to $2.22, the low of March.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.