Decentraland Price Prediction: MANA relief rally capped at $3

- Decentraland price shows its downtrend is still intact but a minor 18% uptrend seems likely.

- Transaction data shows that a cluster of underwater investors could prevent MANA from going beyond $3.

- A breakdown of the $2.20 barrier will invalidate the bullish thesis and potentially trigger a 32% crash to $1.49.

Decentraland price has been on a massive bear trend since its all-time high in late 2021. The collapse of this metaverse token seems to be pausing as MANA trades inside a demand zone. Despite the short-term bearish outlook, a quick uptrend seems likely.

Decentraland price leaves a trail of bloodbath

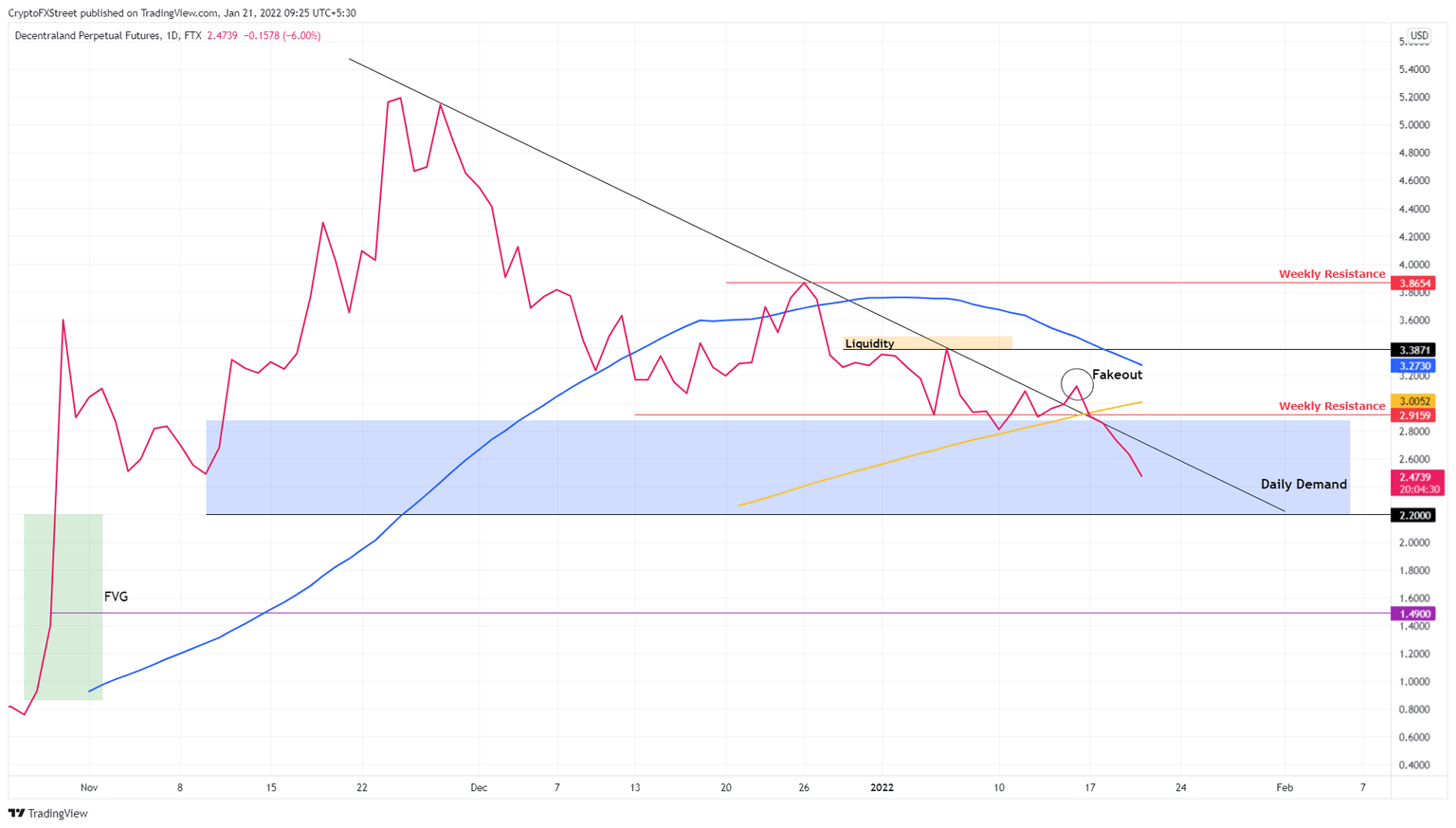

Decentraland price is stuck trading below a declining trend line for nearly two months and has dropped 50% since its first retest. Although MANA attempted a breakout on January 15, it failed and slid back below it.

As Decentraland price trades inside a $2.20 to $2.88 demand zone, there is still a chance for a minor uptrend. Investors can expect MANA to rally 18% and retest the 100-day Simple Moving Average (SMA) at $3. However, this uptrend could be cut short by the weekly resistance barrier at $2.92.

Any move beyond the $3 mark seems unlikely, mainly because of the current outlook of the market and due to the 50-day SMA at $3.27.

MANA/USDT 1-day chart

Supporting this technical perspective of a limited upside is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This on-chain index shows that roughly 31,120 addresses that purchased 488.12 million MANA tokens at an average price of $3.20 are “Out of the Money.”

Therefore any uptrend that pushes Decentraland price to these levels is likely to be met with massive selling pressure from these holders trying to break even.

MANA GIOM

Further exemplifying the nature of investors’ sentiment for Decentraland price is the supply of MANA on exchanges. This on-chain indicator shows that the number of MANA tokens held on centralized entities increased by 43 million between December 18, 2021, and January 19.

This spike in the number of investors holding their tokens on exchanges indicates a potential sell-side pressure, supporting the limited upside possibility detailed above.

MANA supply on exchanges

Regardless of the short-term bullish outlook, a daily candlestick close below $2.20 will create a lower low and invalidate the optimistic scenario for Decentraland price. This development will trigger a bearish outlook that could see MANA crash by 32% to 1.49.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%20%5B08.26.49%2C%2021%20Jan%2C%202022%5D-637783377150741007.png&w=1536&q=95)