Decentraland price positioned to return to $2

- Decentraland price action developing a likely bearish breakout that would drop MANA more than 20%.

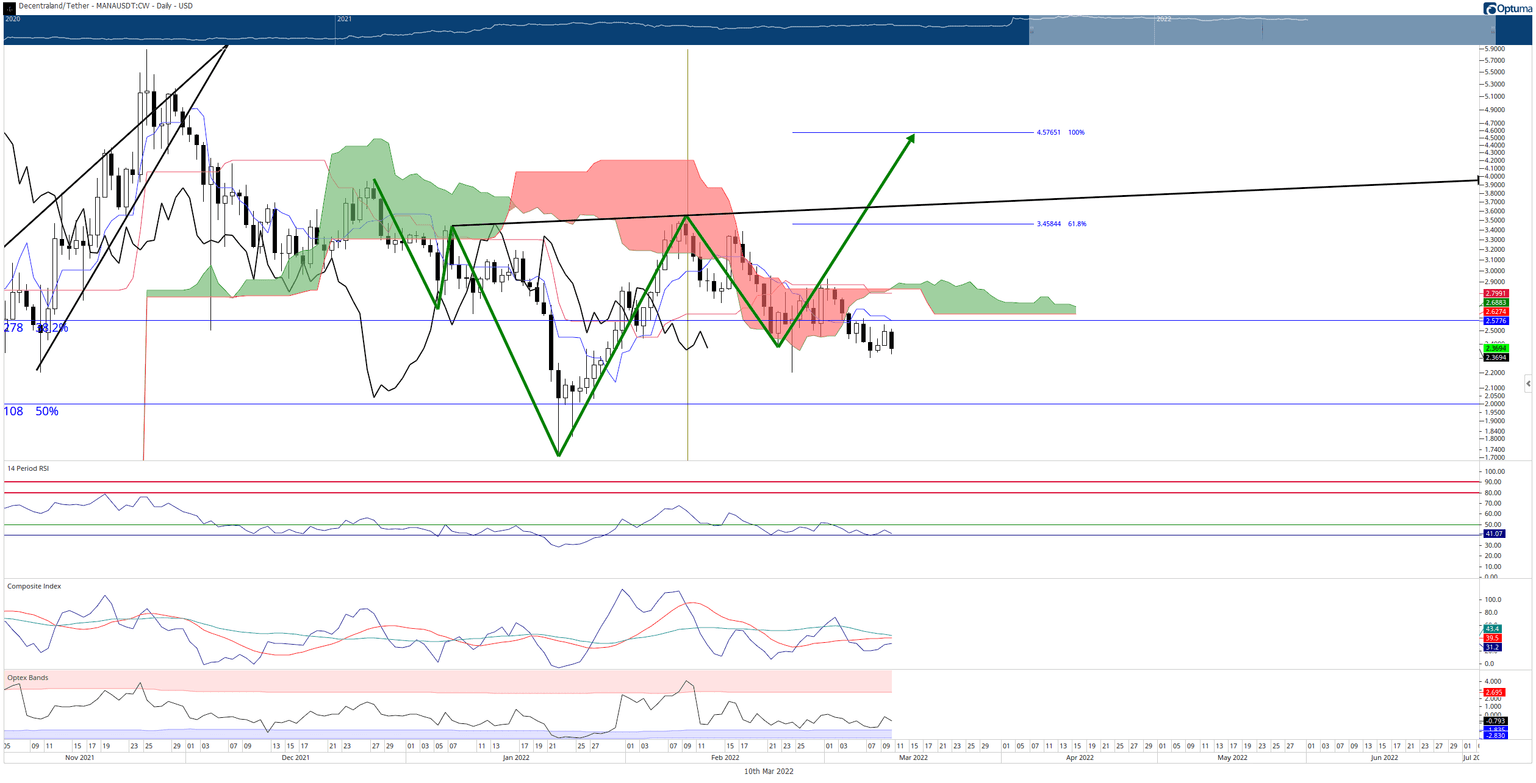

- Zero Ichimoku support structure on the daily and weekly Ichimoku charts.

- Oscillator conditions support further downside movement.

Decentraland price is barely hanging on to some near-term support before crashing back to the $2 level. However, a total absence of any significant support below $2.33 makes the likelihood of a fall extremely probable, and it could occur at any moment.

Decentraland price action indicates a retest of the $2 level may occur before any return to bull market conditions commences

Decentraland price recently confirmed an Ideal Bearish Ichimoku Breakout last Friday (March 4, 2022) by closing below the Ichimoku Cloud. The confirmation warns of an imminent drop and continuation of the broader downtrend, now over one hundred days.

The oscillators for Decentraland price support continue selling pressure. The Relative Strength Index continues to hold the final oversold level in a bull market (40), but the slope suggests a drop below that level is likely to happen soon. If the RSI hits the 30 level, then RSI shifts into bear market conditions, signaling a prolonged and extended downtrend.

The Composite Index and Optex Bands are both in neutral conditions. Because neither the Optex Bands oscillator nor the Composite Index show oversold conditions, a drop in Decentraland price towards $2 should occur with relative ease.

The near-term bearish outlook, however, can easily be countered and invalidated. Despite the confirmation of an Ideal Bearish Ichimoku Breakout and negative economic and geopolitical data, bears have been unable or unwilling to push Decentraland price lower.

MANA/USDT Daily Ichimoku Kinko Hyo Chart

Two Ichimoku conditions may warn of a bear trap in development. The first is the Kumo Twist which occurs today (when Senkou Span A crosses Senkou Span B – or, visually observed as the Cloud changing from red to green and vice-a-versa). Kumo Twists can often precede major/minor swing highs and lows.

The second Ichimoku condition warning of a bear trap is the current Ichimoku Cloud itself, which is extremely thin. Thin Clouds represent weakness, and if MANA price generates some buying pressure, it should be easy for bulls to break above the Cloud near $2.90.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.