Decentraland price on the cusp of a steeper decline

- Decentraland price sees support fading at the 200-day SMA.

- MANA could see a violent drop today if peace talks later this afternoon fail again.

- Independent of the moves intraday, a close below the 200-day SMA might see further deepening of losses into the weekend.

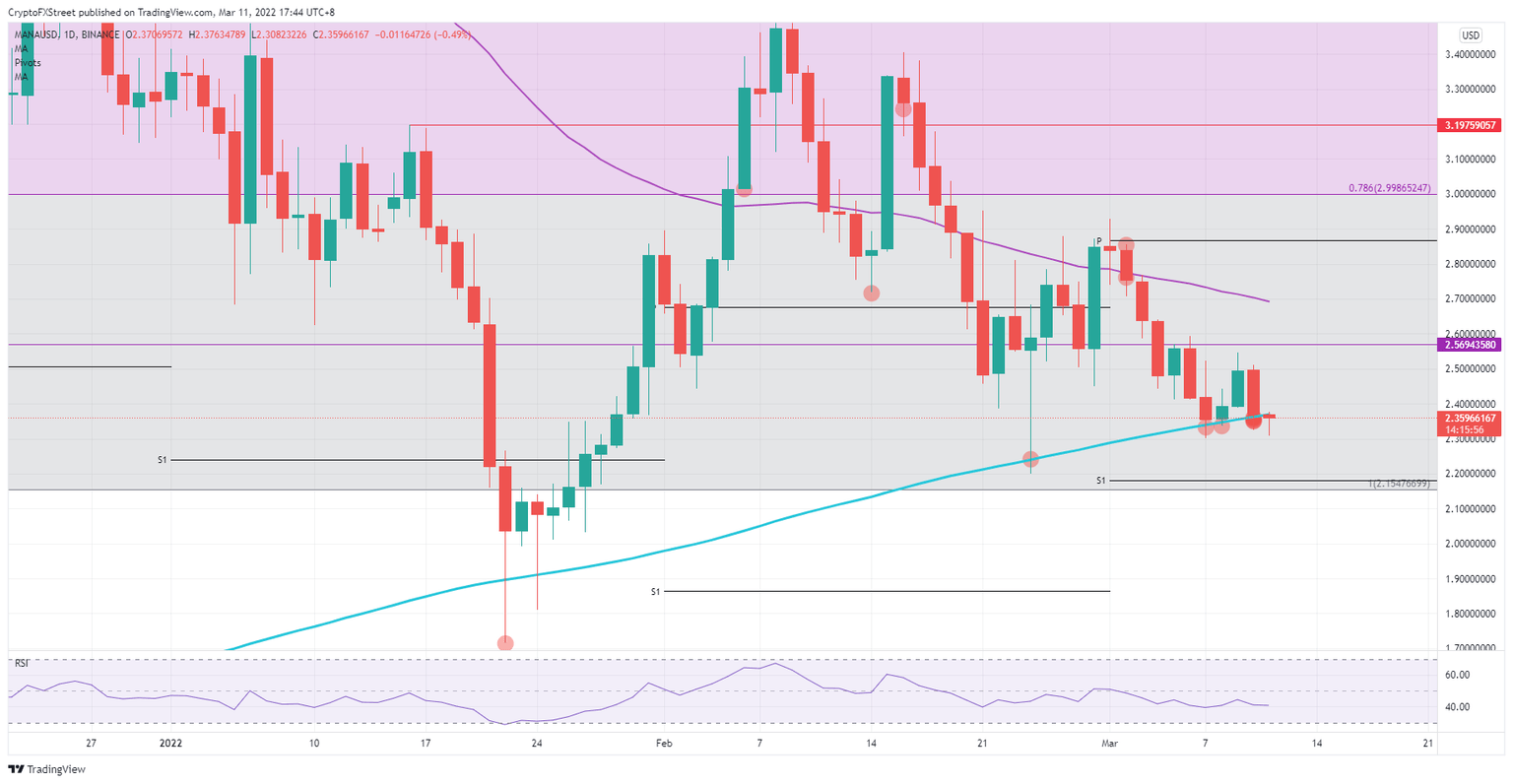

Decentraland (MANA) price action is hanging by a thread as price action opens this morning – sitting just above the 200-day Simple Moving Average (SMA). In the past, the 200-day SMA has proven to be an essential entry point and slowed down many falling knives. A daily close below would show that bears have put on even more short positions, outweighing bulls and triggering another correction in MANA’s price action, finding a new equilibrium between bulls and bears further down the line.

Decentraland price action set to eke out more losses

Decentraland price action has mainly been trading sideways this week, with the 200-day SMA delivering much-needed support to prevent MANA price action from tanking. As MANA already made an excursion below the 200-day SMA, and $2.4000, the situation looks grim as bears have added more short positions at the open after bulls got a firm rejection preventing them from making any further upside. Expect the daily close this evening to be crucial going into the weekend, signalling to markets either Decentraland is in distress – if it closes below the 200-day SMA – or that an uptrend is still on the cards throughout the weekend or by next week.

MANA price action is thus on the cusp of playing an actual psychological game for investors as they need to make up their mind if the current environment can provide enough upside potential to go long Decentraland, or whether to wait for more positive comments and a better economic environment to invest in risk assets. Intraday, a move to the upside could still deliver $2.5000, but do not expect that to break above the high of yesterday. Instead, look for a drop towards $2.2000 with the monthly S1 support near the $2.1548 level of the Fibonacci retracement and near the low of February 24.

MANA/USD daily chart

With several heads of state convening in France at the moment and with another round of peace talks set for this afternoon, expect there to still be a possibility of a turnaround. A more soothing tone in markets would see a pop above $2.5000 and a stretch further towards $2.7000 at the 55-day SMA. That would mean that some positive news could spark a 15% rally in just a matter of a few positive headlines on Ukraine.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.