Decentraland price explodes, as MANA bulls eye all-time highs

- Decentraland price is looking to extend the big technical breakout.

- Facebook’s Meta rebranding announcement drove MANA price to the moon.

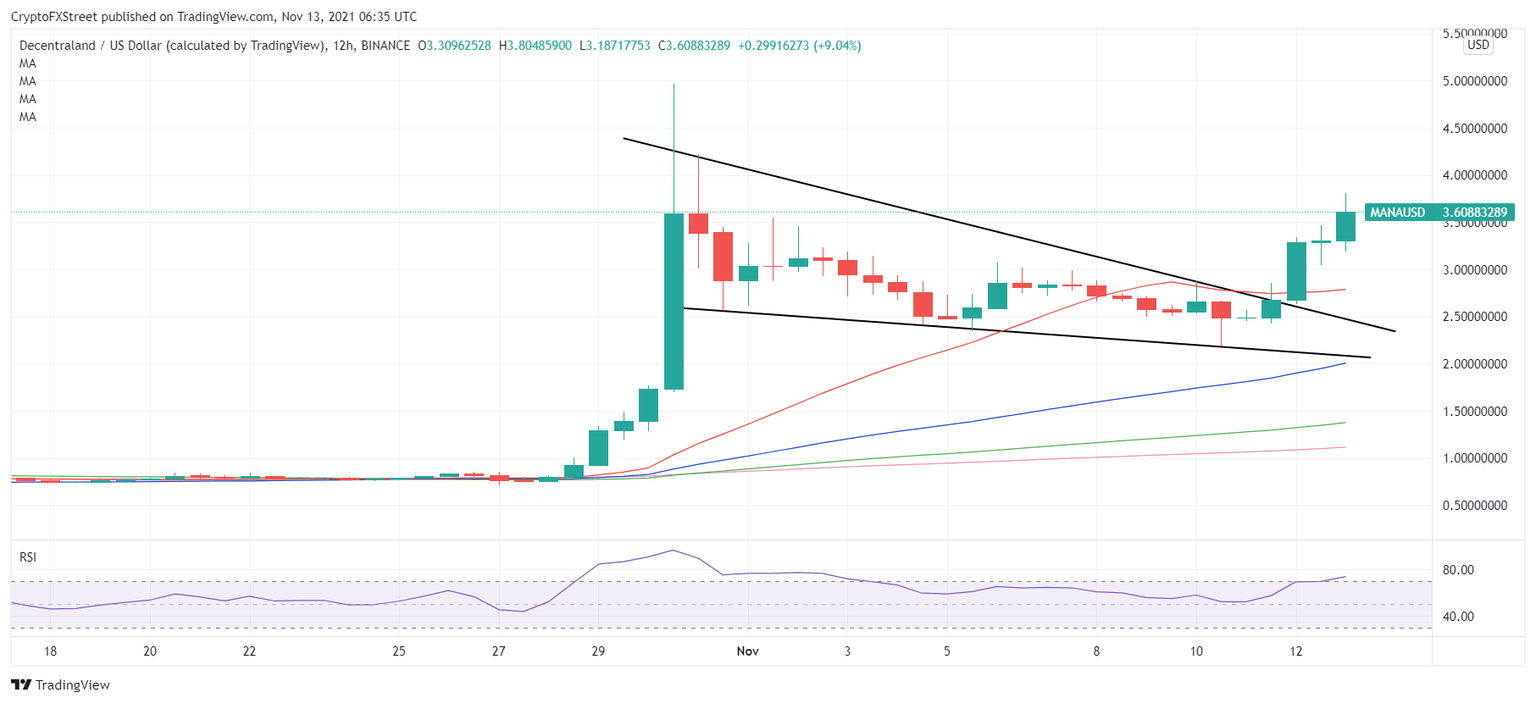

- MANA price charted a falling wedge breakout on the 12-hour sticks.

Decentraland price has resumed its bullish momentum, adding nearly 40% since its renewed upside on Thursday.

At the time of writing, MANA price is off the two-week highs of $3.83, trading around $3.60, looking to recapture the $4 mark.

After a brief consolidative stint seen in the first week of November, MANA price saw a revival in its uptrend triggered by Facebook’s rebranding to Meta late last month.

MANA price shot to all-time highs of $5.03 on Meta’s plan to focus on a metaverse, which stoked investors’ interest.

Decentraland price heads towards all-time highs

The relentless rise in Decentraland price remains unstoppable, as MANA bulls extend the three-day bullish momentum on Saturday.

MANA price consolidates near two-week highs, gathering pace for the next upswing, as the technical setup on the 12-hour chart remains in favor of bulls.

The further upside remains intact, especially in light of a falling wedge breakout confirmed on the said time frame on Friday. MANA price closed the 12-hour candlestick above the falling trendline resistance, then at $2.60, yielding a big technical breakout.

The Relative Strength Index (RSI) is holding firmer above 70.00 but not yet in the extremely overbought region, leaving additional room for the upside.

Therefore, MANA buyers remain on track to recapture the $4 mark if the intraday highs get cleared. The next relevant bullish target is envisioned at the record highs.

MANA/USD 12-hour chart

Any retracement from higher levels could bring Friday’s low of $3.04 back in play.

MANA sellers will then target the mildly bullish 21-Simple Moving Average (SMA) at $2.78 on additional weakness.

If the corrective pressure persists, then MANA bears could be forced to challenge the wedge resistance now support at $2.47.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.