Decentraland price back in a bullish posture after recovering most losses

- Decentraland has seen a massive bullish recovery as price action reaches almost back up to $4.5.

- MANA price sees more bullish signs as well-respected support holds at $3.66.

- Expect further bullish momentum if investors can push the price above $4.50 and consolidate above there.

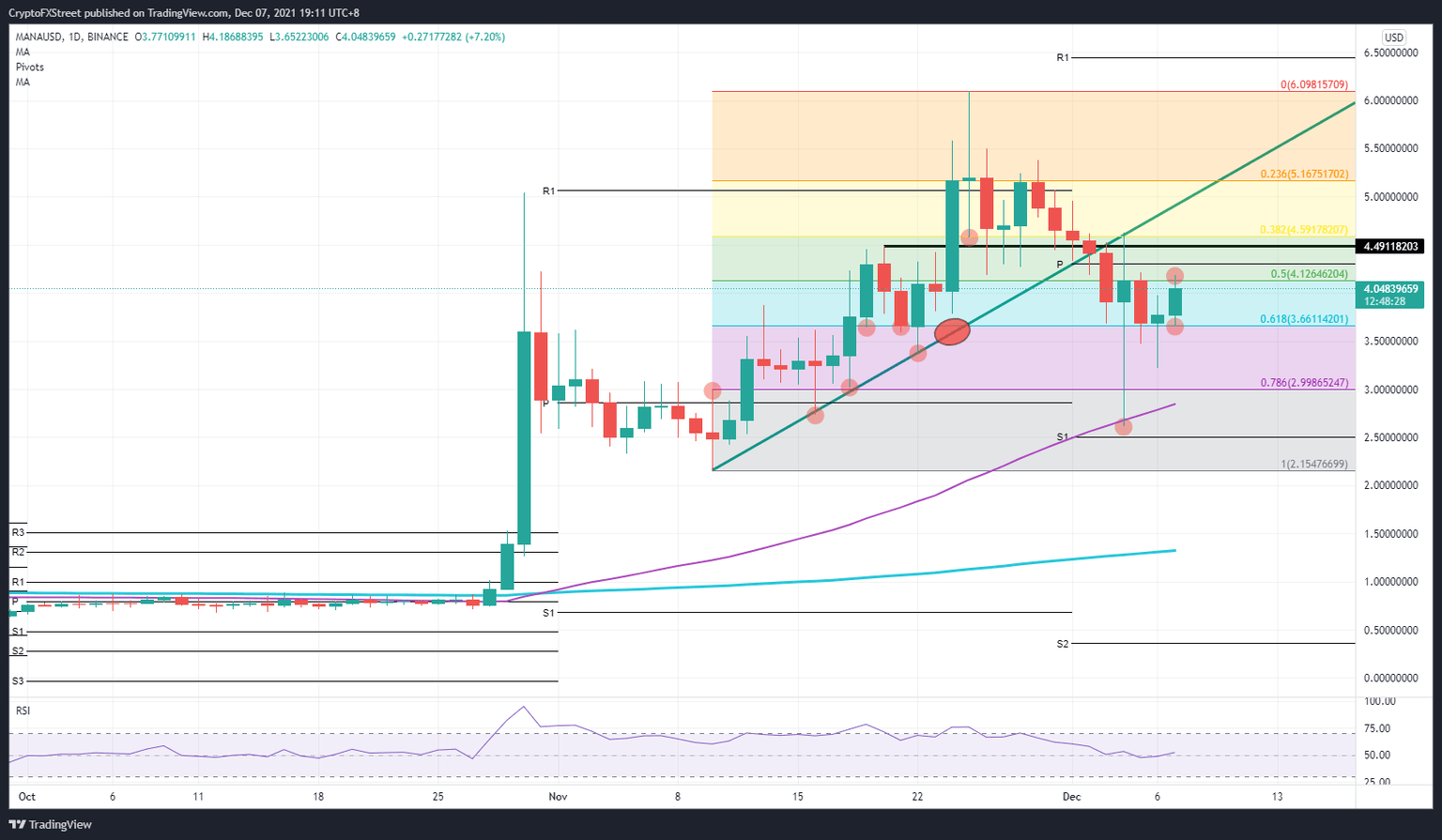

Decentraland (MANA) was no different from most cryptocurrencies after it suffered from Bitcoin’s woes following its flash crash this weekend. Since then MANA has seen bulls grasping the opportunity to jump onboard at a discount with the altcoin trading at $2.60 , and MANA price has since seen a reversal back up to $4.12. A further continuation could see bulls back at $5.0 by the end of this week.

Decentraland to see price back up to $5.0 by the end of this week

Decentraland suffered more than some other major cryptocurrencies after Bitcoin’s flash crash on Saturday morning. Bulls jumped quickly on the opportunity to buy at $2.60, as the 55-day Simple Moving Average acted as an anchor for price. Not even the S1 monthly support level at $2.50 came into play as buying was so massive just a few cents above there.

Expect MANA to further rally to the upside towards the critical $4.50 level. That level is a line in the sand and could mark a level where more investors start picking up MANA. A consolidation or daily close above that level would give the rally additional volume to go for new all-time highs. At the same time, bears will earmark that level as a point to start shorting once again.

MANA/USD daily chart

In a case where current tailwinds fade and headwinds take over again, expect the current recovery rally to fade in the wake of $4.50 and for price to break below the 61.8% Fibonacci level at $3.66. An accelerated sell-off could then occur and a nose dive towards $2.50. Expect the 55-day SMA not to hold this time, so it would be up to the monthly S1 to show support. If it does not hold, the Fibonacci retracement at $2.15 could see some respect instead.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.