Decentraland holds support but MANA may return to $2

- Decentraland price finds buyers near a critical support level.

- Buyers on Thursday have returned MANA to yesterday’s open.

- Yesterday’s losses wiped out as positive sentiment returns – but downside risks remain.

Decentraland price action is, at present, very indecisive. However, while the overall outlook is bearish, especially within the Ichimoku Kinko Hyo system, there is evidence that a turnaround to the upside may be coming soon. Holding the $2.50 level as support is key to any sustained rally higher.

Decentraland price still bearish, but a bullish breakout could begin at any moment

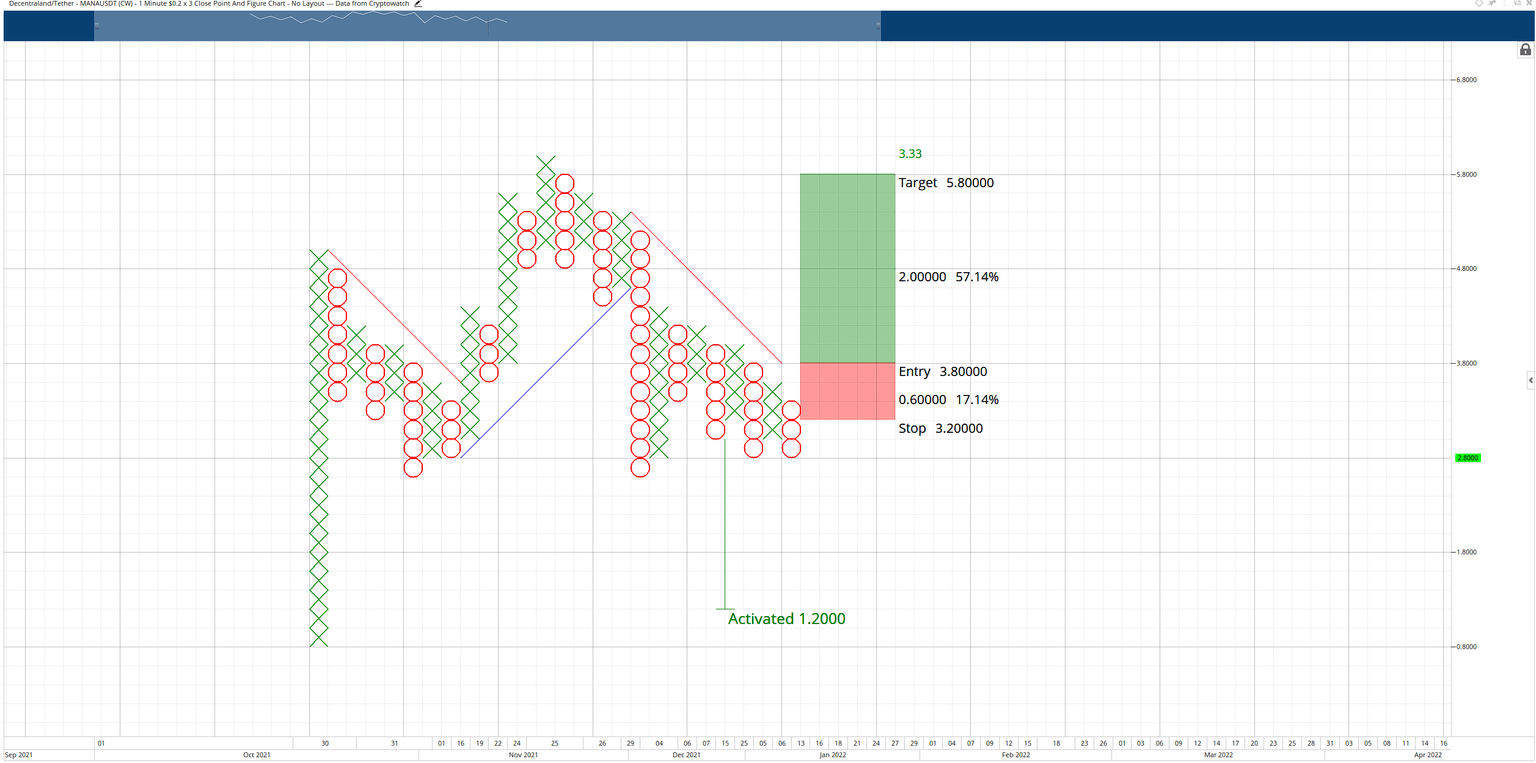

Decentraland price has two setups with solid probabilities of becoming profitable trades – one long and one short. A hypothetical long setup with a buy stop order at $3.80, a stop loss at $3.20, and a profit target at $5.80. The trade is based on the simultaneous breakout above the upper trendline of a descending triangle and the bear market trendline. If MANA hits the entry, it converts the $0.02/3-box reversal Point and Figure chart into a bull market.

The hypothetical long trade setup represents a 3.33:1 reward/risk with an implied profit target of 57% from the entry. However, a trailing stop of two to three boxes would help protect any profit generated after the entry is triggered. This long idea is invalidated if Decentraland price drops to $2.40.

MANA/USD $2.00/3-box Reversal Point and Figure Chart

There is a strong but increasingly unlikely short setup for Decentraland price based on an anticipated triple-bottom breakout. The theoretical short entry is a sell stop order at $2.60, a stop loss at $3.00, and a profit target at $1.40. The short idea is a 3:1 reward/risk with a little over a 40% gain projected from the entry. A three-box trailing stop may be too large for this trade setup, so a two-box trail would be most appropriate.

MANA/USDT $1.00/3-box Reversal Point and Figure Chart

The short idea is invalidated if the long entry triggers first.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.