Bitcoin may drop before the US elections and rebound sharply afterwards, historical data shows

- The upcoming 2020 US election will have a direct impact on the cryptocurrency market.

- Although no candidate has presented policies in favor or against cryptos, result will still influence Bitcoin and the entire market.

The entire global stock market is already starting to experience volatility due to the upcoming US presidential election. In the past, the cryptocurrency market had somewhat similar reactions.

Will history repeat itself with the 2020 election?

If we observe Bitcoin's price action in November 2012, around two weeks before the election, the digital asset plunged by 20% and didn’t recover until weeks later. It’s important to note that BTC was far more volatile in 2012 as trading volume was minimal.

BTC past elections chart

In the past election in 2016, Bitcoin also had a significant crash around five days before the results. Similarly, it took BTC more than a week to fully recover. However, on both occasions, the digital asset experienced two colossal bull runs months later.

Less than a week away from the 2020 elections, Bitcoin continues trading above $13,000 at exactly $13,550 at the time of writing. A similar 12% drop, like the one seen in 2016, would push BTC down to $11,875.

However, looking at the In/Out of the Money Around Price (IOMAP) chart, three critical support levels are observed on the way down. The area between $13,131 and $13,536. The range between $12,725 and $13,131 and finally $11,489-11,914.

BTC IOMAP chart

These three ranges have a lot of Bitcoin volume, meaning that many investors bought many coins. In comparison, the resistance ahead seems almost non-existent. Considering what the IOMAP chart shows, a drop below $12,725 seems unlikely.

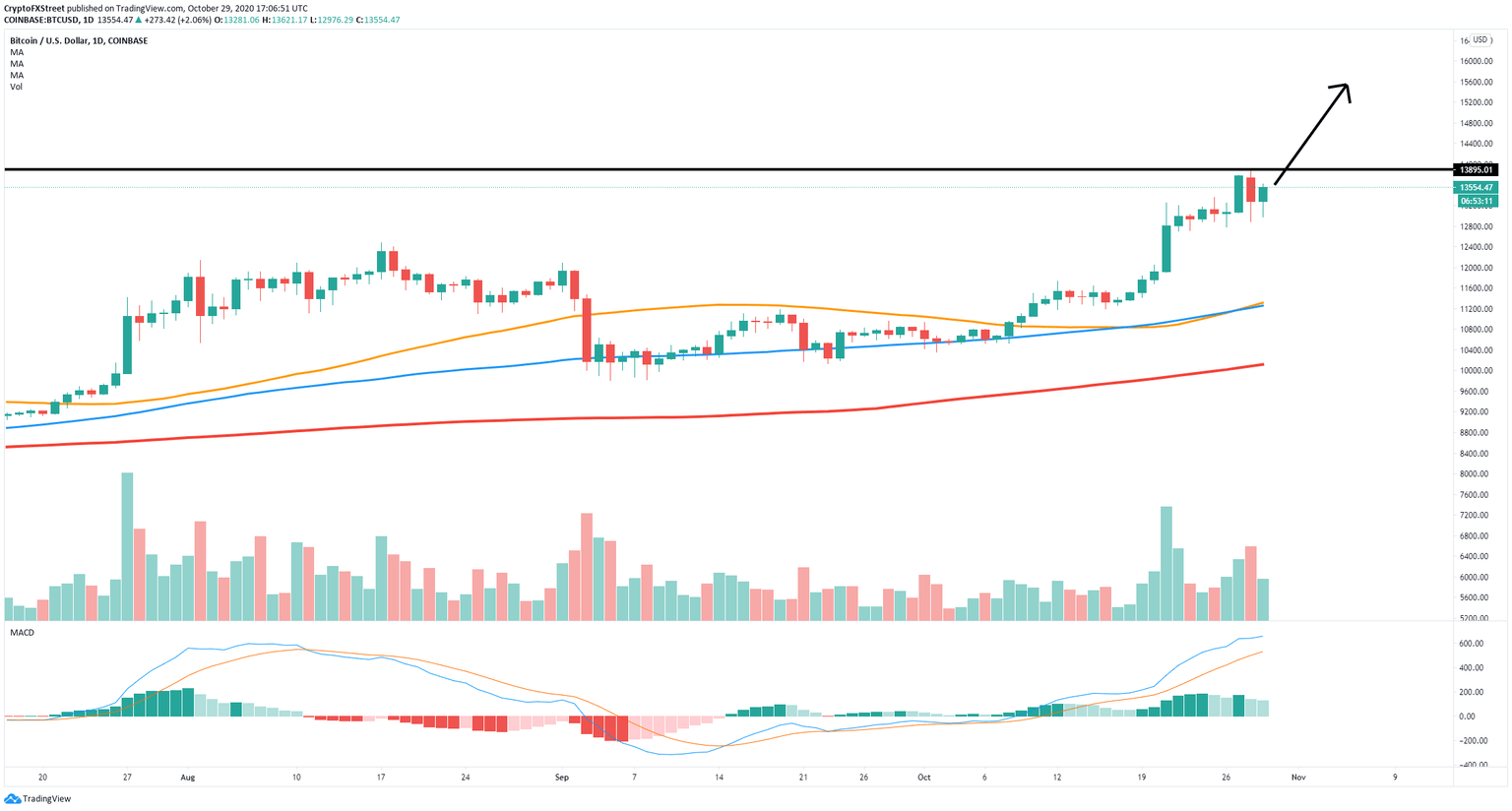

BTC/USD daily chart

If Bitcoin can resume its bullish trend a few weeks after the elections, as it did in the previous ballots, the flagship cryptocurrency could easily jump towards the last high at $13,863 and as high as $15,583 as the IOMAP chart shows no significant resistance until that point.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637395881053689856.png&w=1536&q=95)