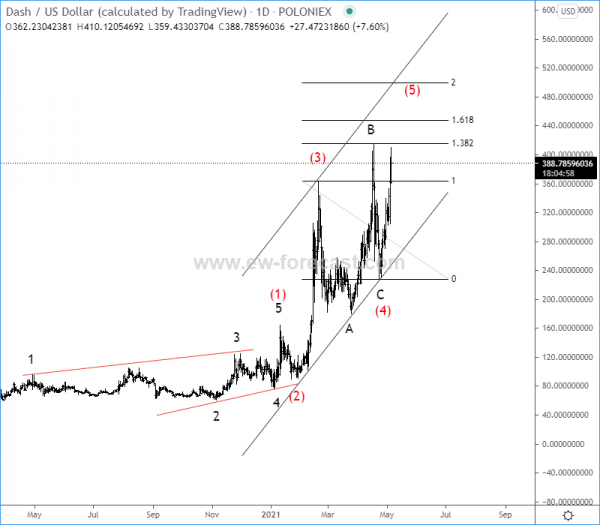

DASH/USD Elliott Wave analysis – Eyes towards 400-500 level

-

DSHUSD Eyes Towards 400-500 level.

-

Be aware of Deep Correction after completing five waves move of 5 of5).

Looking at the daily chart, DSHUSD is still on the rise, unfolding five waves up from March 2020 lows, but we can see it now trading in wave (5) after a running flat correction in wave (4). However, there's still room for more upside towards 400-500 area, but be aware of limited gains and watch out for a higher degree corrective decline, as we know that after every five waves, a three-wave setback follows.

DSH/USD Elliott Wave analysis daily chart

On 4h chart, DSHUSD remains under bullish pressure and it's trying to continue higher back to highs for wave (5), ideally within a new five-wave cycle, where waves 4 and 5 are still missing. So, it can ideally stop somewhere in the 400-500 area and from where we should be aware of deeper, higher degree corrective decline.

DSH/USD Elliott Wave Analysis 4h Chart

Finally, another ELLIOTT WAVE OPEN DOOR Event is here. See all of our charts FREE for 10 days. Join us at www.ew-forecast.com/register

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.