- DASH is currently trading at $68.36 after defending a critical support level at $66.5.

- The TD Sequential indicator is showing several buy signals on various time-frames.

DASH has lost 36% of its value since its peak on August 6 at $104.8. The digital asset is currently trying to bounce back up with the help of various indicators which are showing a shift in momentum for the bulls.

DASH/USD daily chart

The TD sequential indicator has presented a buy signal on the daily chart at around $68 right after DASH defended a critical support level at $66.5 formed on May 11 and defended on several occasions through June and September.

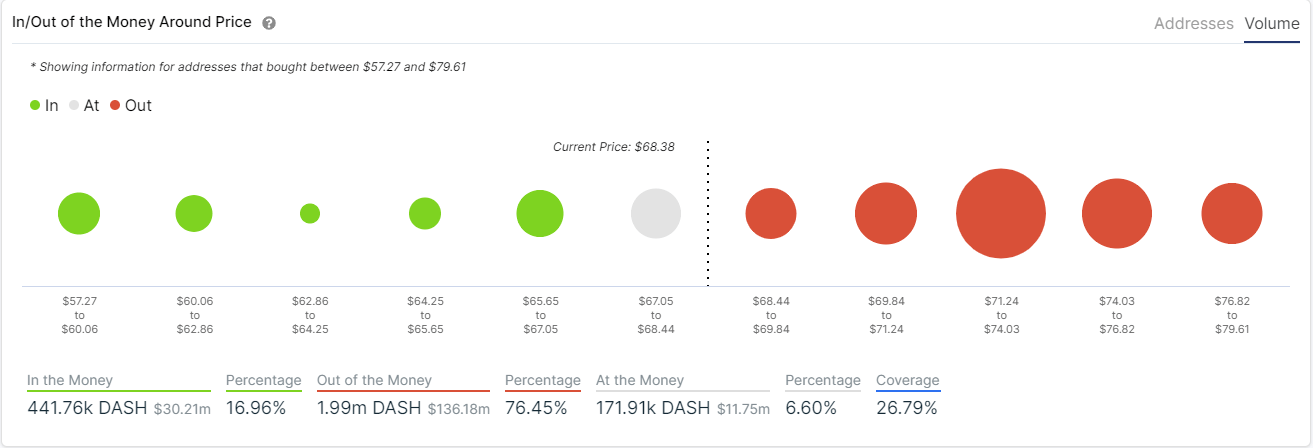

DASH IOMAP Chart

The In/Out of the Money Around Price indicator by IntoTheBlock shows a good amount of support at $68 and $66.55, right where the trendline is formed. The IOMAP chart basically identifies how many DASH coins were bought at a specific price.

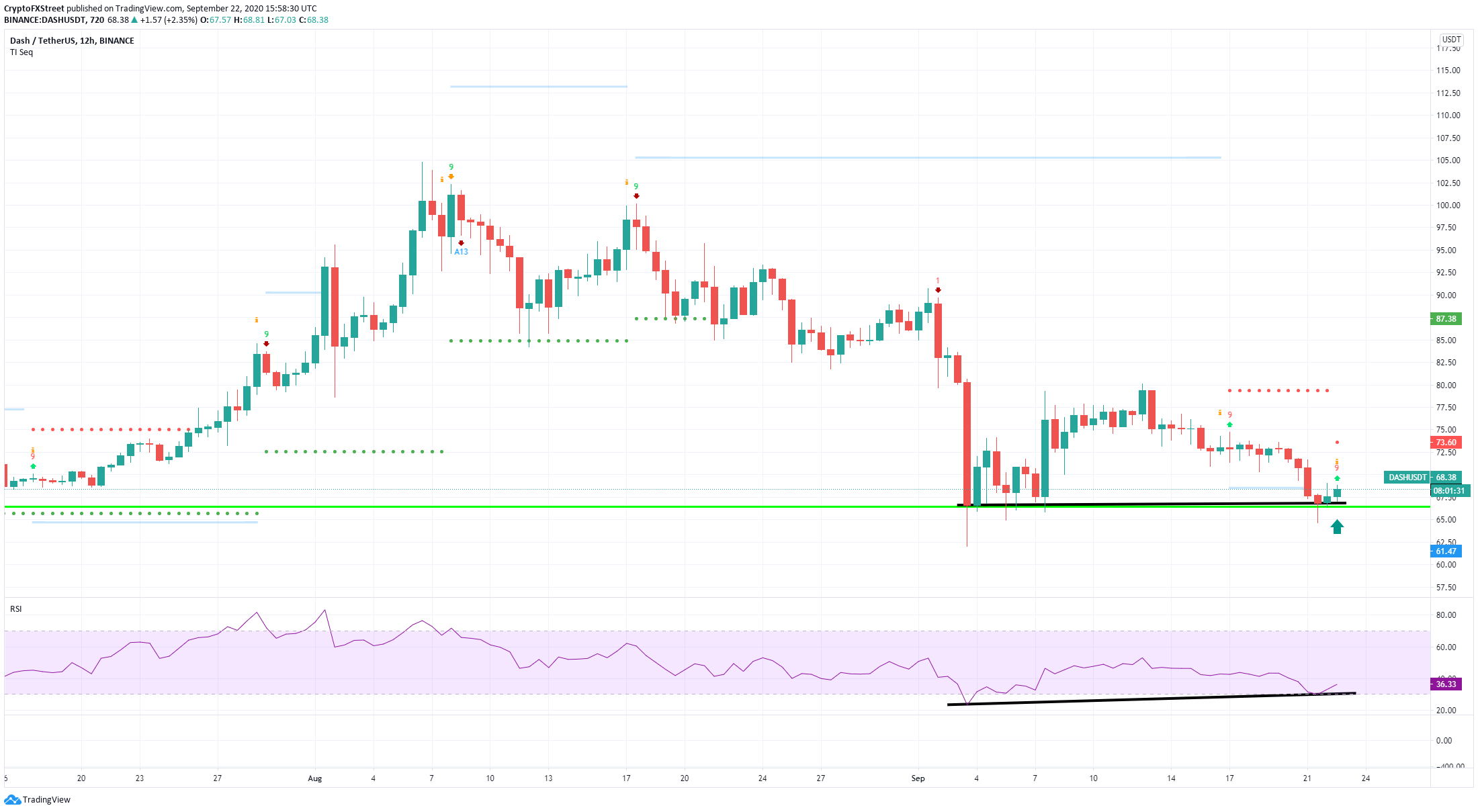

DASH/USD 12-hour chart

Similarly, on the 12-hour chart, the TD indicator has presented a buy signal just hours ago while the RSI was close to creating a bullish divergence but the price of DASH didn’t create lower lows but rather defended the same price point at $66.5.

DASH IOMAP Chart

Although the IOMAP chart confirms that there are a lot of buyers at $66.5 it also shows stiff resistance ahead at $69, $70, and most notably at $72 with a total volume of 796,000 DASH. For comparison, the $66.5 support level only has around 147,000 DASH in volume which means there are five times more buyers at $72.

Investors need to be on alert for a bearish breakout of $66.5 as this would most likely push DASH to lower lows close to $60. On the other hand, if both TD buy signals are correct, we could see the digital asset climb above $70 to test the massive resistance level at $72.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Monero Price Forecast: XMR soars over 19% amid rising demand for privacy coins

Monero (XMR) price is extending its gains by 19% at the time of writing on Monday, following a 9.33% rally the previous week. On-chain metrics support this price surge, with XMR’s open interest reaching its highest level since December 20.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH stabilize while XRP shows strength

Bitcoin and Ethereum prices are stabilizing at around $93,500 and $1,770 at the time of writing on Monday, following a rally of over 10% and 12% the previous week. Ripple price also rallied 8.3% and closed above its key resistance level last week, indicating an uptrend ahead.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.