Dash price on the verge of a collapse as indicator flashes several sell signals

- Dash price had a massive 70% breakout on January 9 hitting a high of $158.5.

- There are bearish signs in the short-term for the digital asset.

It seems that it’s time for Dash to experience another pullback after a massive breakout in the past week. An indicator has just flashed a significant sell signal on the daily chart which could translate into a correction in the short-term.

Dash price could fall towards $110 if this sell signal is validated

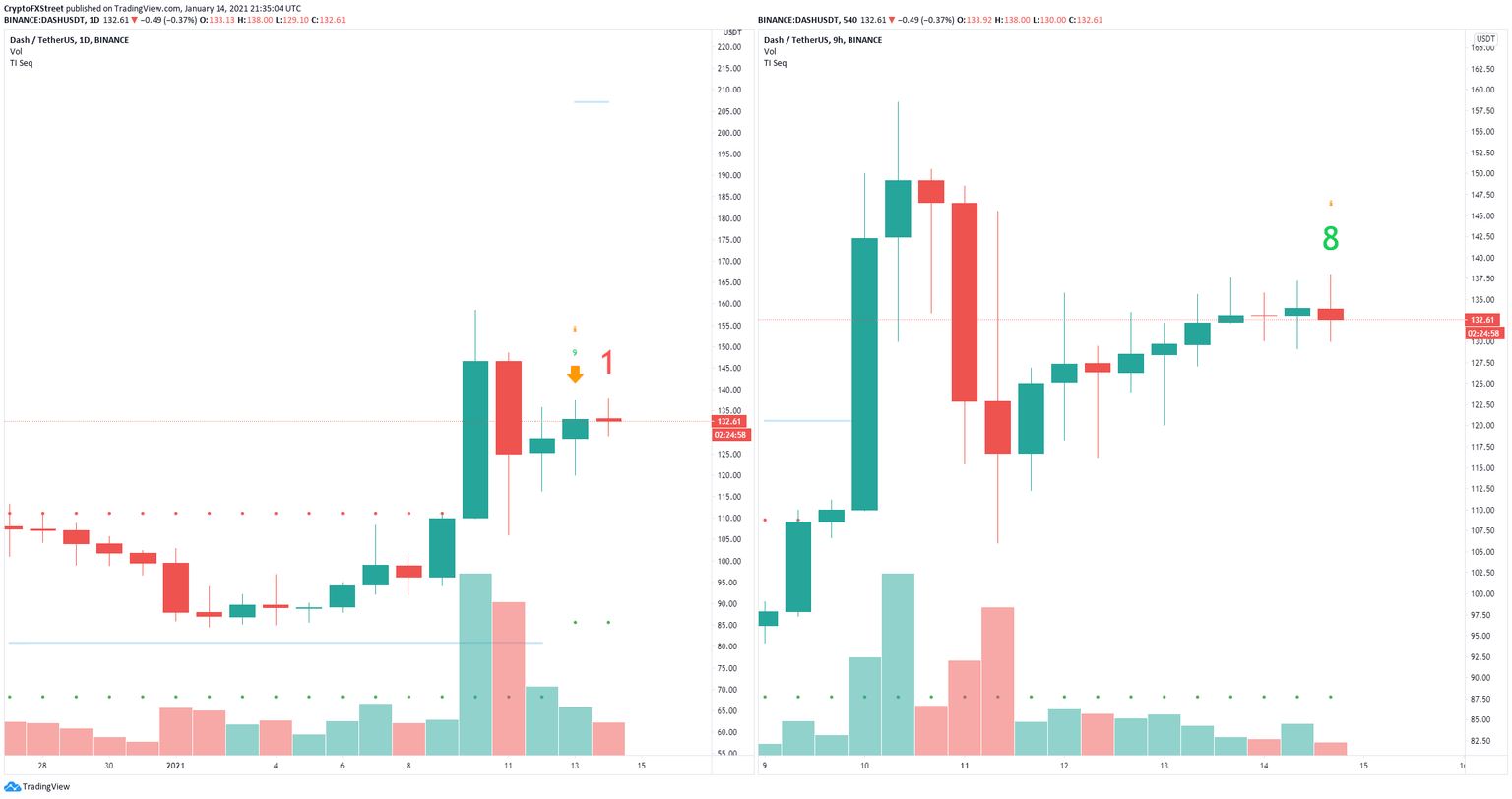

On the daily chart, the TD Sequential indicator presented a sell signal on January 13 and it’s about to do the same on the 9-hour chart, although this last call hasn’t been confirmed yet.

DASH sell signals

Using the Fibonacci Retracement indicator on the 12-hour chart, we can determine several interesting price targets on the way down. First, at the 50% Fib Level, Dash price would be around $120. The 38.2% level would be the $112 and one of the lowest targets for the bears.

DASH 12-hour chart

However, it seems that the In/Out of the Money Around Price (IOMAP) chart shows a lot of support on the way down between $125 and $130 and still good support below this range.

DASH IOMAP chart

Additionally, the IOMAP model also indicates that there is only one resistance area between $136 and $141. A breakout above this point can quickly push Dash price towards $153 as there is no resistance overhead.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.