- The bullish trend appears to have turned bearish as the week’s trading nears the end.

- Since July 12, DASH/USD has been trading highs and higher lows supported by the trendline.

This week’s trading has seen most coins and altcoins break psychological barriers, while some digital assets are back to trading June levels. However, the bullish trend appears to have turned bearish as the week come s to an end. The market is slightly red on Friday 20 with some of the top cryptos like Ripple (XRP), Bitcoin Cash (BCH), and NEO correcting lower over 3% on the day. Ethereum Classic (ETC), Monero (XMR) and IOTA (IOT) are down 2%. The trend is generally bearish across the board, on the contrary, Dash price is up over 5% on the day, defying the correction.

Dash price analysis

Dash is one of the strongest daily gainers on the day. After opening the trading session at $ $260.3654, it tested the critical resistance zone at $280.00. However, on failing to breach the resistance, the price is reacting with subtle lower corrections.

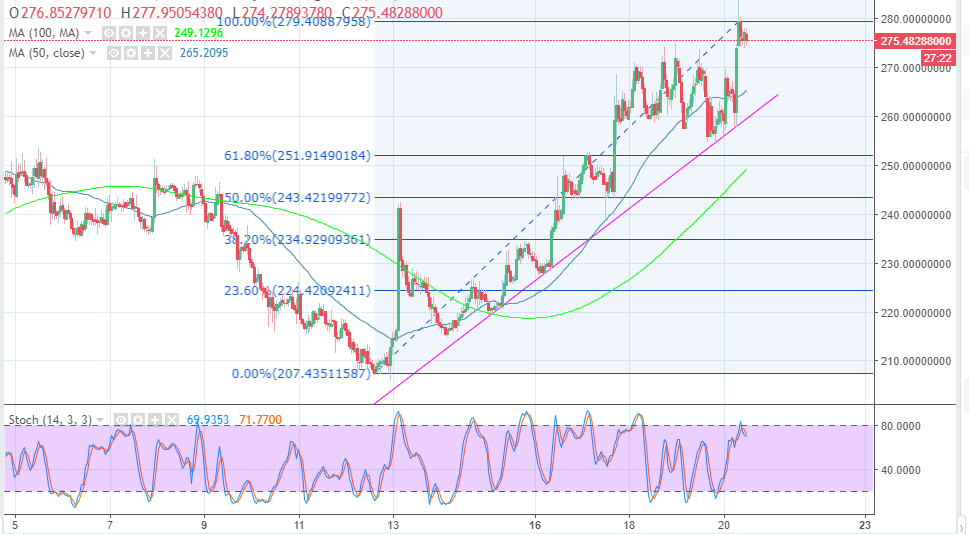

Since July 12, DASH/USD has been trading highs and higher lows supported by the trendline on the chart. The price has been bouncing off the trendline in brief and extended engulfing candles. Until today morning (GMT), the upside had been limited below $270 with attempts to break past the level rendered unsuccessful. However, the breakout from the immediate demand zone at $260, not only broke above $270 resistance, it tested the critical $280.

The price is likely to settle in a bullish flag pattern supported above $270 while on the upside, the supply zone at $280, will continue to limit gains in the near-term. Sellers are reaching out for more entries at the moment, besides the stochastic is pointing south and leaving the levels above 70%. The gap between the 50 SMA is widening to confirm the rising selling pressure.

DASH/USD 1-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Pro-crypto French Hill selected as Chairman of the House Financial Services Committee

Republicans selected French Hill as the new Chairman of the House Financial Services Committee. Hill is a crypto supporter and spearheaded the FIT21 bill for crypto regulations. French Hill will be replacing Chair Patrick McHenry, who is retiring from office.

Ethereum could see new all-time high above $5,000, on-chain data signals bullish momentum

Ethereum is up 1% on Thursday as it aims to tackle the selling pressure near the $4,000 psychological level. On-chain data shows that ETH has begun seeing increased bullish momentum, which could push its price to a new all-time high above $5,000.

Crypto Today: Bitcoin price tops $102K as Trump’s firm acquires Ethereum and Chainlink

Cryptocurrency market valuation broke $3.5 trillion Thursday, up 9.4% since Tuesday's market crash halt. In the last 24 hours, 104,700 traders liquidated $172.7 million in long contracts, accounting for 58% of the $298.5 million total liquidations.

Shiba Inu Price Prediction: SHIB set for $0.00004000 breakout as ETH leads market recovery

Shiba Inu price has rebounded 22% from its 14-day low of $0.00002400 recorded during the crypto market dip on Tuesday. With the Ethereum ecosystem attracting rapid capital inflows, is SHIB on the verge of a major breakout?

Bitcoin: BTC reclaims $100K mark

Bitcoin (BTC) reclaimed the $100K level, trading near $100,100 on Friday after a recent decline earlier this week. The recent pullback in BTC was mostly due to high-leverage traders and some holders booking profits. Despite Microsoft’s rejection of adding Bitcoin to the company’s balance sheet, institutional demand remained strong, recording a total inflow of $1.72 billion until Thursday.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.