Dash price could see a massive explosion towards $100 if this level is cracked

- Dash price is currently contained inside a parallel channel on the 1-hour chart.

- The digital asset faces a critical resistance level before it can climb towards $103.

After a brutal 16% drop on January 1, Dash has been trying to recover and managed to establish an ascending parallel channel on the 1-hour chart. Dash bulls aim for $103 but need to crack a critical resistance level at $95 first.

Dash price can rise towards $100 if bulls can push it above $95

On the 1-hour chart, Dash has established a parallel channel with the resistance trendline at $95. Bulls have defended the 26-EMA and are hoping for a rebound towards the resistance upper boundary.

DASH/USD 1-hour chart

If Dash can recover above the 12-EMA, it will quickly jump towards $95. A breakout above this point will drive Dash price to $100 and eventually as high as $103 if the bullish momentum continues strong.

DASH IOMAP chart

The In/Out of the Money Around Price (IOMAP) chart shows a strong resistance area between $92 and $95, which adds credence to the bullish outlook. There is a lot of support on the way down starting at $91.

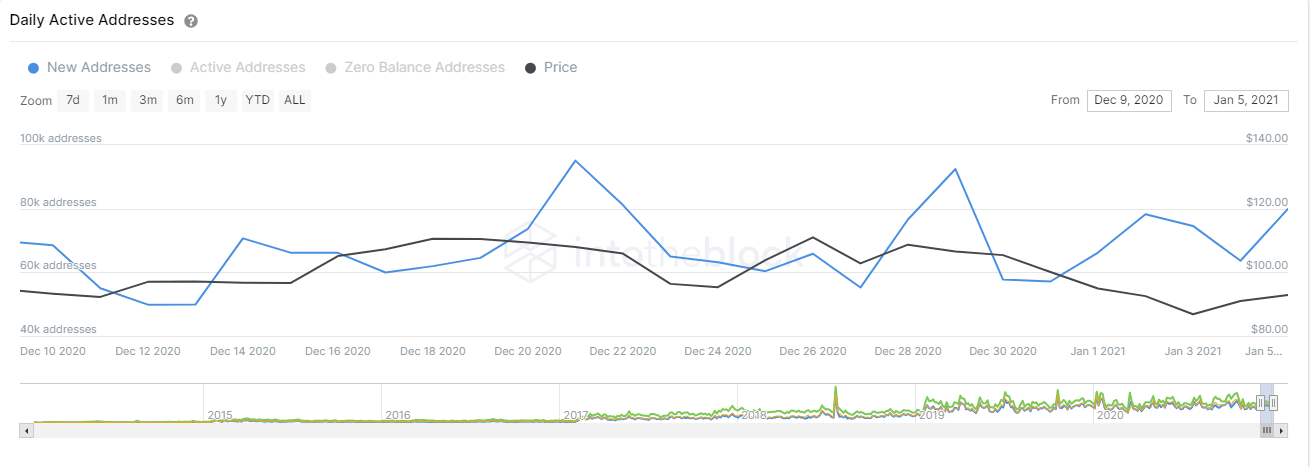

DASH New Addresses chart

There are, however, some concerning signs for the bulls. The number of new addresses joining the network has dropped significantly in the past week by 13.5%. This indicates that new investors are losing interest in Dash. If the bears can push Dash price below the 26-EMA at $91, the digital asset can drop to $87.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.