- DASH recovered from the ashes below $170 but facing hurdles towards $225.

- FanDuel fantasy sports competition is back and the current NFL edition is supported by DASH.

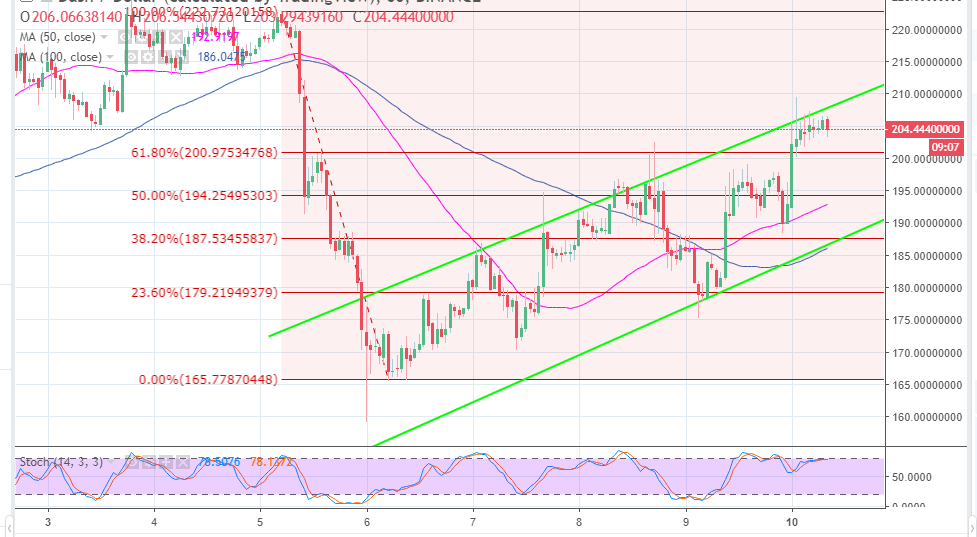

The crypto carnage is the market has been paralyzing investors. While everyone thought the drop in August of severe, last week’s declines were worse. However, certain digital assets like Dash have engaged thrust boosters are proving to the bears that they cannot be tied down. DASH broke below the short-term support at $220 on failure to recoil above $225. The slide could not be stopped at $200 but created a low of $165.77. This gave the buyers an opportunity to enter and since then they have increased the ball possession.

In other news, Dash has entered into a partnership with FanDuel. The platform has decided to re-launch its fantasy sports competition referred to as Crypto Cup. The competition gives lovers of sports opportunities win prizes in DASH. The previous competition was the February edition of Crypto Cup based on NBA. Consequently, the current edition is based on NFL, which started on Sept 9 to Sunday, January 6.

At present, Dash is trading in an ascending channel after recovery from the above-mentioned lows. The upside is, however, limited at $210 but the trend is still strongly bullish. The stochastic oscillator on the hourly chart is ranging at 80%. Moreover, the Initial support is at $200, although the 150SMA currently at $192.89 and the 100SMA at $186.01 will halt declines in the event the bears increase their grip and declines extended below $200.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: Further upside likely after hitting new all-time high

Bitcoin (BTC) surged more than 10% this week, hitting a new high of $76,849 on Thursday, buoyed by the crypto-friendly candidate Donald Trump’s victory in the US presidential election.

Cardano breaks above descending trendline, eyes April high as bullish momentum builds

Cardano extends gains on Friday, following a close above a descending trendline the previous day. Technical indicators and on-chain data show bullish momentum, suggesting a rally ahead.

Top 3 Price Prediction: BTC touches new all-time high near $77,000 following Fed rate cut

Bitcoin price rallied and reached a new all-time high of $76,849 following the US Federal Reserve’s 25 basis point rate cut. Ethereum and Ripple followed suit and closed above their key resistance levels, hinting at a possible rally ahead.

Bitcoin, crypto market remain in uptrend following 25 bps Fed rate cut

Fed Chair Jerome Powell stated that the FOMC lowered the Fed funds rate by 25 basis points. The rate cut comes after Bitcoin reached a new all-time high price upon Donald Trump's election victory.

Bitcoin: Further upside likely after hitting new all-time high

Bitcoin (BTC) surged more than 10% this week, hitting a new high of $76,849 on Thursday, buoyed by the crypto-friendly candidate Donald Trump’s victory in the US presidential election.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.